17th September, 2020

Good day students. you are welcome to today’s online class

1(a) state three reasons why a trial balance may not balance.

(b) State four uses of control account.

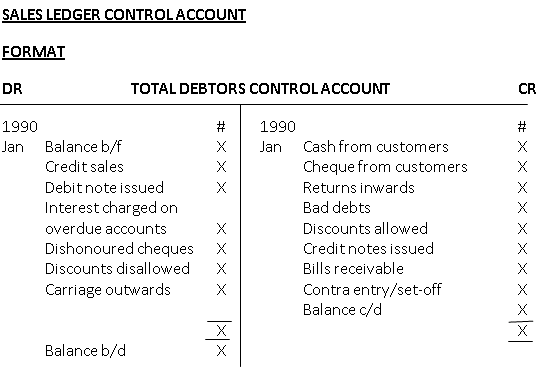

2(a) List the subsidiary books from which each of the following items are obtained:

(i) payment in cash to creditors;

(ii) credit sales

(iii) cash and cheques received

(iv) discount received

(v) discount allowed

(vi) credit purchases

(vii) bad debts written off

(viii) debtors’ cheque dishonoured

(ix) sales ledger balance set-off against purchases ledger balance.

3(a) Explain the following terms:

(i) members’ subscriptions;

(ii) accumulated fund;

(iii) bar stock

(iv) bar profit

10th SEPTEMBER, 2020

LESSON 17

REVISION

You are welcome to this week on-line class. Let us look at more exercise for more understanding.

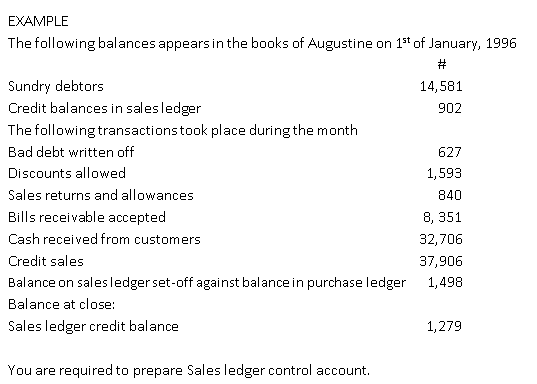

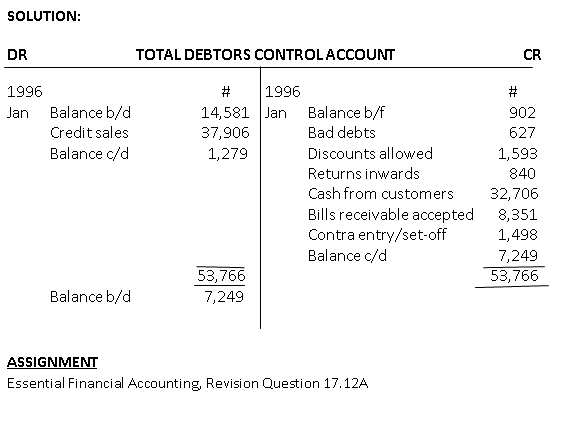

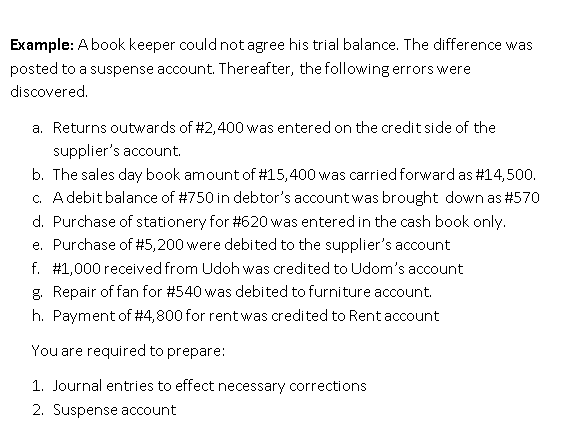

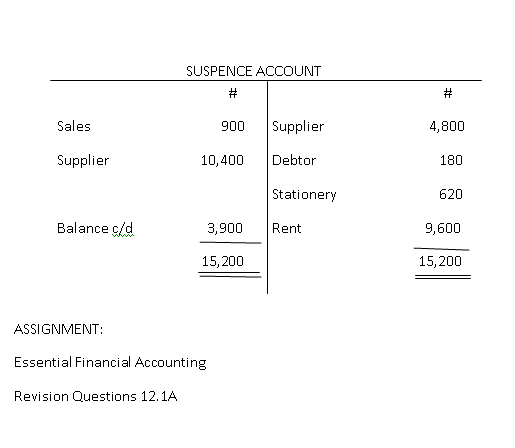

Essential Financial Accounting

Revision Question 20.3.

September 3rd, 2020

Good morning students and welcome to today’s online revision Financial Accounting class.

REVISION QUESTIONS

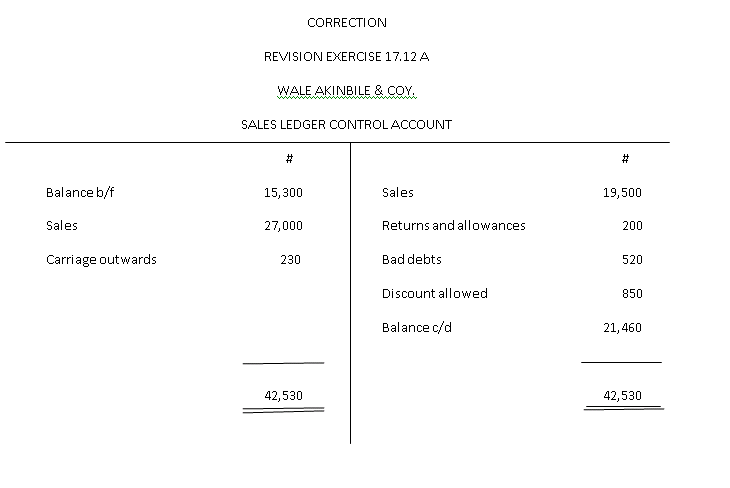

1 (a) What is a suspense account?

(b) Explain five errors that would not affect the agreement of the trial balance.

2 (a) What is a general journal?

(b) State six uses of the general journal.

3 List four items each that are found on the:

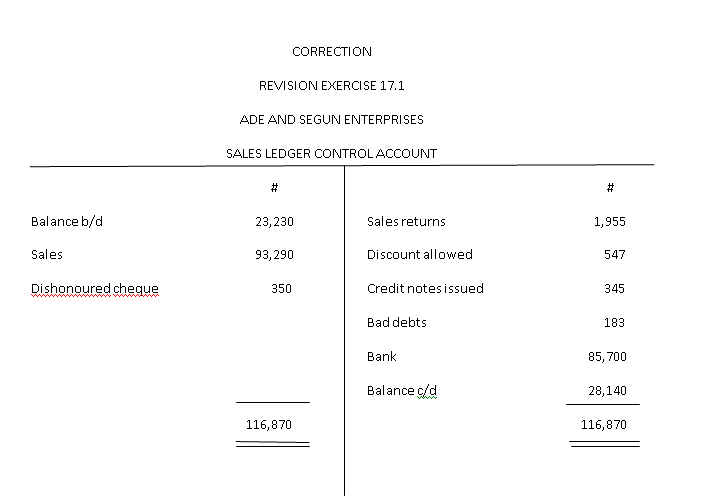

(a) credit side of the sales ledger control account;

(b) debit side of the purchases ledger control account.

AUGUST 27TH, 2020

LESSON

REVISION

You are welcome to the on-line class. I hope you are writing your notes and reading very well.

Due to the fact that we are through with the topics, there is need for further revision of the topics we have threated. So, try this revision question from the textbook.

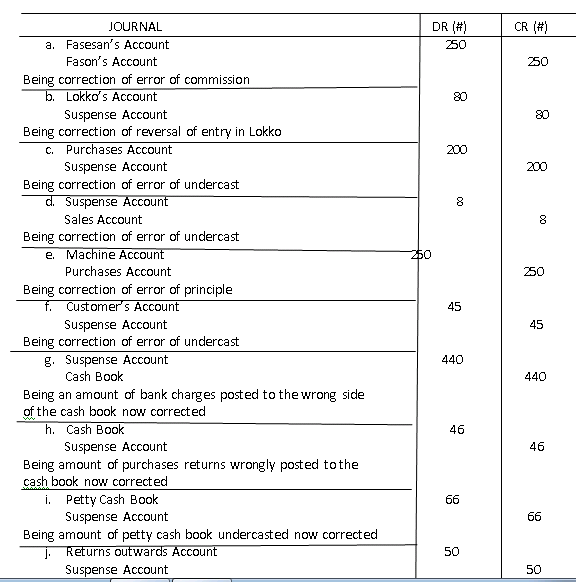

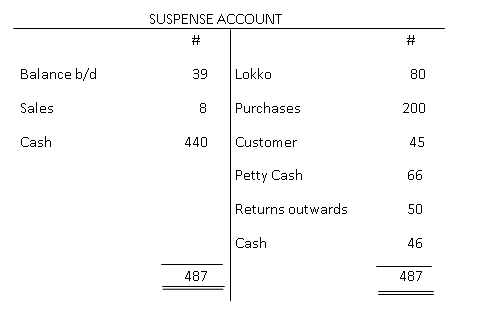

ESSENTIAL FINANTIAL ACCOUNTING

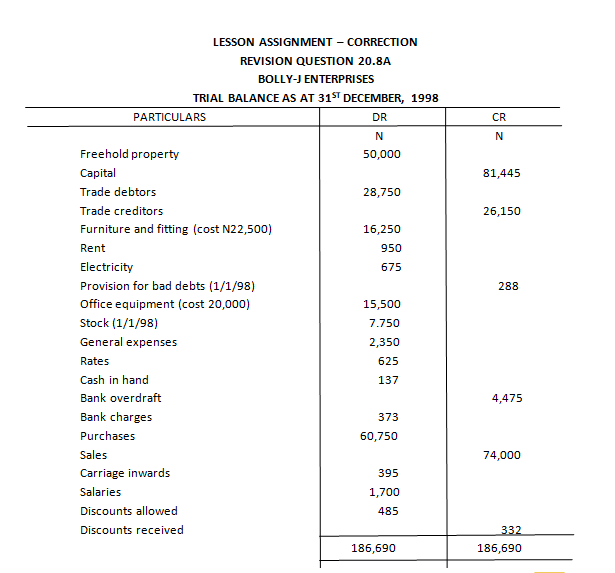

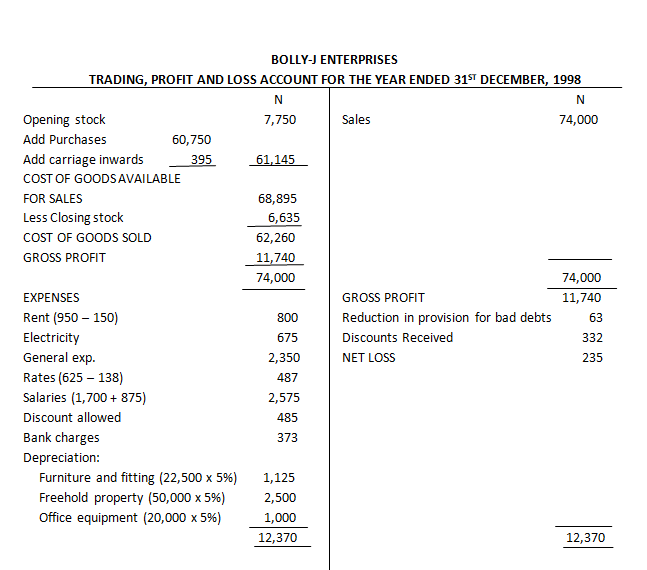

REVISION QUESTION 20.8A

Ensure you do the exercise in your note and also on this platform.

AUGUST 20, 2020

Good day students and welcome to today’s online class.

REVISION QUESTIONS

1(a) What is a bank reconciliation statement?

(b) State three reasons for preparing a bank reconciliation statement.

(c) Explain the following terms:

(i) Unpresented cheques;

(ii) Standing order;

(iii) Credit transfer

2(a) Define and list two classifications of each of the following:

(i) assets

(ii) liabilities.

(b) Explain how the following items are treated in the profit and loss account and balance sheet.

(i) provision for doubtful debt;

(ii) depreciation on fixed assets;

(iii) accrued income;

(iv) prepaid expenses.

AUGUST 13, 2020

LESSON 13

REVISION

You are welcome to today’s on-line class. Since we are through with the scheme of work, we will be trying more exercises on all the topics threated for better understanding.

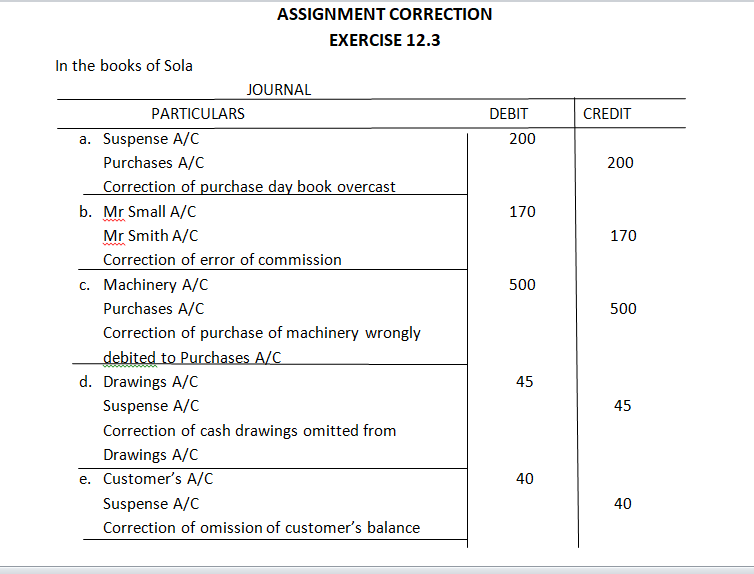

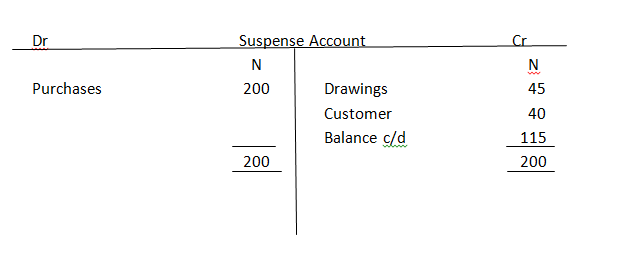

Essential Financial Accounting; Revision Exercise 12.3

SS1

AUGUST 6TH, 2020

Good morning students and welcome to this week’s online class. This week I shall be teaching you account of non-profit making organisation.

ACCOUNT OF NON-PROFIT MAKING ORGANISATION

These are organizations that do not have their primary aim as the making of profit. E.g. clubs, societies, churches, mosque, charitable organizations. These organizations prepare Receipt and Payment account, income and expenditure account just like the trading organization that prepare trading, profit and loss account. Non profit making organization in addition prepares balance sheet.

Receipts and Payment Account

This is an account that summarizes the cash payment of the organization at the end of a given period.

It is similar to the cashbook of a trading organization.

Characteristics of Receipts and Payments Account

- Items are treated in the same way as cashbook.

- All receipts and payments are recorded.

- Any amount owing or prepaid are not shown.

Limitations of Receipts and Payments Account

- It does not disclose accruals and prepayments.

- Non cash items are not disclosed.

- Surplus or deficit cannot be determined.

- It makes no distinction between capital and revenue items.

- It doesn’t disclose profit or loss on sale of fixed assets.

- Income items and capital items are not separated therefore it is difficult to compare them over the year.

- It does not reveal whether an organisation is being well managed.

Uses of Receipt and Payment Account

- It is used by non-profit making organization instead of the cashbook.

- It records all capital and revenue cash receipts by the organisation.

- It records all cash transactions including arrears.

- It is used to ascertain the cash balance of the organisation.

- It assesses the liquidity position of the organisation.

Features of Receipt and Payment Accounts

- It is a real account.

- Both capital and revenue transactions are recorded in the account.

- It does not show the amount which is accrued (owing) or prepaid.

- The closing balance is either a current asset or a current liability.

- All receipts are debited and all payments are credited to the account.

- Balance represents cash in hand.

Similarities between Receipt and Payment Account and Income and Expenditure Account

- Both accounts follow the principle of double entry.

- They are summaries of financial statements.

- Both are prepared by non-profit making concern.

- They are prepared to cover the same period.

Differences between Receipts and Payment Account and Income and expenditure Account

| Receipts and Payment Account | Income and Expenditure Account |

| It is a real account | It is a nominal account |

| Only actual cash receipt and payments are recorded | Cash accruals and pre-payment are included. |

| There is no record of depreciation | It gives effect to depreciation |

| Balance represents cash or bank overdraft | Balance represents surplus of income or expenditure. |

| It is another name for cashbook adopted by clubs | It is another name for profit and loss adopted by clubs. |

| It includes capital and revenue items | Only revenue items are recorded |

| Receipts are debited and payments are credited | Expenditure is debited and income is credited |

Income and Expenditure Account

This is similar to the profit and loss account of a trading organisation. When the organisation is operating a bar the profit or loss would be transferred to income and expenditure accounts.

Expenditure means cost consumed and income means revenue earned in the period. When income is greater than expenditure, we have surplus of income over expenditure.

Also, when the income is less than expenditure, we have excess of expenditure over income.

Features of Income and Expenditure Accounts

- It is equivalent to profit and loss account

- All expenses are debited and income credited, it is a nominal account.

- The excess of income over expenses is termed “surplus” and excess of expenses over income is termed “deficit”

- It does not record capital expenditure.

- All revenue expenditure items in a period are included in the account whether they are actually paid or not.

- All revenue receipt items in a period are included in the account whether received or not.

- It excludes all capital items, it records only revenue items.

- It allows adjustments to be made both for accruals and prepayments.

Uses of Income and Expenditure Accounts

- It is used by non-profit making organizations instead of profit and loss account.

- It records only current transactions whether cash or credit transactions.

- To records all income of the organization except capital receipts.

- To record all expenditures of the organization except capital expenditure.

- To ascertain the surplus or deficit of the organization.

Format of Income and Expenditure Account

Income and Expenditure Account

| Expenditure | ₦ | Income | ₦ |

| Rent | X | Subsription | X |

| Wages | X | Donations | X |

| Postages | X | Rent received | X |

| Secretary’s honourarium | X | Profit on bar | X |

| Lightning | X | Proceed from summer | X |

| Surplus of income over expenditure account | X | Sales of dance ticket | X |

| XX | XX |

Terminologies Used in Income and Expenditure Account

- Accumulated Fund: This is the same thing with capital in the trading organisation. It is determined by subtracting total liabilities from total assets. It is the excess of the assets over the liabilities of a non-profit making organization, which takes the place of the capital found in a trading organization.

- Subscription: This is the periodic contribution of member to the association of club which could be paid in advance or in arrears.

- Subscription in Arrears: this is the sum of money due for membership for a particular year, but remained unpaid for that year. Since it is not paid, it remains in the following year until it is paid. It is a current asset in the club and it is treated as debtors in the balance sheet.

- Subscription in advance: this is the sum of money paid by the members of a club or association which represents their due for the forth-coming year(s). It is a current liability in the club.

Sources of Income to a Non-profit Making Organisation

- Entrance fees

- Donations

- Subscriptions/dues

- Profit from bar

- Profit from special events.

- Sales of assets/disposal of assets

- Fines

- Levies

ILLUSTRATION

Bello sports Club had q membership of 140 who pay annual subscription of ₦2,000 each. For the year 2018, the receipts and payments showed the following:

Receipts and payment Account

| ₦ | ₦ | ||

| Balance b/d | 12,000 | Cost of games | 27,000 |

| Subscriptions | 290,000 | Rent | 2,000 |

| Donations | 50,000 | Groundman’s wages | 2,400 |

| Sales of games ticket | 45,000 | Cost of refreshment | 4,900 |

| Squash racquets | 6,000 | ||

| Hockey sticks | 10,000 | ||

| Games prize | 12,000 | ||

| Annual awards | 100,000 | ||

| Balance c/d | 232,700 | ||

| 397,000 | 397,000 | ||

| Balance b/d | 232,700 |

Additional information:

31/12/2017 31/12/2018

₦ ₦

- Subscription owing 30,000 25,000

Subscription in advance 10,000 15,000

Sports equipment 40,000 ?

- Sports equipment are to be depreciated at 50%

You are required to prepare:

- Subscriptions account

- Income and expenditure account for the year ended 31st December, 2018 and

- A balance sheet as at that date.

Bello Sport Club

Subscription Account

| ₦ | ₦ | ||

| Balance b/d | 30,000 | Balance b/d | 10,000 |

| Income and expenditure | 280,000 | Receipt and payment | 290,000 |

| Balance c/d | 15,000 | Balance b/d | 25,000 |

| 325,000 | 325,000 |

Income and Expenditure Account for the Year Ended 31st December, 2018

| Expenditure | Income | ||

| ₦ | ₦ | ||

| Cost of games | 27,000 | Donations | 50,000 |

| Rent | 2,000 | Sales of games ticket | 45,000 |

| Groundman’s wages | 2,400 | Subscription | 280,000 |

| Cost of refreshment | 4,900 | ||

| Games prizes | 12,000 | ||

| Annual Awards | 100,000 | ||

| Depreciation : sports equipment | 28,000 | ||

| Surplus | 987,000 | ||

| 375,000 | 375,000 |

Statement of Affairs as at 1st January, 2018

| Assets | ₦ |

| Equipment | 40,000 |

| Cash | 12,000 |

| Subscription owing | 30,000 |

| 82,000 | |

| Less subscription in advance | 10,000 |

| Accumulated fund | 72,000 |

Balance sheet as at 31st December, 2018

| ₦ | Fixed Assets | ₦ | |

| Accumulated fund | 72,000 | Sport equipment 56,000 | |

| Surplus | 198,700 | Less depreciation 28,000 | 28,000 |

| Current liability | Current Assets | ||

| Subscription in advance | 150,000 | Subscription owing 25,000 | |

| Cash 232,700 | 257,700 | ||

| 285,700 | 285,700 |

Assignment

The treasurer of Rokel Cricket Club prepared the following receipts and payment accounts for the year ended 31st December, 2107.

Receipt and Payment Accounts

| ₦ | ₦ | ||

| Balance as at 1/1/2017 | 8,184 | Expenses on dance | 3,660 |

| Subscriptions | 35,160 | Repairs | 1,752 |

| Income from dance | 23,604 | Extension of club house | 8,820 |

| Bank interest | 720 | Wages and salaries | 26,976 |

| Donations | 3,612 | Sundry expenses | 1,248 |

| Cash at bank | 28,824 | ||

| 71,280 | 71,280 |

Additional information:

- Subscriptions received included ₦420 for the year commencing 1st January, 2018

- Accrued wages and salaries at 1/1/2017 amounted to ₦696 and at 31/12/2017, ₦768.

- Depreciation is charged on club house at 10% per annum on cost

- The following were balances as at 31/12/2016:

₦

Land at cost 48,000

Club house at cost 48,600

Depreciation on club house 17,928

Subscription in arrears 960

Subscription in advance 360

Accrued sundry expenses 696

Accumulated fund 86,064

You are required to prepare:

- Subscription account

- Income and expenditure accounts for the year ended 31st December, 2017.

- Balance sheet as at that date.

JULY 30TH

LESSON 11

You are welcome to this week on-line class. This week, we will be looking at the other aspect of Control Account

JULY 23RD, 2020

LESSON 10

You are welcome to this week class. Hope you are following the lesson. If you are, please, do your assignment and always submit.

CONTROL ACCOUNT

MEANING OF CONTROL ACCOUNT

Control account can be defined as memorandum account, the balance of which reflects the aggregate balances of many related subsidiary accounts which are part of the double entry system. It is the account to which is debited and credited the total amounts of all the transactions which have been debited and credited in details to individual debtors and creditors ledgers.

USES OF CONTROL ACCOUNT

1. They facilitate preparation of interim and final accounts such as interim profit and loss and balance sheet. They facilitate the derivation of the sale, purchases, debtors and creditors figures.

2. They facilitate the correction of errors in the ledgers. Errors are easily identified by comparing the sum of the balances in the ledgers with the balances of the control account.

3. They reduce the possibility of fraudulent entries.

4. They act as on internal check on accuracy of debtors. They thus provide a guarantee of assurance to the management on the accuracy of the debtors’ figures.

5. They act as an aid in balancing the accounts.

ADVANTAGED OF CONTROL ACCOUNTS

- Control accounts helps in locating errors.

- It can provide a check on the accuracy of balances of the ledgers.

- Fraud will become difficult

- They save time.

- They can be used to detect missing figures.

- The balances of the total debtors and creditors can be easily calculated.

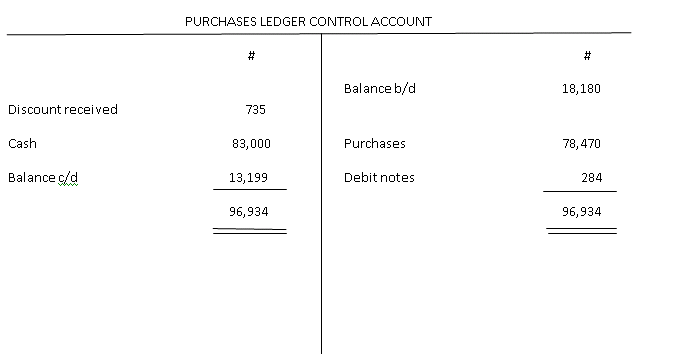

DIVISION OF CONTROL ACCOUNT

- Total Debtors Control Account or Sales Ledger Control Account

- Total Creditors Control Account Or Purchases Ledger Control Account

JULY 16TH, 2020

LESSON 9

SUSPENSE ACCOUNT

You are welcome to this week on-line class. How are you? I hope you are following the lessons.

ERRORS THAT WILL AFFECT THE AGREEMENT OF THE TRIAL BALANCE

Some errors will cause the trial balance not to balance. Errors which are likely to cause a difference on the trial balance include:

- One sided omission: Omission in one of the two accounts e.g. sales of goods #300 for cash were entered in sales account but not recorded in the cash account.

- Items can be mis-posted to the account e.g. an item was recorded as #1,009 debit and credited as #9,001 for the same transaction.

- Two entries can be made on the same side of the account e.g. sales of goods for cash were debited twice to cash account.

- The trial balance is incorrectly totaled.

- An item can be omitted from the balance.

- An item that is entered on the wrong side of the trial balance.

- Error can also occur when transferring the totals of subsidiary book.

When the trial balance totals disagree and the errors are not discovered before the final accounts, it will be necessary to open a suspense account.

SUSPENSE ACCOUNT

Suspense account can be defined as the account used to record the difference on a trial balance temporarily until the errors are detected and corrected. If the difference is a debit, it will be shown on the assets side but if it is a credit, it will be shown on the liabilities side.

When errors affect the trial balance, it must pass through the suspense account. The correction requires one account to be debited or credited and the corresponding debit or credit must be made in the suspense account.

The procedures to be followed:

- Identify the type of error.

- If it is an error that will not affect the trial balance, it must not pass through the suspense account.

- If it is an error that will affect the agreement of the trial balance, it must pass through the suspense account.

- Illustrate the errors in the ledgers and make the necessary corrections.

- The correction will now be posted to the journal.

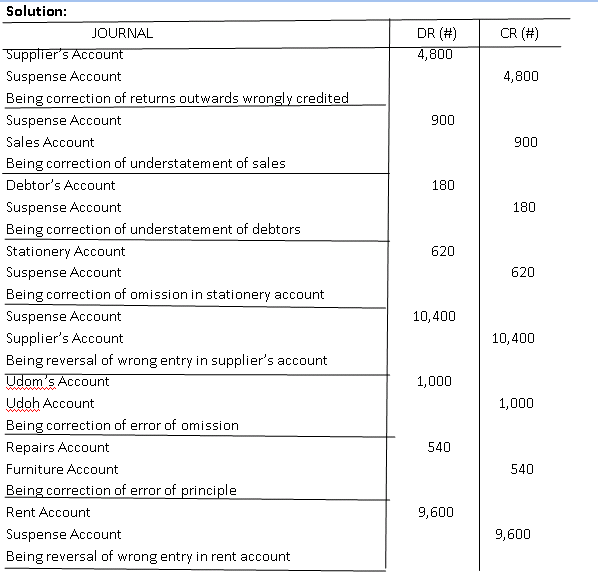

Lesson 9 Assignment – Correction

Revision Question 12.1A

9/7/2020

Good day students. You are welcome to today’s online Financial Accounting class.

CORRECTION OF ERRORS

Errors can be defined as mistakes made in the preparation of accounts. The main purpose of the trial balance is to show the arithmetical accuracy of the entries in the ledgers. The two sides (debit and credit sides must be equal. If the debit side is not equal with the credit side, then there is an indication of error. Errors can be grouped into two, namely

Errors that affect the agreement of a trial balance

(1) Errors that do not affect the agreement or totals of the trial balance.

(2) Errors that do not Affect the Agreement of the Trial Balance

(1) Error of Omission: This error occurs when transactions are completely omitted from the debit and credit sides of the books of accounts. Since there is omission on both the debit and credit sides, the trial balance will still balance. E.g. Payment of rent ₦2,000 to Ayo has been omitted from the books of account.

(2) Error of Commission: This occurs when correct amount is entered in a wrong person’s account e.g. Sales of goods to Ola was entered in Olu’s account.

(3) Error of Original Entry: This error occurs when a wrong amount is entered on the debit and credit sides. The original amount is transposed and passed through the double entry system. For example, purchase of goods ₦4,900 from Tayo entered in the accounts as₦9,400.

(4) Error of Principle: This is an error whereby transactions are entered in a wrong class of accounts, e.g. payment of₦60,000 for motor van entered in motor expenses.

(5) Compensating Errors: This occurs when errors of the same amount are posted to the two sides of the ledgers, therefore, they cancelled out each other. The two sides may be overcast or undercast by the same amount e.g. Sales account is undercast so also is salaries account.

(6) Complete Reversal of Entry: This error occurs when the double entry for a transaction is reversed, resulting in a situation whereby the account that ought to be debited is credited and the account that ought to be credited is debited. E.g. a receipt of cash from Biodun ₦20,000 has been entered on the credit side of cash account and debit side of Biodun account.

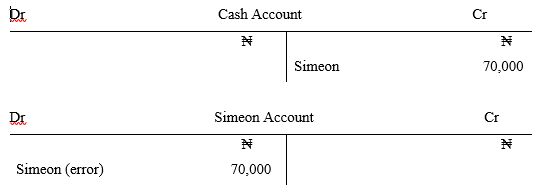

(7) Error of Duplication: This error occurs when the same transaction is recorded more than once in the books of account e.g. payment of cash ₦3,000 to Olu had been entered twice in the two accounts.

PROCEDURES TO BE FOLLOWED WHEN CORRECTING ERRORS

In order to correct errors, the following procedures must be followed:

(i) Assets account Dr balance

Income account Cr balance

Expenses account Dr balance

Sales account Cr balance

Purchases account Dr balance

Liabilities account Cr balance

(ii) Identification of the types of errors

(iii) Identification of the two accounts involved.

(iv) Interpretation of errors in the ledger

(v) Preparation of Journal

ILLUSTRATION I:

(a) Cash paid to Simeon ₦35,000 was entered on the credit side of his account and debited to cash account.

(b) Payment of cash ₦62,000 to Glory has been entered in the two accounts.

(c) Sales of motor van ₦85,000 had been entered in the sales account.

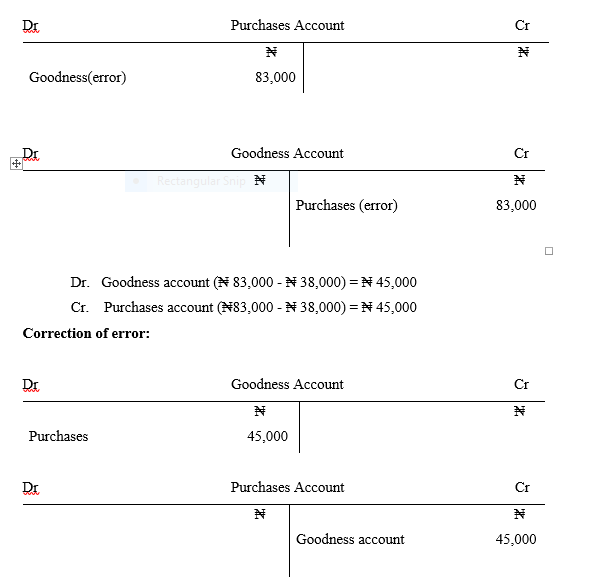

(d) Purchases of goods from Goodness ₦38,000 has been entered in the account as ₦83,000.

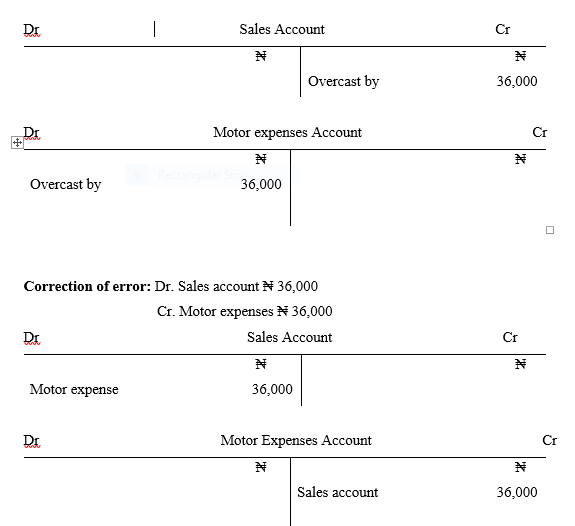

(e) Sales were overcast by ₦36,000 so also were motor expenses

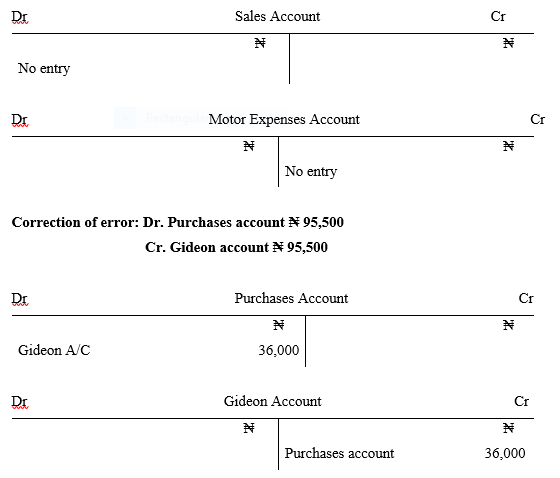

(f) Purchase of goods from Gideon ₦95,500 was completely omitted from the account.

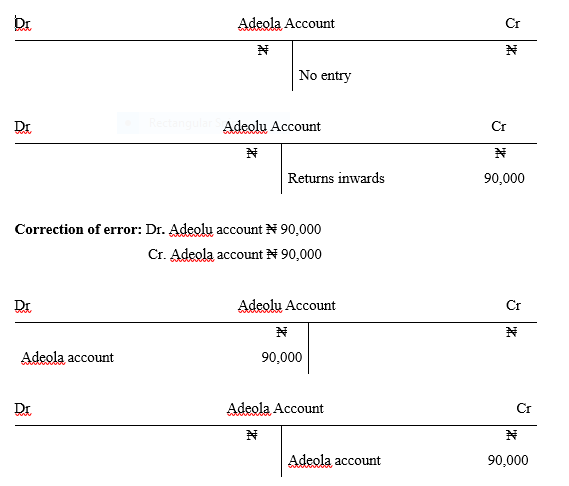

(g) Goods of ₦90,000 returned by Adeola has been entered in Adeolu’s account.

SOLUTION:

The question above will be used for our illustration and the procedures will be followed:

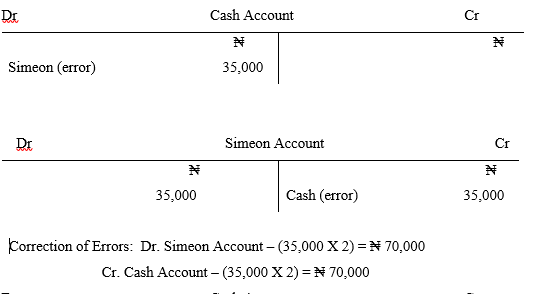

(a) ii. Complete Reversal of Entry.

iii. Cash account and Simeon account

iv. Interpretation of errors in the ledgers

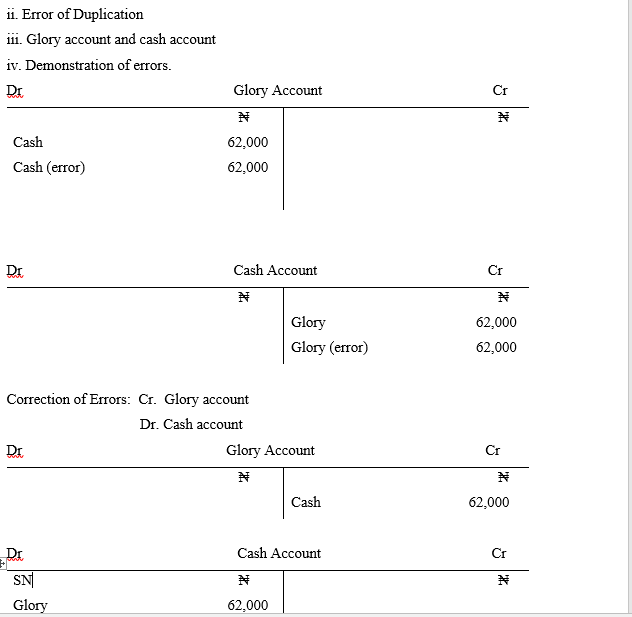

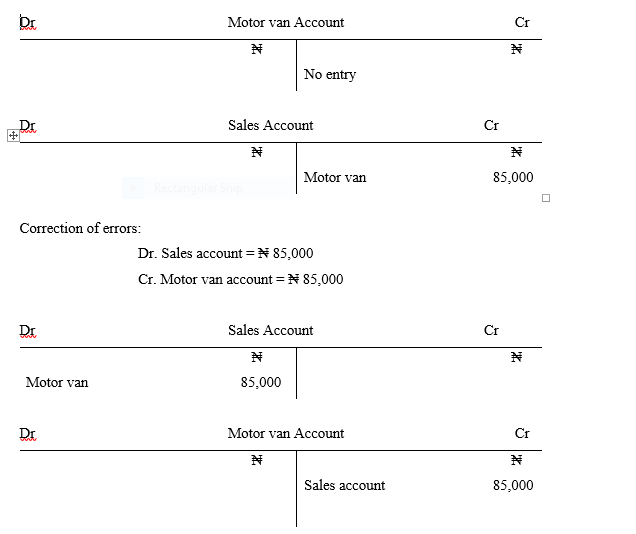

(c) ii. Error of Principle

iii. Motor van account and sales account

iv. Interpretation of error in the ledgers

(d) ii. Original Entry

iii. Purchases account and Goodness account

iv. Interpretation of error in the ledgers.

(e) ii. Compensating error

iii. Sales account and Motor expenses account

iv. Interpretation of error in the ledgers.

(f) ii. Error of Omission

iii. Purchases account and Gideon account

iv. Interpretation of error in the ledgers.

g. ii. Error of Commission

iii. Adeola account and Adeolu account

iv. Interpretation of error in the ledgers.

JOURNAL

| Dr | Cr | ||

| ₦ | ₦ | ||

| a. | Simeon account | 70,000 | |

| Cash account | 70,000 | ||

| Payment of cash to Simeon mistakenly reversed now corrected. | |||

| b. | Glory account | 62,000 | |

| Cash account | 62,000 | ||

| Recording of a transaction twice in the accounts now corrected | |||

| c. | Sales account | 85,000 | |

| Motor van account | 85,000 | ||

| Sales of motor van entered in sales account now corrected | |||

| d. | Goodness account | 45,000 | |

| Purchases account | 45,000 | ||

| Correction of error of wrong amount | |||

| e. | Sales account | 36,000 | |

| Motor expenses account | 36,000 | ||

| Correction of overcast of sales and motor expenses | |||

| f. | Purchases account | 95,500 | |

| Gideon account | 95,500 | ||

| Purchases of goods from Gideon omitted now corrected | |||

| g. | Adeola account | 90,000 | |

| Adeolu account | 90,000 | ||

| Goods returned by Adeola mistakenly entered in Adeolu account now corrected |

ILLUSTRATION 2

The following errors were discovered from the book of Jessy:

(a) Discount allowed of 30,000 was entered in error on the debit side of discount received.

(b) Sales of ₦ 331,000 to Elijah has been entered in the books, both credit and debit as ₦313,000.

(c) Cash paid to Toyin ₦5,500 was entered on the credit side of her account and debited to cash account

(d) Sales account is undercast by ₦38,000 so also is salaries account.

(e) Rent receivable of ₦100,000 had been entered in the sales account.

(f) Purchases of goods on credit from Sanjo ₦80,000 has been entered in error in the fittings account.

SOLUTION:

JOURNAL

| Dr | Cr | ||

| ₦ | ₦ | ||

| (a) | Discount allowed account | 30,000 | |

| Discount received account | 30,000 | ||

| Correction of errors on the debit side now entered on the credit side of discount received | |||

| (b) | Sales account | 18,000 | |

| Elijah account | 18,000 | ||

| Correction of undercast of sales and Elijah | |||

| (c) | Toyin account | 11,000 | |

| Cash account | 11,000 | ||

| Payment of cash to Toyin mistakenly reversed now corrected. | |||

| (d) | Salaries account | 38,000 | |

| Sales account | 38,000 | ||

| Correction of undercast of salaries and sales account | |||

| (e) | Sales account | 100,000 | |

| Rent receivable account | 100,000 | ||

| Rent receivable entered in sales account now corrected | |||

| (f) | Purchases account | 80,000 | |

| Fittings account | 80,000 | ||

| Purchases of goods from Sanjo entered in fittings account now corrected |

ASSIGNMENT

The following errors were discovered from the books of Goodness:

- Returns inwards from Dennis ₦8,000 was entered in Daniel account.

- Cash payment for rent ₦75,000 was omitted from the books

- The sales account was overcast by ₦10,500 and the purchases account was also overcast by ₦10,500.

- A machine was purchased for ₦8,000 and debited to the purchases account.

- A receipt of cash from Joy ₦56,000 has been entered on the credit side of the cash book and the debit side of Odeyemi account.

CORRECTION TO ASSIGNMENT GIVEN ON 9/07/2020

GOODNESS

JOURNAL

| Dr | Cr | ||

| D | D | ||

| a. | Daniel account | 8,000 | |

| Dennis account | 8,000 | ||

| Goods returned by Dennis mistakenly entered in Daniel’s account now corrected. | |||

| b. | Rent account | 7,500 | |

| Cash account | 7,500 | ||

| Cash payment for rent accounts omitted now corrected. | |||

| c. | Sales account | 10,500 | |

| Purchases account | 10,500 | ||

| Correction of overcast of sales and purchases account. | |||

| d. | Machine account | 8,000 | |

| Purchases account | 8,000 | ||

| Correction of purchased of machine entered in purchases account. | |||

| e. | Cash account | 56,000 | |

| Joy account | 56,000 | ||

| A receipt of cash from Joy mistakenly reversed now corrected. |

LESSON 7

JULY 2ND, 2020

JOURNAL PROPER

You are welcome to this week on-line class. i hope you are following the class. this week, we will be looking at another topic.

MEANING

Journal proper is a book of original entries or prime entries which recorded transactions in chronological order (i.e. the day to day recording of transactions arranged to when something happened).

ADVANTAGES OF JOURNAL

a. Its main purpose is to provide a convenient record of transactions in chronological order.

b. Journal reduces the risk of omission of transactions.

c. The explanations of the entries are made known by the journal.

SOME USES AND FUNCTIONS OF JOURNAL PROPER

- Opening entries

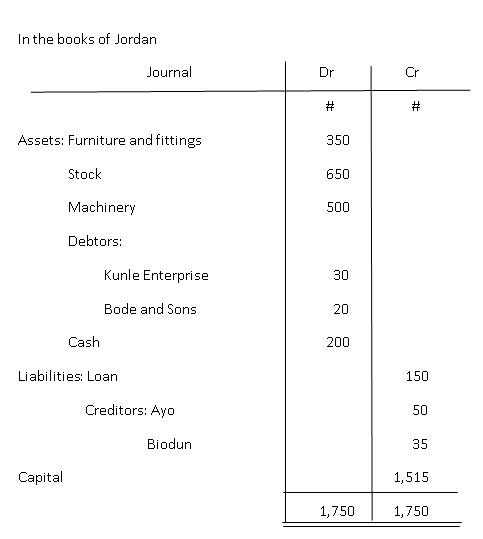

Joe’s book shows the following balances on 1st January 1991:

Assets: Motor van #700, Plant machinery #500, Stock #150, Bill receivable #50, Cash #800, Bank #510, Debtors #700

Liabilities: Creditors #770, Loan #500, Bills payable #20

| JOURNAL | DR | CR |

| # | # | |

| Assets: Motor van | 700 | |

| Plant and machinery | 500 | |

| Stock | 150 | |

| Bill receivable | 50 | |

| Cash | 800 | |

| Bank | 510 | |

| Debtors | 700 | |

| Liabilities: Creditors | 770 | |

| Loan | 500 | |

| Bill payable | 20 | |

| Capital | 2,120 | |

| 3,410 | 3,410 |

- Sales and purchase of assets on credit: These transactions do not fit into any subsidiary books and hence they must be journalized.

Example: a. Sold motor car #500 to Obadare on credit.

| JOURNAL | DR | CR |

| # | # | |

| Motor car | 500 | |

| Obadare | 500 | |

| Sales of motor car to Obadare |

b. Purchase of freehold premises #10,000 from Ayo on credit.

| JOURNAL | DR | CR |

| # | # | |

| Freehold premises | 10,000 | |

| Ayo | 10,000 | |

| Purchases of premises on credit from Ayo |

- Use of Journal to answer questions on double entry principal: The journal as a subsidiary book can be used for recording all transactions in the ledger.

Example: a. Paid wages #1,500

b. Cash sales #200

| JOURNAL | DR | CR | |

| # | # | ||

| a. | Wages | 1,500 | |

| Cash | 1,500 | ||

| Wages paid with cash | |||

| b. | Sales | 200 | |

| Cash | 200 | ||

| Sales of goods for cash |

- Correction of Errors: Journals are used in correcting errors detected in the books.

Example: Cash sales #300 was omitted completely form the books.

| JOURNAL | DR | CR |

| # | # | |

| Cash | 300 | |

| Sale | 300 | |

| Correction of cash sales omitted from the books |

- Transfers between accounts

Example: Boca Enterprises, a debtor, could not pay #31,000 owed to us but he brought machinery for full settlement of his debt.

| JOURNAL | DR | CR |

| # | # | |

| Boca | 31,000 | |

| Machinery | 31,000 | |

| Full settlement of debt with machinery |

ASSIGNMENT

Essential financial Accounting, Exercise 10.1

Correction to Lesson 7 Assignment

Essential financial Accounting, Exercise 10.1

JUNE 25, 2020

Good day students. You are warmly welcome to today’s online class. Make sure you copy your notes into your Financial Accounting notebooks.

Please ensure that you submit your assignment on or before Monday, June 29, 2020.

Also, always check for the correction to the previous assignment below the NINJA FORMS before the next online Financial Accounting class.

ADJUSTMENTS IN THE FINAL ACCOUNT.

- PREPAYMENT: This can be categorized into prepaid income and prepaid expenses.

- Prepaid income: This is when revenue is collected in advance. Prepaid income is deducted from incomes shown on the trial balance to obtain income earned. It is treated as a liability in the balance sheet.

- Prepaid Expenses: This is the prepayment for services in account which have not been enjoyed. It is otherwise known as advance payment. It is a benefit paid for, but not used up at the end of the period. It is deducted from the expenses in the profit and loss account so that the actual profit or loss can be ascertained. It is treated as a current asset in the balance sheet.

- ACCRUALS: These are classified into accrued income and accrued expenses.

- Accrued Income: This is the revenue due, but cash has not yet been received as at the trial the balance date. Accrued income is added to income shown on the trial balance to obtain income earned. It is treated as a current asset in the balance sheet.

- Accrued Expenses: These are expenses for benefit received before the cash payment is made. It is otherwise known as outstanding expenses or arrears. It is expenses due, but not yet paid as at the trial balance date. It is added to the expenses in the profit and loss account so that the actual profit or loss can be ascertained. It is treated as a current liability in the balance sheet.

- Discounts Allowed: These are reductions given by a business to his customers. They are debited in the profit and loss account.

- Discounts Received: They are reductions by a business from suppliers. Discounts received are credited in the profit and loss account.

- Provision for Depreciation: This is the provision made for the part of the cost of a fixed tangible or non-current asset consumed during its period of use by an organization.

OR

It is the provision made for the reduction in the economic value of a fixed tangible or non-current asset as a result of wear and tear, usage, effluxion and passage of time. In the final accounts, provision for depreciation is debited to Profit and Loss Account; but in the Balance Sheet it is deducted from the cost of the fixed tangible asset.

10. Drawings by the owner: Traders will often take items from their business for own use without payment. Therefore, goods withdrawn by the owners should be deducted from purchases and added to drawings.

11. Provision for Discounts on Creditors: This is the percentage calculated on the total amount of creditors. In the final accounts, it is credited to Profit and Loss Account; but in the Balance Sheet the amount is deducted from the creditor’s total. It is known as provision for discount receivable

12. Provision for Discount on Debtors: This is the amount set aside out of profit to provide for discounts that are likely to be allowed to debtors who settle their debts within a stipulated period. The percentage is calculated on the total amount of debtors after the deduction of provision for doubtful debts. Provision for discount on debtors is debited to the Profit and Loss Account; but in the Balance Sheet the amount is deducted from the debtor’s balance.

13. Increase in Provision for Doubtful Debts: This occurs when the current year’s provision for doubtful debts is more than the previous year’s provision. In the final accounts, increase in provision for doubtful debts is charged as an expense, hence debited to profit and Loss Account; but in the Balance Sheet, the increase is added to any previous provision and the total subtracted from the debtor’s balance to disclose the estimated realizable value of debtors.

14. Decrease in Provision for Doubtful Debts: This occurs when the current year’s provision for doubtful debt is less than the previous year’s provision. In the final accounts, decrease in provision for doubtful debts should be treated as an income, therefore credited to Profit and Loss Account; but in the balance sheet, it is deducted from the previous provision and the balance subtracted from the debtors total.

15. Bad Debts: Debts which at the trial balance date, is considered to be irrecoverable. Charge the total bad debt as an expense. If the bad debt is given as additional information, it should be deducted from debtor before showing the balance of debtors under current assets. If the bad debt is on the trial balance, there is no need to deduct it from debtors because that has been done already.

16. Provision for Bad Debts: This is an amount set aside out of profit to provide for debts that cannot be recovered. Increase in the provision of bad debts is treated as an expense, hence debited to the Profit and Loss Accounts, while the decrease is treated as an income and credited to the Profit and Loss Account. In the Balance Sheet, it is deducted from debtors to disclose the estimated realizable value of debtors.

REASONS FOR END-OF-YEAR ADJUSTMENTS

(1) To ensure that the incomes of a particular period relate to that year.

(2) To ensure that financial statements are prepared in accordance with accounting concepts and conventions.

(3) To ensure that the double entry principle is applied.

(4) To provide for depreciation of fixed assets.

(5) To ensure proper classification of capital items from revenue items.

(6) To ensure that expenses of a particular period relate to that year.

(7) To take into consideration any stock valuation at the end of the year.

T- FORMAT: FINAL ACCOUNTS OF A SOLE TRADER SHOWING ADJUSTMENTS.

Trading, Profit and Loss Account for the Year Ended 31st December, 20…

| ₦ | ₦ | ₦ | ₦ | ||

| Opening stock | X | Sales | X | ||

| Add: Purchases | X | Less returns inwards | X | X | |

| Add: Carriage inwards | X | ||||

| X | |||||

| Less: Returns Outwards | X | ||||

| Less Goods withdrawn/ destroyed by fire | X | X | |||

| Cost of goods available for use | X | ||||

| Less: closing stock | X | ||||

| Cost of goods sold | XX | ||||

| Gross Profit c/d | XX | ||||

| XX | XX | ||||

| Expenses | Gross profit | X | |||

| Discount allowed | X | Discount received | X | ||

| General expenses | X | Decrease in provision for doubtful debts | X | ||

| Carriage outwards | X | Rent received | X | ||

| Advertising | X | Commission received | X | ||

| Rent and rates | X | ||||

| Commission payable | X | ||||

| Travelling expenses | X | ||||

| Sundry expenses | X | ||||

| Insurance | X | ||||

| Bad debts | X | ||||

| Bank charges | X | ||||

| Motor expenses | X | ||||

| Increase in provision for doubtful debts | X | ||||

| Insurance | X | ||||

| Repairs | X | ||||

| Lighting | X | ||||

| Office expenses | X | ||||

| Wages and salaries | X | ||||

| Depreciation | X | ||||

| XX | XX |

BALANCE SHEET AS AT 31ST DECEMBER, 20………

| ₦ | ₦ | ₦ | ₦ | ||

| Capital | X | Land and Building | X | ||

| Add: Net profit | X | Less depreciation | X | X | |

| X | Equipment | X | |||

| Less Drawings | X | Motor van | X | ||

| X | Investment | X | |||

| Goodwill | X | ||||

| Long Term Liabilities | |||||

| Debenture | X | ||||

| Mortgage | X | X | |||

| Current Liabilities | Current Assets | ||||

| Creditors | X | Stock | X | ||

| Bank overdraft | X | Debtor | X | ||

| Loan | X | Less: provision for doubtful debt | X | X | |

| Prepaid income | X | Prepaid expenses | X | ||

| Accrued expenses | X | X | Cash at bank | X | |

| Accrued income | X | ||||

| Cash in hand | X | ||||

| XX | XX |

VERTICAL FORMAT:

Trading, Profit and Loss Account for the Year Ended 31st December, 20…

| ₦ | ₦ | ₦ | |

| Sales | X | ||

| Less Returns inwards | X | ||

| XX | |||

| Less: Cost of goods sold | |||

| Opening Stock | X | ||

| Add: Purchases | X | ||

| Add: Carriage inwards | X | ||

| X | |||

| Less: Returns Outwards | X | ||

| X | |||

| Less Goods withdrawn/ destroyed by fire | X | X | |

| Cost of goods available for use | X | ||

| Less: closing stock | X | X | |

| Gross Profit | XX | ||

| Discount received | X | ||

| Decrease in provision for doubtful debts | X | ||

| Rent received | X | ||

| Commission received | X | ||

| XX | |||

| Less: Expenses | |||

| Discount allowed | X | ||

| General expenses | X | ||

| Carriage outwards | X | ||

| Advertising | X | ||

| Rent and rates | X | ||

| Commission payable | X | ||

| Travelling expenses | X | ||

| Sundry expenses | X | ||

| Insurance | X | ||

| Bad debts | X | ||

| Bank charges | X | ||

| Motor expenses | X | ||

| Increase in provision for doubtful debts | X | ||

| Insurance | X | ||

| Repairs | X | ||

| Lighting | X | ||

| Office expenses | X | ||

| Wages and salaries | X | ||

| Depreciation | X | XX | |

| Net Profit / Loss | XXX |

BALANCE SHEET AS AT 31ST DECEMBER, 20………

| Cost | Depreciation | Net Book Value | |

| Fixed Assets | ₦ | ₦ | ₦ |

| Land and Building | X | X | X |

| Fixture and fittings | X | X | X |

| Equipment | X | X | X |

| Motor van | X | X | X |

| Premises | X | X | X |

| Goodwill | X | X | X |

| Investment | X | X | X |

| XX | XX | XXX | |

| Current Assets | |||

| Stock | X | ||

| Debtor | X | ||

| Less: provision for doubtful debt | X | X | |

| Prepaid expenses | X | ||

| Bank | X | ||

| Accrued income | X | ||

| Cash in hand | X | ||

| XX | |||

| Less: Current Liabilities | |||

| Creditors | X | ||

| Loan | X | ||

| Bank overdraft | X | ||

| Prepaid income | X | ||

| Accrued expenses | X | X | |

| Working Capital | XX | ||

| Capital Employed | XXX | ||

| Financed By: | |||

| Capital | X | ||

| Add: Net profit or Less: Net loss | X | ||

| X | |||

| Less Drawings | X | ||

| XXX |

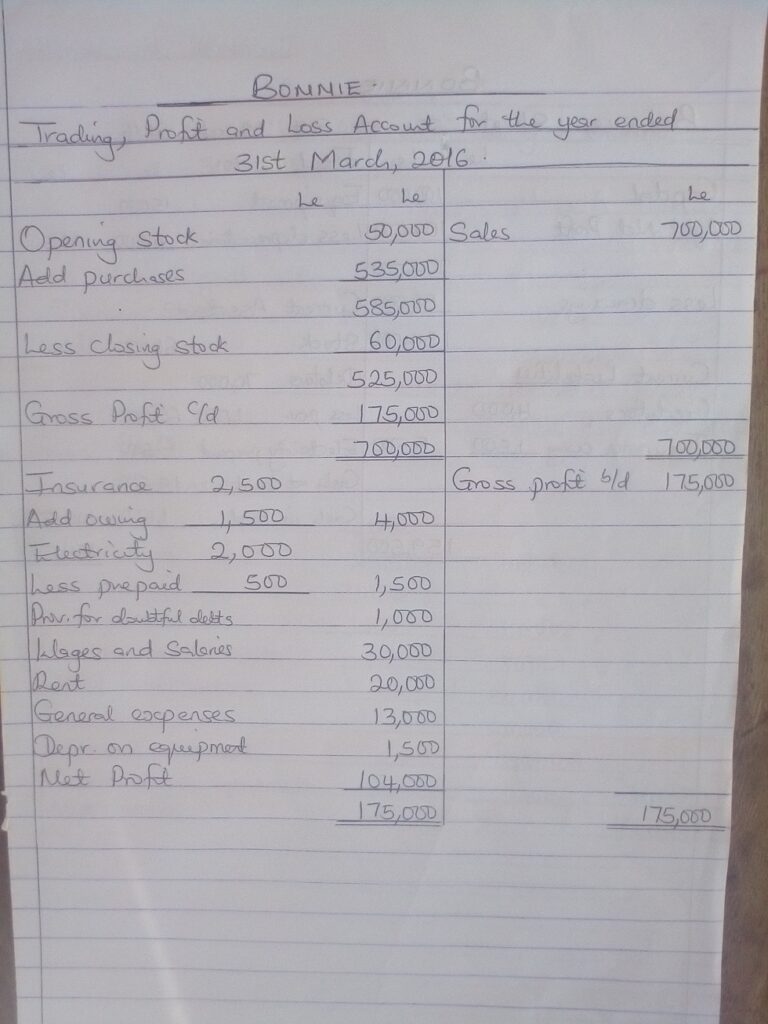

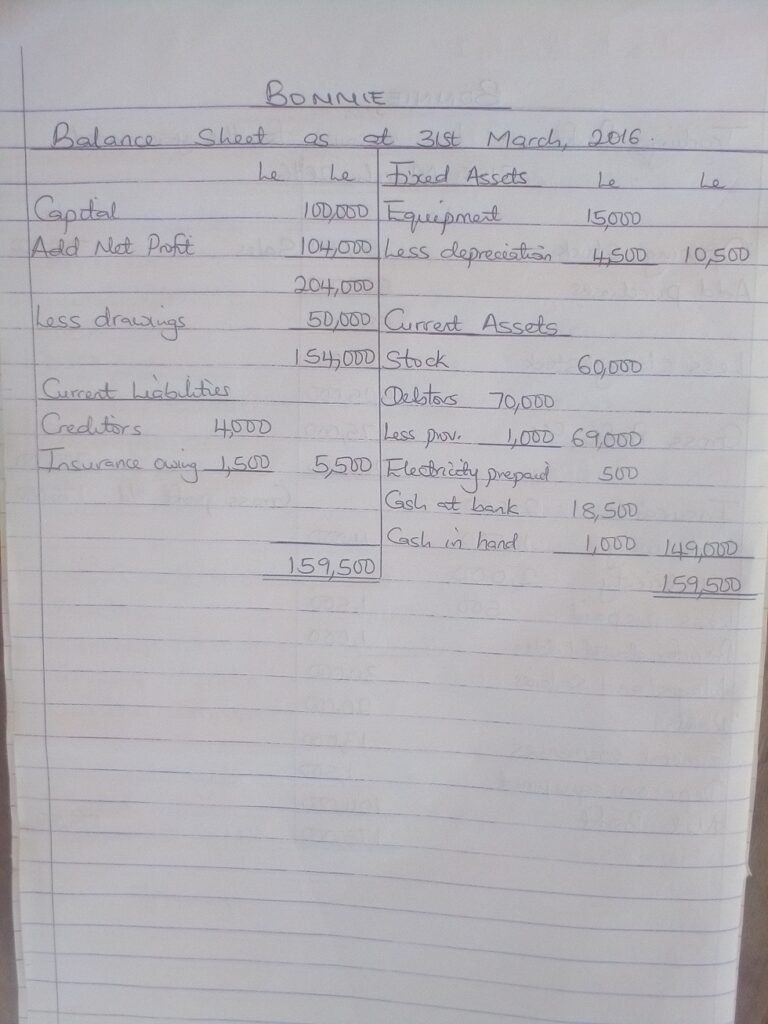

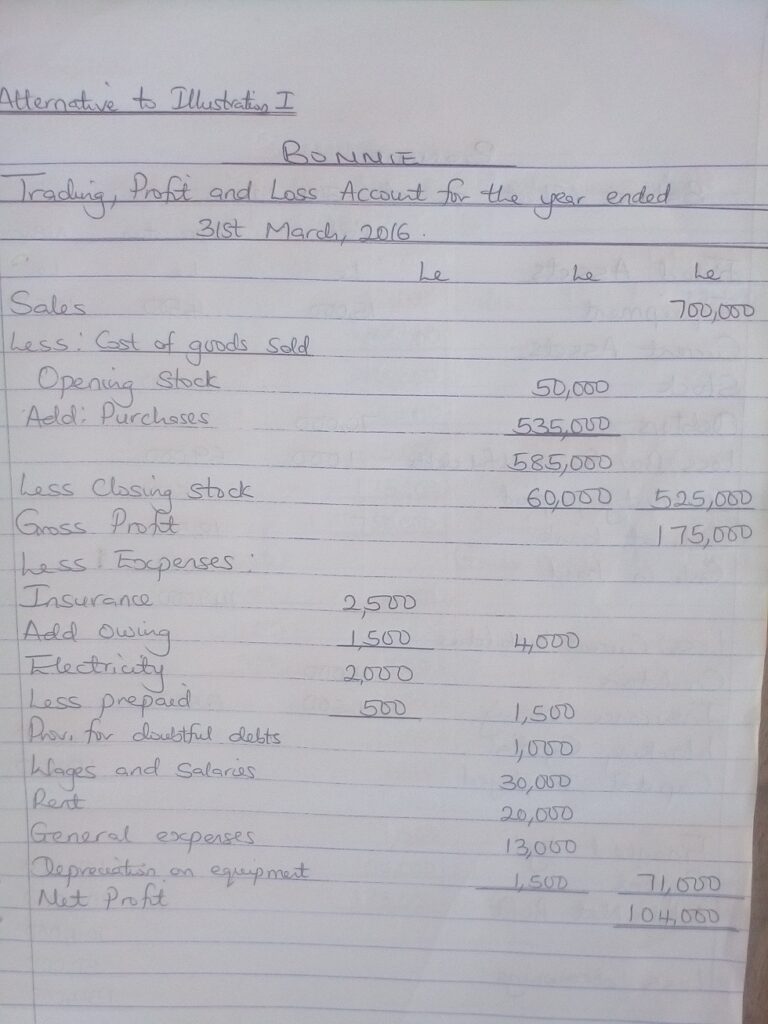

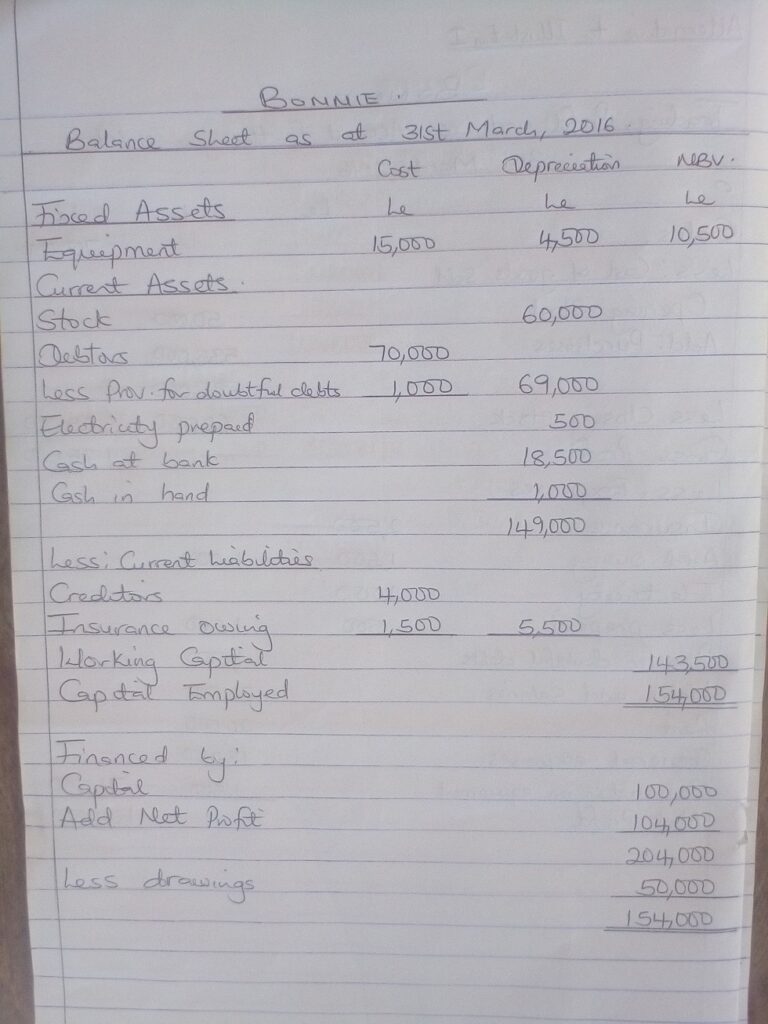

ILLUSTRATION 1:

The following balances were extracted from the books of Bonnie, a retailer as at 31st March, 2016.

| Dr | Cr | |

| Le | Le | |

| Capital | 100,000 | |

| Drawings | 50,000 | |

| Cash in hand | 1,000 | |

| Cash at bank | 18,500 | |

| Debtors and Creditors | 70,000 | 4,000 |

| Insurance | 2,500 | |

| Purchases and Sales | 535,000 | 700,000 |

| Stock: 1st April, 2015 | 50,000 | |

| Electricity | 2,000 | |

| General Expenses | 13,000 | |

| Equipment at cost | 15,000 | |

| Provision for depreciation of Equipment – 1st April, 2015 | 3,000 | |

| Wages and salaries | 30,000 | |

| Rent | 20,000 | |

| 807,000 | 807,000 |

Additional Information:

- Stock on 31st March, 2016 was valued at Le 60,000

- At 31st March, 2015; Le 1,500 was outstanding on insurance; electricity was prepaid by Le 500 and there was am doubtful debt of Le 1,000.

- Depreciation is to be provided on equipment at 10% on cost.

You are required to prepare:

(a) Trading, Profit and Loss Account for the year ended 31st March, 2016

(b) Balance Sheet as at that date.

SOLUTION:

ALTERNATIVE SOLUTION TO ILLUSTRATION I

ILLUSTRATION II:

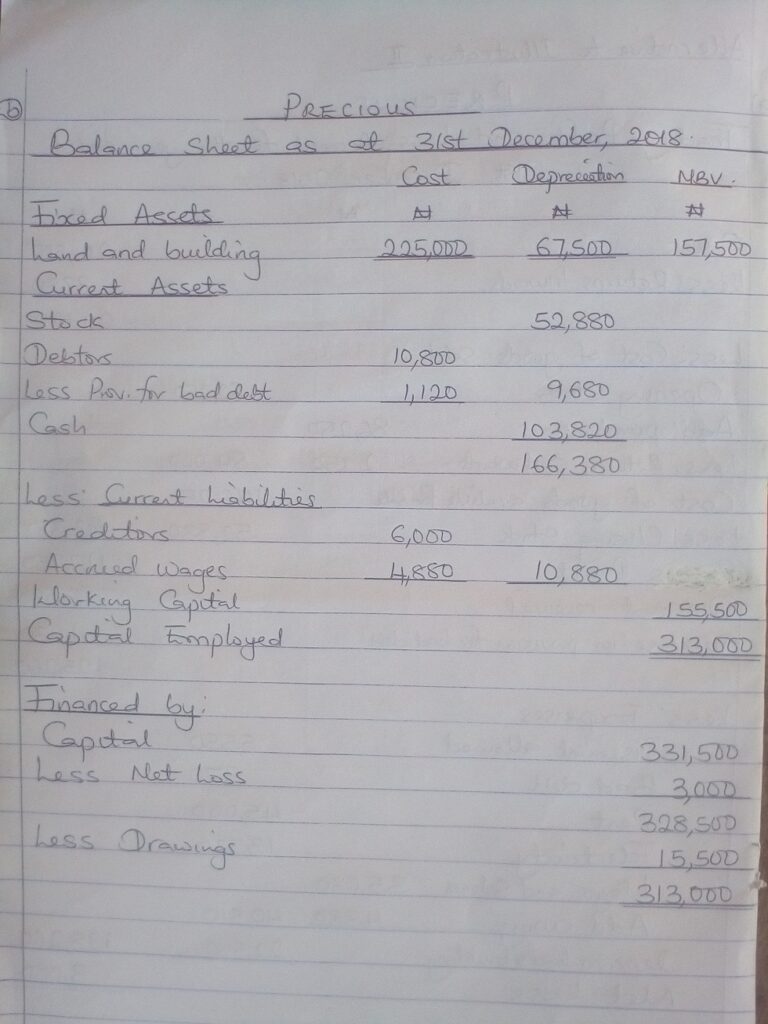

The following is an extract of Precious Trial Balance as at 31st December, 2018.

| ₦ | ₦ | |

| Stock | 62,250 | |

| Purchases | 86,250 | |

| Sales | 214,500 | |

| Returns inwards | 3,380 | |

| Returns outwards | 2,250 | |

| Discount received | 6,080 | |

| Discount allowed | 5,550 | |

| Land and Buildings at cost | 225,000 | |

| Provision for depreciation: Land and Building | 45,000 | |

| Debtors | 10,800 | |

| Bad debts | 970 | |

| Creditors | 6,000 | |

| Provision for bad debts – 1st January,2018 | 2,550 | |

| 45,000 | ||

| Electricity | 13,730 | |

| Wages and salaries | 35,630 | |

| Drawings | 15,500 | |

| Cash at hand | 103,820 | |

| Capital | 331,500 | |

| 607,880 | 607,880 |

Additional information:

- Stock at hand at 31st December, 2017 was ₦52,880

- Wages and salaries owing amounted to ₦4,880

- Provision for bad debts is to be reduced to ₦1,120.

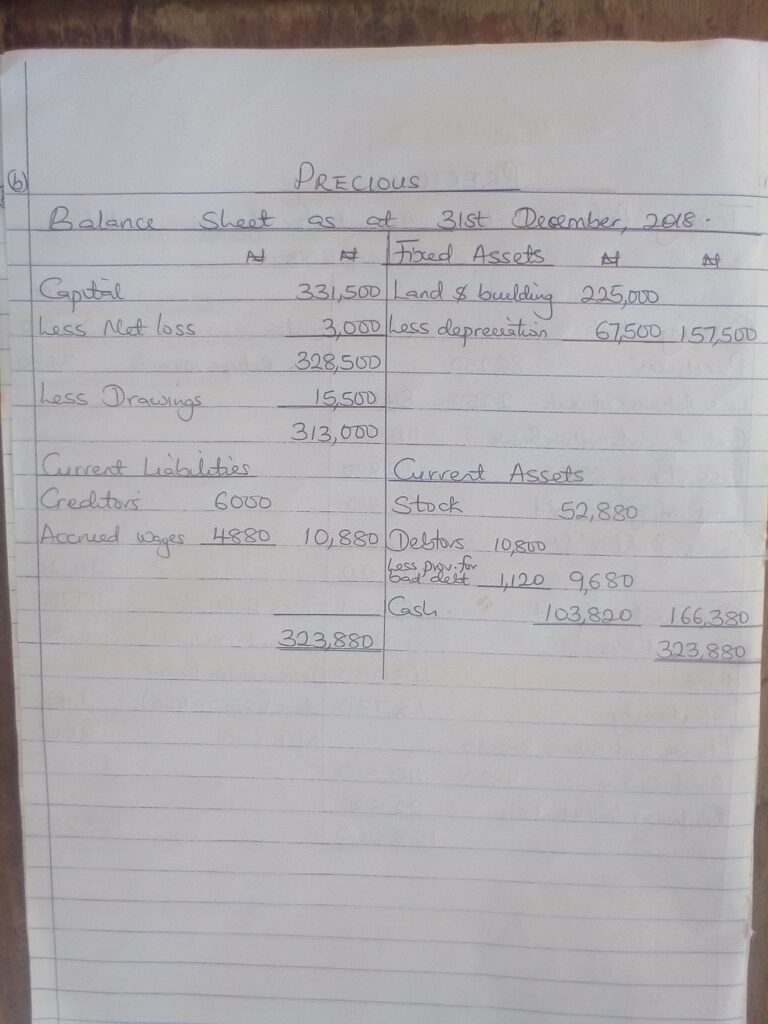

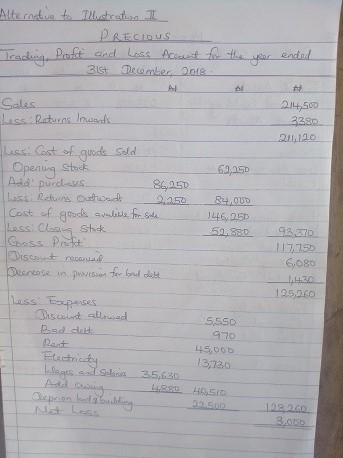

You are required to prepare:

(a) Trading, Profit and Loss Account for the year ended 31st December, 2018

(b) Balance Sheet as at that date.

SOLUTION:

ALTERNATIVE SOLUTION TO ILLUSTRATION II

ASSIGNMENT

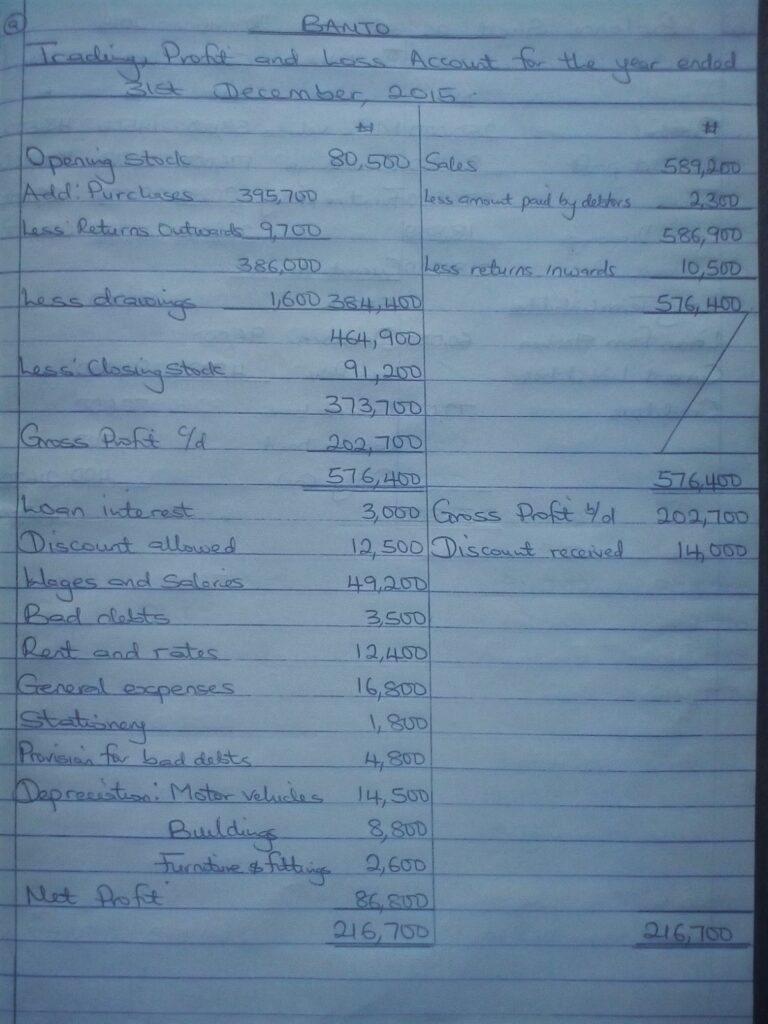

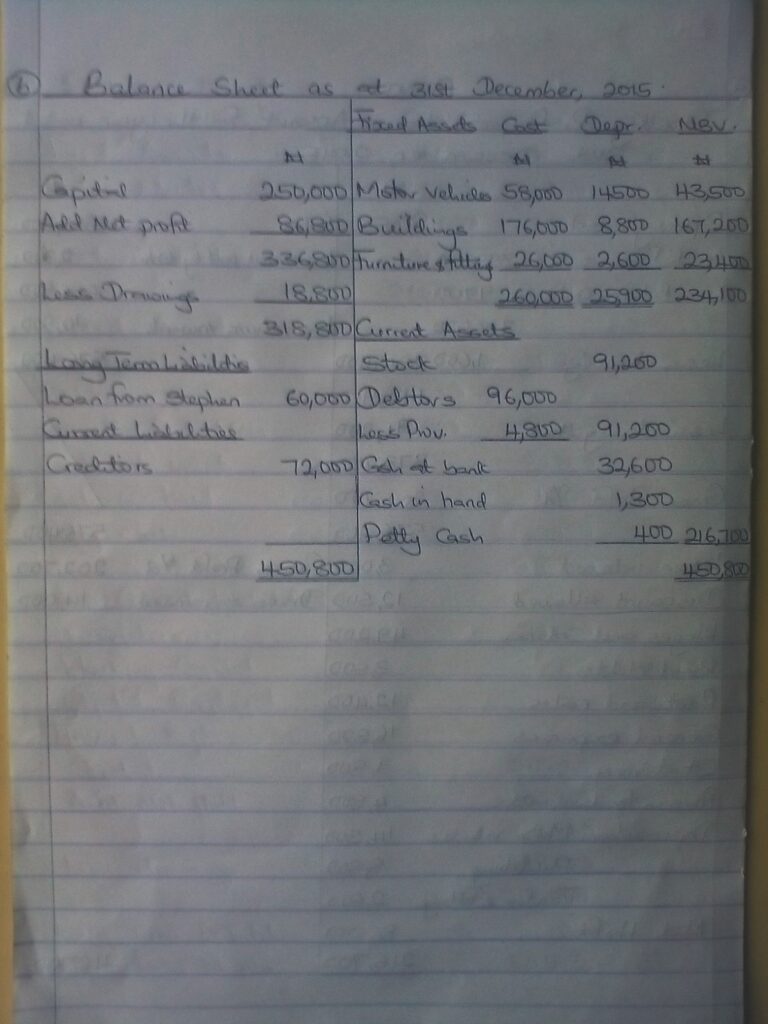

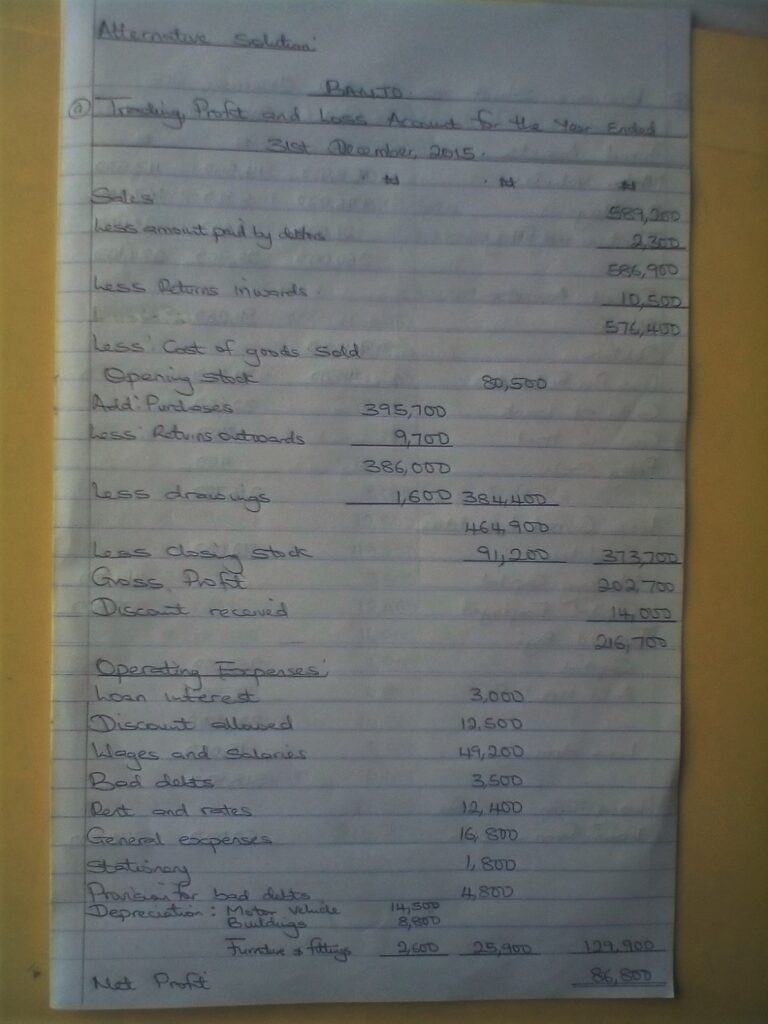

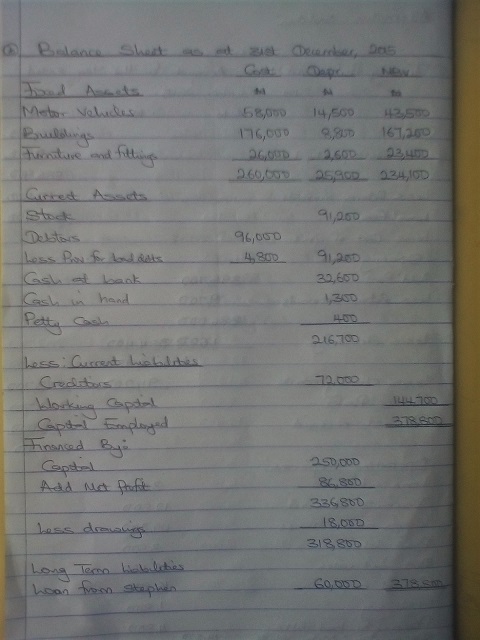

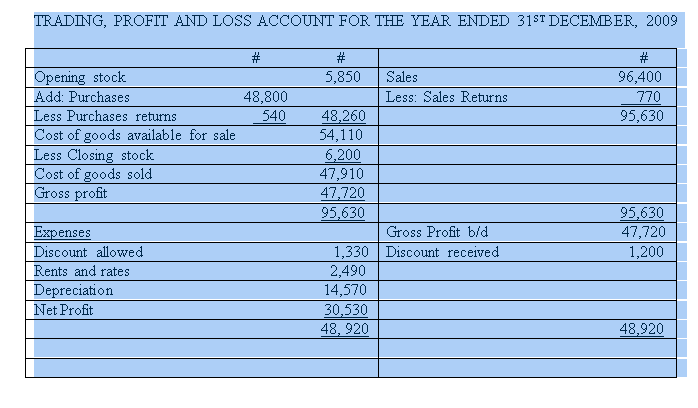

The following trial balance was extracted from the books of Banjo on 31st December, 2015

| ₦ | ₦ | |

| Stock – 1st January, 2015 | 80,500 | |

| Motor vehicles | 58,000 | |

| Buildings | 176,000 | |

| Furniture and fittings | 26,000 | |

| Debtors and Creditors | 98,300 | 72,000 |

| Purchases and Sales | 395,700 | 589,200 |

| Returns | 10,500 | 9,700 |

| Discounts | 12,500 | 14,000 |

| Wages and Salaries | 49,200 | |

| Drawings | 16,400 | |

| Loan from Stephen | 60,000 | |

| Bad debts | 3,500 | |

| Loan interest | 3,000 | |

| General expenses | 16,800 | |

| Stationery | 1,800 | |

| Rent and Rates | 12,400 | |

| Petty cash | 400 | |

| Cash in hand | 1,300 | |

| Cash at bank | 32,600 | |

| Capital | 250,000 | |

| 994,900 | 994,900 |

Additional Information:

- Stock – 31st December, 2015 was ₦91,500.

- Depreciation: Motor Vehicles 25%

Buildings 5%

Furniture and fittings 10%

- Make a 5% provision for doubtful debts

- ₦2,300 paid by a debtor during the year was mistakenly credited to sales account.

- Goods worth ₦1,600 withdrawn by Banjo was not accounted for.

You are required to prepare:

(a) Trading, Profit and Loss Account for the year ended 31st December, 2015

(b) Balance Sheet as at that date.

LESSON 5

CLASS: SS 1 DATE: JUNE 18TH, 2020

You are welcome to this week on-line class. I have not seen your assignment. Are you sure you are following the class? DO THE ASSIGNMENT so that I can be sure you are following the class. Let us go to today’s topic.

FINAL ACCOUNT OF SOLE TRADER

The final accounts consists f the following:

- Trading account

- Profit and loss account

- Balance sheet

TRADING ACCOUNT

The trading account is prepared to show the gross profit or gross loss for the period. It is prepared to conform to the rules of double entry. It consists of the following:

Debit side:

- Opening stock

- Purchases

- Carriage inwards

- Returns outwards

- Closing stock

- Cost of goods available for sale

- Cost of goods sold

- Gross profit

Credit side:

- Sales

- Returns inwards

PROFIT AND LOSS ACCOUNT

The profit and loss account is the account that shows the net profit or net loss of an organization. Income or gains are credited, while expenses are debited. The profit or loss will be taken to the balance sheet.

Example: From the following trial balance of Ajayi, draw up a trading, profit and loss account for the year ended 31st December, 1996.

| Dr | Cr | |

| # | # | |

| Capital | 22,636 | |

| Stock | 2,368 | |

| Carriage outwards | 200 | |

| Carriage inwards | 310 | |

| Returns inwards | 205 | |

| Sales | 18,600 | |

| Purchases | 11,874 | |

| Returns outwards | 322 | |

| Salaries and wages | 3,862 | |

| Rent | 304 | |

| Insurance | 78 | |

| Sundry expenses | 664 | |

| Advertising | 216 | |

| General expenses | 480 | |

| Land and building | 5,000 | |

| Furniture and fitting | 1,800 | |

| Motor car | 350 | |

| Debtors | 3,896 | |

| Bank | 10,482 | |

| Creditors | 1,731 | |

| Drawings | 1,200 | |

| 43,289 | 43,289 |

Stock at 31st December 1996 was #3,000.

SOLUTION

In the books of Ajayi

Trading, Profit and Loss Account for the year ended 31st December, 1996

| # # | # # |

| Opening stock 2,368 | Sales 18,600 |

| Add purchases 11,874 | Less Returns inwards 205 |

| Add carriage inwards 310 | 18,395 |

| 12,184 | |

| Less returns outwards 322 11,862 | |

| 14,230 | |

| Less closing stock 3,000 | |

| 11,230 | |

| Gross profit 7,165 | |

| 18,395 | 18,395 |

| Expenses | |

| Carriage outwards 200 | Gross profit b/d 7,165 |

| Salaries and wages 3,862 | |

| Rent 304 | |

| Insurance 78 | |

| Sundry expenses 664 | |

| Advertising 216 | |

| General expenses 480 | |

| Net profit 1,361 | |

| 7,165 | 7,165 |

BALANCE SHEET

Balance sheet can be defined as the statement that shows the presentation of the summary of assets and liabilities in a well arranged form, so that the financial position may be clearly ascertained. Balance sheet is not an account; it is a statement shoeing the balance remaining in the books. The balance sheet consists of the assets and liabilities.

The assets are divided into fixed assets and current assets while the liabilities too are divided into long term and current liabilities.

Balance Sheet as at 31st December, 1996

| # | # |

| Capital 22,636 | Fixed Assets |

| Add Net Profit 1,361 | Land and building 5,000 |

| 23,887 | Furniture and fitting 1,800 |

| Less Drawings 1,200 | Motor car 350 |

| 22,797 | 7,150 |

| Current Assets | |

| Stock 3,000 | |

| Current liabilities | Debtors 3,896 |

| Creditors 1,731 | Bank 10,482 17,378 |

| 24,528 | 24,528 |

ASSIGNMENT

Essential Financial Accounting , Exercise 16.6A

LESSON 5: ASSIGNMENT – CORRECTION

OKOKWO

FINANCIAL ACCOUNTING

CLASS: SS 1 DATE: JUNE 11TH, 2020

Good morning students, you are welcome to today’s online class. Please, make sure you copy the scheme of work and today’s notes into your Financial Accounting notebooks.

SCHEME OF WORK FOR 3RD TERM

- Revision of 2nd term

2. Bank reconciliation – adjustment

3. Final account of sole trader

- Identify trading account items

- Determine the gross profit and loss

- Profit and loss account

4. Final account of a sole trader

- Balance sheet

- Adjustments

5. Principal journal

- Meaning and features of general journal

- Uses of journal

- Accounting entries

6. Correction of Errors

- Errors that do not affect the agreement of the trial balance

- Errors that affect the agreement of the trial balance

7. Suspense account

8. Control account

- Meaning of control account

- Uses of control account

- Sales ledger control account

- Sources and format

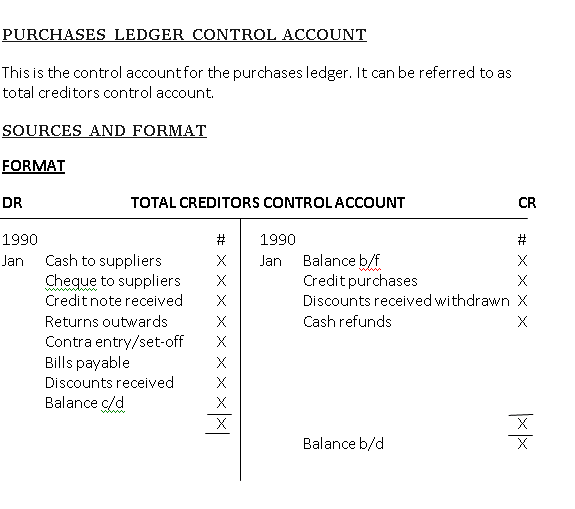

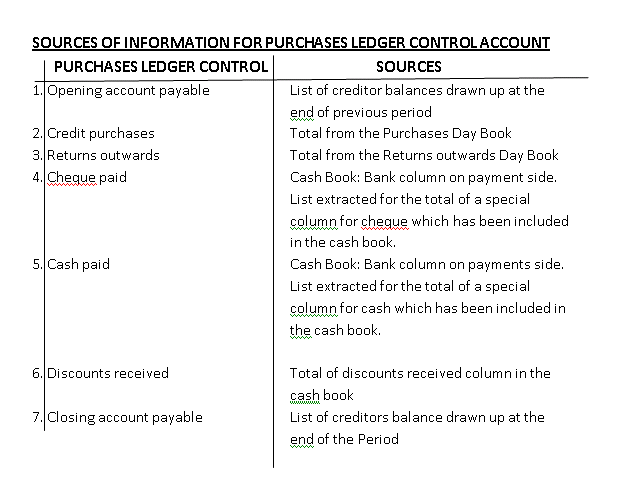

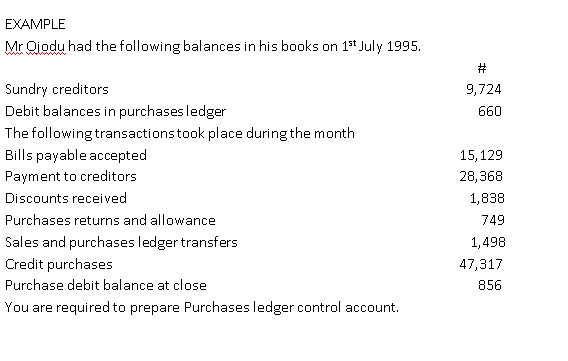

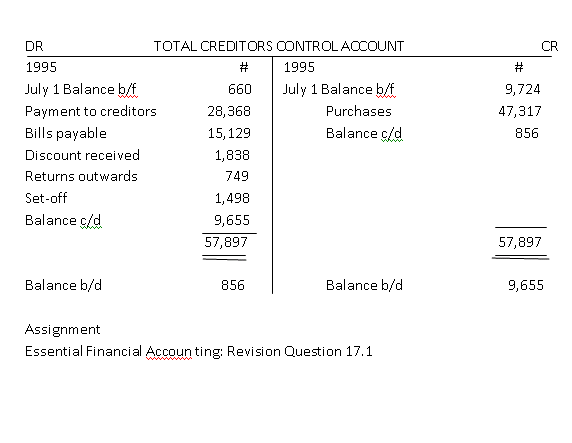

9. Purchases ledger control account

- Sources and format

- Combination of control account

10. Non-profit making account

- Receipt and payment account

- Income and expenditure account

Today, we shall be considering bank reconciliation statement with adjusted cashbook.

Bank Reconciliation Statement with Adjusted Cashbook

Under this method, an adjusted cash book will be prepared. The balance arrive googat will be used in preparing bank reconciliation statement. The bank reconciliation statement will now be relieved of some items which would have been posted to the Adjusted Cashbook.

FORMAT

Adjusted Cash book

| Balance b/d | X | Bank charges | X |

| Credit transfer | X | Standing order | X |

| Dividend | X | Direct debits | X |

| Receipt undercast | X | Receipt overcast | X |

| Payment overcast | X | Payment undercast | X |

| Trade creditors | X | Interest payment | X |

| Dishonoured cheque | X | ||

| Balance c/d | X | ||

| XX | XX | ||

| Balance b/d | X | ||

After the preparation of the adjusted cash book, the bank reconciliation statement will then be prepared using the balance as per adjusted cashbook.

Bank Reconciliation Statement as at that date

| Balance as per adjusted cashbook | X | |

| Add: Unpresented cheque | X | |

| Wrong credit in the bank statement | X | XX |

| XX | ||

| Less: Uncredited cheque | X | |

| Bank error | X | XX |

| Balance as per bank statement | XXX |

Illustration on Bank Reconciliation Statement

On 30th November, 2018, Adedeji’s cash book showed a debit balance of GHȼ 76,000. However, his bank statement showed an overdraft balance of GHȼ 18,800. On investigation, the following details were discovered:

- A standing order of GHȼ 1,600 had not been entered in the cash book

- Bank charges of GHȼ 400 did not appear in the cashbook;

- Cash paid into the bank for GHȼ 4,000 had been entered in the cashbook as GHȼ 3,600.

- A cheque of GHȼ 2,000 received from a customer was dishonoured;

- The bank received a credit transfer of GHȼ 4,000 from a customer;

- A cheque of GHȼ 13,600 paid to Dexteri Ltd had been entered in the cash book as GHȼ 17,200;

- A receipt of GHȼ 400 shown on the bank statement had not been entered in the cash book;

- A cheque drawn amounting to GHȼ 1,600 paid is still with the supplier;

- Receipt of GHȼ 36,000 paid into the bank on 30th November, 2018 did not appear on the bank statement until December 2018;

- A cheque of GHȼ 10,800 paid into the bank had been wrongly credited by bank as GHȼ6,000;

- A transfer of GHȼ 60,000 to the bank had not been recorded in the cash book.

You are required to prepare:

- Adjusted cashbook;

- Bank Reconciliation Statement as at 30th November, 2018.

SOLUTION

ADEDEJI

(a) Adjusted Cashbook

| 2018 | GHȼ | 2018 | GHȼ |

| 30th Nov. Balance b/d | 76,000 | 30th Nov. Standing order | 1,600 |

| Understated receipt | 400 | Bank charges | 400 |

| Credit transfer | 4,000 | Dishonoured cheque | 2,000 |

| Payment overstated | 3,600 | Amount transferred | 6,000 |

| Receipt omitted | 400 | Balance c/d | 20,400 |

| 84,400 | 84,400 | ||

| 1st Dec. Balance b/d | 20,400 |

(b) Bank Reconciliation Statement as at 30th November, 2018

| GHȼ | GHȼ | |

| Balance as per adjusted cashbook | 20,400 | |

| Add: Unpresented cheque | 1,600 | |

| 22,000 | ||

| Less: Uncredited cheque | 36,000 | |

| Bank error | 4,800 | 40,800 |

| Overdraft as per bank statement (30/11/2018) | 18,800 | |

Workings:

(iii) Understated receipt: GHȼ4,000 – GHȼ3,600

= GHȼ400

- Payment overstated: GHȼ17,200 – GHȼ13,600

= GHȼ3,600

- Receipt omitted: Debit GHȼ400

- Unpresented cheque: GHȼ1,600

- Uncredited cheque: GHȼ36,000

- Bank error: GHȼ10,800 – GHȼ6,000

= GHȼ4,800

- Amount transferred: GHȼ60,000

ASSIGNMENT

NOTE: Please, make sure you submit your assignment on or before Tuesday 16th, 2020.

On 31st December, 2017, the bank column of the cashbook of Durojaye Enterprise showed a debit balance of ₦ 48,500. However, the bank statement showed a credit balance of ₦ 54,900 as on the same date.

A detailed comparison of entries revealed the following:

- Customers’ cheques amounting to

₦8,450 had not been credited by the bank as at 31/12/2017. - Cheques amounting to

₦8,850 had not been presented for payment as at 31/12/2017. - Bank charges of

₦1,000 and interest on investment of₦2,500 collected by the bank appeared only in the bank statement. - On the 30/12/2017, there was a wrong credit of

₦3,500 in the bank statement. - Durojaye Enterprise, a customer, had paid into the bank directly a sum of

₦3,000 on 29th December, 2017. This had not been recorded in the cashbook. - A cheque for

₦2,000 received from Jessy Enterprise, a customer, which was deposited had been returned unpaid. This had not been entered in the cash book.

You are required to:

- Write up the adjusted cash book.

- Prepare a bank reconciliation statement as at 31st December,2017.

SOLUTIONS TO JUNE 11, 2020 ASSIGNMENT.

DUROJAYE ENTERPRISE

(a) Adjusted Cashbook

| | | ||

| Balance b/d | 48,500 | Bank charges | 1,000 |

| Interest received | 2,500 | Jessy Enterprise | 2,000 |

| Durojaye Enterprise | 3,000 | Balance c/d | 51,000 |

| 54,000 | 54,000 | ||

| Balance b/d | 51,000 |

(b) Bank Reconciliation Statement as at 31st December, 2017

| | | |

| Balance as per adjusted cash book | 51,000 | |

| Add: Unpresented cheques | 8,850 | |

| Wrong credit in the bank statement | 3,500 | 12,350 |

| 63,350 | ||

| Less: Uncredited cheques | 8,450 | |

| Balance as per bank statement | 54,900 |

Alternative to Q(b): Preparing Bank Reconciliation Statement beginning with Bank Statement balance.

(b) Bank Reconciliation Statement as at 31st December, 2017

| GHȼ | GHȼ | |

| Balance as per bank statement | 54,900 | |

| Add: Uncredited cheque | 8,450 | |

| 63,350 | ||

| Less: Unpresented cheque | 8,850 | |

| Wrong credit in the bank statement | 3,500 | 12,350 |

| Balance as per adjusted cashbook | 51,000 |

LESSON 3

FINANCIAL ACCOUNTING

CLASS: SS 1 DATE: JUNE 4TH, 2020

You are welcome back to class. I hope you are enjoying the stay at home. Please don’t eat more than expected. Have you been enjoying the class? You have not been attempting the assignment I gave. Why? Anyway, at the end of each lesson, (beneath the form) the correction to each assignment is there.

CASHBOOK

TWO COLUMN CASHBOOK

Virtually all businesses of reasonable standards operate through one bank or the other. In this situation, there is need to adjust the format of one column cashbook, i.e. the amount column is to be divided into two; cash column and bank column. Hence, all transactions made by cheque or through bank are recorded in the bank column while those made in cash are entered in cash column.

Therefore, two column cashbook, otherwise known as double column cashbook is a cashbook which combines two separate accounts, cash and bank for convenience sake. The table is divided into two, debit and credit side and each side contains five columns.

| DR | CR | ||||||||

| DATE | PART | FOLIO | CASH | BANK | DATE | PART | FOLIO | CASH | BANK |

CONTRA ENTRIES

Contra entries are double entries made in the same cashbook when cash is deposited into the bank account out of the cash in hand or when cash is withdrawn from the bank for office use. This can only take effect in two or three column cashbook.

Hence, there is need to write ‘C’ in the folio columns I line with the date, particulars and amount of the transaction. The ‘C’ means CONTRA.

BANK OVERDRAFT

Unlike the cash account, the bank account can be overdrawn. That is, a customer, through special arrangement with his banker, can withdraw more money than he has in his bank account to meet urgent needs.

The customer’s account appears as a debit balance in the books of the banker and in the books of the customer, the bank account shows a credit balance meaning that he (the customer) owes the bank. Interest is always charged on overdraft since it is a short term loan.

NOTE: When the credit side (payments) of the bank column is greater than debit side (receipts), then there is an overdraft.

THREE COLUMN CASHBOOK

It is obvious that most businesses, whether large or small, transacts business on credit. To encourage prompt payment, however, cash discount is usually introduced. This enables a debtor to pay less than what he owes in full settlement of his debt provided he settles the debt within the stipulated period.

A business unit that receives or allows cash discount would find it necessary to adjust its two-column cashbook by adding another column that will accommodate the discounts, to make it a three column cashbook.

DISCOUNT

A discount can be defined as a percentage reduction in the price of a particular commodity.

TYPES OF DISCOUNT

- Trade discount: This is the percentage reduction in selling price given by a seller to favour buyers. The trade discount ends just in the journals.

- Bulk Discount: This is the percentage reduction in the selling price given to a customer to encourage him/her to buy more. The larger the quantity of goods bought, the higher the discount given. The bulk discount also is treated in the journal. It is also called a ‘Quantity Discount’.

- Cash Discount: This is the percentage reduction in the amount payable by the buyer to induce prompt payment. It appears in the cashbook and ledger. It is deducted after trade discount has been given.

| DR | CR | ||||||||||

| DATE | PAR | F | DIS. ALL | CASH | BANK | DATE | PAR | F | DIS. REC | CASH | BANK |

Illustration: Essential Financial Accounting, Exercise 7.2A

Solution:

In the book of Wilson

DR Three Column Cash Book CR

| DATE | PART. | F | DIS. ALL | CASH | BANK | DATE | PART. | F | DIS. REC | CASH | BANK |

| Mar ‘94 | =N= | =N= | =N= | Mar ’94 | =N= | =N= | =N= | ||||

| 1 | Bal. b/d | 2000 | 3 | Purchases | 1000 | ||||||

| 4 | Bank | C | 100 | 4 | Cash | C | 100 | ||||

| 8 | Dayo | 3 | 123 | 5 | Stationery | 15 | |||||

| 9 | Faji | 5 | 140 | ||||||||

| 12 | Gart | 4 | 180 | 13 | Wages | 29 | |||||

| 13 | Uden | 6 | 193 | ||||||||

| 15 | Dayo | 67 | 15 | Carriage | 4 | ||||||

| 17 | Janet | 100 | |||||||||

| 19 | Postage | 5 | |||||||||

| 20 | Sales | 184 | 24 | Purchases | 152 | ||||||

| 25 | Cleaning | 3 | |||||||||

| 30 | Drawings | 50 | |||||||||

| 30 | Salaries | 75 | |||||||||

| 31 | Bal. c/d | 231 | 837 | ||||||||

| 12 | 284 | 2510 | 6 | 284 | 2510 |

ASSIGNMENT

Essential Financial Accounting, Exercise 7.6A

CORRECTION – LESSON 3 ASSIGNMENT

THREE COLUMN CASHBOOK

| Date | Part | F | Disc All | Cash | Bank | Date | Part | F | Disc Rec | Cash | Bank |

| July | # | # | # | July | # | # | # | ||||

| 1 | Bal b/f | 3,000 | 9,000 | 2 | Sola | 45 | 405 | ||||

| 3 | Sales | 17,000 | 2 | Sobo | 300 | 2700 | |||||

| 5 | Ayo | 2,400 | 13,600 | 4 | Tmt rate | 1,800 | |||||

| 5 | Sule | 630 | 3,570 | 6 | Drawing | 1,000 | |||||

| 10 | Bank | C | 6,000 | 10 | Cash | C | 6,000 | ||||

| 13 | Purchases | 500 | |||||||||

| 14 | Purchases | 90 | |||||||||

| 25 | Building | 300 | |||||||||

| 31 | Kayode (Loan) | 1,000 | 30 | Insurance | 20 | ||||||

| 31 | Bal c/d | 24,380 | 15,975 | ||||||||

| 3,030 | 27,000 | 26,170 | 345 | 27,000 | 26,170 |

28/ 5/ 2020

CLASS EXERCISE

Precious Limited operates an imprest with N90,000 paid out of bank. The following expenses were settled out of petty cash during the month of June, 2016.

| June | | |

| 1 | Wages | 6,000 |

| 2 | Rates | 4,500 |

| 3 | Postage stamps | 600 |

| 4 | Transport expenses | 15,600 |

| 5 | Postage stamps | 750 |

| 8 | Wages | 1,500 |

| 10 | Segun (creditor) | 6,000 |

| 13 | Wages | 4,500 |

| 18 | Gbenga (creditor) | 4,500 |

| 22 | Rates | 6,000 |

| 23 | Wages | 4,200 |

| 24 | Rates | 2,400 |

| 26 | Registered letters | 3,000 |

| 28 | Rates | 2,700 |

| 29 | Wages | 3,600 |

| 30 | Wages | 4,800 |

| 30 | Float restored | ? |

You are required to write up the petty cash book for the month of June, 2016 having analysis columns for Rates, Postage, Transport, Wages and Ledger.

SOLUTION

ASSIGNMENT

1 (a) Explain the following terms:

(i) petty cash book

(ii) contra entries

(iii) imprest system

(b) State three advantages of keeping petty cash book using imprest system.

(c) State four source documents that are used to make entries in the petty cash book.

No Fields Found.CORRECTION TO ASSIGNMENT GIVEN ON 28/5/2020

- Petty cash float: It is the maximum amount a petty cashier is allowed to hold at any point in time for the payment of minor expenses.

- Contra entries: These are entries which are recorded on the opposite sides of an earlier entry to reverse or offset their effects on their account balances. OR They are entries made for transactions whose debits and credits are in the same book.

- Imprest system: This is a system wherebya fixed amount of money is given to a petty cashier for the payment of minor expenses and he is reimbursed with the amount disbursed over a period of time.

1 (b) Advantages of keeping petty cash book using imprest system.

- It saves the main cashier’s time so as to concentrate on larger disbursements.

- It provides a training opportunity for young and inexperienced cashiers that enables them to take up higher cash responsibilities.

- It provides support for internal checks or detection of errors.

- It minimizes delays in cash disbursements.

- It reduces the burden on the main cashier.

- It enables the petty cashier to analyse expenditure as they occur.

- It decongests the main cashbook.

- It helps to classify petty expenses for easy identification.

1 (c) Source documents that are used to make entries in the petty cash book.

- Receipts

- Petty cash vouchers

- Certificate of honour

- Invoices

- Bills

LESSON 1 – WEEK 1

Hello student, how have you been enjoying the holiday? I hope you are reading and staying safe.

Let us have a little revision of work done during the previous terms.

CASHBOOK

Cashbook is the book of original entry for recording detailed particulars of all money received and paid. The cashbook is both a journal and also a ledger.

TYPES OF CASHBOOK

- Single or one column cashbook

- Double or two column cashbook

- Three column cashbook

- Petty Cashbook

ONE COLUMN CASHBOOK

One column cashbook is divided into two segment; the debit side and the credit side. Each segment has four column: date, particulars, folio and amount.

The debit side is used for recording receipts while the credit side used for recording the givings.

| Dr | Cr | ||||||

| Date | Particulars | Folio | Amount | Date | Particulars | Folio | Amount |

Assignment

- Explain how the cashbook is both a journal and a ledger.

- From the textbook, Essential Financial Accounting, try exercise 6.7A.

If you want to upload your answer, use the form below.

No Fields Found.CORRECTION FOR LESSON 1 ASSIGNMENT

- Explain how the cashbook is both a journal and a ledger.

The cashbook is both a ledger and a journal.

A cashbook is a ledger because it is the final destination of all cash (and bank)transactions (depending on the type of cashbook) and it follows the principle of double entry.

The cashbook is a journal because it is the book of original or prime entry or the first book of entry for all cash (and bank) transactions (depending on the type of cashbook).

2. From the textbook, Essential Financial Accounting, try exercise 6.7A.

| DR | CR | ||||||

| DATE | PARTICULARS | F | AMOUNT | DATE | PARTICULARS | F | AMOUNT |

| Mar ’90 | =N= | Mar’90 | =N= | ||||

| 15 | Capital | 3000 | 16 | Purchases | 300 | ||

| 16 | Transport | 30 | |||||

| 21 | Advertising | 20 | |||||

| 22 | Gen. exp. | 10 | |||||

| 28 | Sales | 430 | 29 | Rent | 40 | ||

| 31 | Wages | 20 | |||||

| 31 | Balance c/d | 3010 | |||||

| 3430 | 3430 | ||||||

| Apr 1 | Balance b/d | 3010 |