September 8th, 2020

Good morning students. You are warmly welcome to today’s online Commerce revision class.

REVISION QUESTIONS.

1 (a) What is warehousing?

(b) State five Importance of Warehousing.

(c) Give four Features of a Warehouse

(d) Mention four types of Warehouses.

2 (a) What is turnover in Commerce?

(b) State four features of capital.

(c) List and explain six factors that determine the turnover of a product.

3 (a) State four importance of working capital to a business.

(b) Use the following information to answer the questions below

Item Le

Debtor 30,000

Cash in hand 6,750

Plant and machinery 72,000

Motor van 31,000

Stock of raw materials 12,000

Loan 50,000

Trade creditors 43,000

Calculate:

(a)The liquid capital for the business.

(b)The fixed asset.

(c)Tosin Enterprise’s capital or statement of affairs as at 31\10\2010

(d)The working capital for Tosin Enterprises Limited.

SEPTEMBER 1ST, 2020

LESSON 16

REVISION

You are welcome to today’s class. I hope you are reading and preparing for resumption. Since we are through with all the topics, let us revise some of the topics with the following questions.

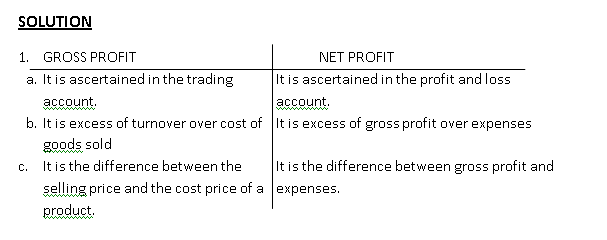

Differentiate between:

- Home trade and foreign trade

- Gross profit and Net profit

- Trust and cartel

AUGUST 25, 2020

Good day students and welcome to today’s online Commerce revision class.

REVISION QUESTIONS

1 (a) What is foreign trade?

(b) Explain four ways by which foreign trade is different from home trade.

(c) State three reasons why countries restrict foreign trade.

2 (a) State five functions of a chamber of commerce

(b) Explain five functions of a trade association.

3 (a) What is turnover in Commerce?

(b) State and explain six factors that determine the turnover of a product.

AUGUST 18, 2020

LESSON 14

You are welcome to this week online class. Hope you are reading and preparing for resupmption.

COMMODITY EXCHANGE

Commodity is specifically applied to goods for which there is demand, but which is supplied without qualitative differential across market. A commodity exchange refers to a marketable item produced to satisfy wants or need. Economic commodities comprises of goods and services.

TRADABLE COMMODITIES

Tradable commodities are usually categorized into four basic groups: energy, metals, livestock and agriculture. Among economists, there is little differentiation between a tradable commodity coming from one producer and the same commodity from another source.

TYPES OF TRADABLE COMMODITIES

- Soft and hard commodities: Soft commodities are agricultural products or livestock—such as corn, wheat, coffee, sugar, soybeans, and pork whereas hard commodities are typically natural resources that must be mined or extracted—such as gold, rubber, and oil.

- Energy commodities: The term energy commodities refers to a variety of coal, oil, and gasoline derived products. These include such energy sources as coal, Brent Sea Oil, gasoline, heating oil, and natural gas.

COMMODITY EXCHANGE

A commodities exchange is a legal entity that determines and enforces rules and procedures for trading standardized commodity contracts and related investment products. A commodities exchange also refers to the physical center where trading takes place. … The most traded commodity future contract is crude oil.

CONDITIONS NECESSARY FOR TRADING

- Someone trading must have knowledge of the product.

- He/she must be familiar with his/her customers desires or buying pattern.

- He/she must carry out a feasibility study of the area he/she wants to carry out the trade.

- He/she must be familiar with the type of transport network he/she wants to use.

- He/she must be familiar with online trading.

REQUIREMENT FOR TRADING

- Grading system: This involves the process of arranging the commodities in a manner to ensure quality delivery of the commodities to the customers.

- Warehousing: Warehousing is the act of storing commodities produced or bought in a place until they are needed by the customers. It ensures that there is a regular and steady supply of goods or commodities.

- Clearing system: This refers to the situation where commodities exported are carefully cleared from the seaports or airports.

- Standardizing: This is a process which the wholesaler or the importer do to ensure that the commodities exported are able to meet the standard set by a particular country.

METHODS OF TRADING ON COMMODITIES

- Open outcry: Open outcry is a method of communication between professionals on a stock exchange or futures exchange typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. In an open outcry auction, bids and offers must be made out in the open market, giving all participants a chance to compete for the order with the best price.

- Electronic means (i.e. Online): This involves the use of the computer system to trade either nationally or internationally. The computer system enables traders to do business successfully. The computer system provides useful information on how buyers and sellers can communicate on all matters that borders on tradable commodities.

BENEFITS OF COMMODITY EXCHANGE

- Commodity exchange ensure an increase in agricultural production.

- It brings about stabilization in agricultural product pricing.

- It brings about improvement in output and quality.

- It helps to generate employment.

- It encourages exploration of solid minerals.

CONSTRAINTS TO COMMODITY TRADING

- Inadequate supply

- Poor storage

- Bad weather

- Inadequate knowledge on commodity exchange

- Bad government policies

- Fraudsters

- Poor road network

Assignment

What are the methods of commodity trading?

LESSON 14 ASSIGNMENT – CORRECTION

METHODS OF COMMODITIES TRADING

- Open outcry: Open outcry is a method of communication between professionals on a stock exchange or futures exchange typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orders. In an open outcry auction, bids and offers must be made out in the open market, giving all participants a chance to compete for the order with the best price.

- Electronic means (i.e. Online): This involves the use of the computer system to trade either nationally or internationally. The computer system enables traders to do business successfully. The computer system provides useful information on how buyers and sellers can communicate on all matters that borders on tradable commodities.

AUGUST, 11TH 2020.

Good day students and welcome to today’s online class. Our topic today is career opportunities for Commercial students.

CAREER OPPORTUNITIES FOR COMMERCIAL STUDENTS.

A career is a type job or profession undertaken for a long period of a person’s life, usually with opportunities to gain advancement.

A career refers to an individual employment throughout their work life. A career involves changes within an occupation to another. The term “career” implies change and development over a period of time. This change can be classified into two mainly:

(i) Horizontal development

(ii) Vertical development

(i) Horizontal Development: This occurs when someone change from one job to another similar job.

(ii) Vertical Development: This occurs when someone gets a fresh job or a different job.

DIFFERENCE BETWEEN CAREER AND OCCUPATION.

Career applies to several occupation during a period a person’s working life span, while occupation is the job a person does at a particular time in their working life span.

Career Opportunities in the Public Sector

In the public sector, the local, state and federal government are the employers of labour. Although, the Federal government is the largest employer. Public sector are divided into two:

a. Public service

b. Civil service

Classes of Career Opportunities in the Public Sector

- Administrative, Professional and scientific or research class.

- Executive or technical class

- The Secretary

- Clerical or junior technical and sub-clerical officers, etc.

- Miscellaneous or an unestablished or daily rated groups.

Career Opportunities in the private Sector

- Marketing and sales

- Production and Marketing management

- Accounting and Management Information System

- Insurance Industry

Career Opportunities in the Teaching Profession

Various opportunities are available for people that major in Business Education in Colleges of Education, Polytechnics and Universities, the opportunities include:

1. Teachers in secondary schools

2. Lecturers in polytechnics.

3. Lecturers in Colleges of Education

4. Lecturers in the Universities

5. Bursars

6. Registrars

Requirement for Engagement in Commercial Field

- Basic Requirement for Unskilled Jobs: Holders of Primary six certificates. Career opportunities open to them are messengers, cleaners, office assistants.

- Basic Requirement for Semi-skilled jobs: Secondary school certificate or National Diploma Certificate. Career opportunities open to them are clerical jobs in account, administration, insurance, banking.

- Basic Requirement of Management trainee, Top management or Executive level: First degree or higher National Diploma (HND) are offered for middle level and holders of second degree for top management level.

Commercial Courses

Graduate of the following professions are offered employment opportunities in commercial or management field, depending on one’s are of specialization, such as:

- Accounting

- Insurance

- Management

- Banking

- Finance

- Actuarial Science

- Economics

- Industrial relations

- Personnel Management

- Public Administration

- Marketing

- Secretarial Administration

Professional Examinations

There is need for higher professional examination to be taken so as to attain top management level in an organization. The following are some of the institutes conducting professional examinations:

- Chartered Institute of Bankers of Nigeria (CIBN)

- Institute of Chartered Accountants of Nigeria (ICAN)

- Nigerian Institute of Marketing (NIMARK)

- Charted Institute of Taxation

- Nigerian Institute of Management (NIM)

ASSIGNMENT

- Outline ten courses in commercial field.

- State three career opportunities open to a Senior Secondary School Certificate holder.

AUGUST 4TH, 2020

LESSON 12

You are welcome to this week on-line class. Hope you are enjoying the lessons.

TRADE TERMS AND ABBREVIATIONS

DISCOUNTS: Discount can be defined as the percentage reduction in the actual price of a product. It is reduced prices or something being sold at a price lower than that item is normally sold for. Discount means a reduction off of the normal price for goods or services.

There are 3 Types of Discount;

- Trade discount,

- Quantity or bulk discount, and.

- Cash discount

COST, INSURANCE AND FREIGHT (C.I.F): This price quotation means that the price quoted includes the cost of the goods, the freight and insurance up to the port of destination while the purchaser is responsible for other subsequent charges.

CARRIAGE PAID (CP): This is used to show that the company or person sending goods has paid for them to be transported as far as the place named.

COST AND FREIGHT (CF): This means that the price quoted covers all charges including freight payable to the point of destination while the buyer pays the insurance charge.

CARRIAGE FORWARD (CF): This isused to show that the cost of shipping goods will be paid by the buyer.

FREE ON RAIL (FOR): This price quotation means that the seller has paid all charges, including loading the goods on rail. The purchaser takes over other charges such as insurance from then on.

FREE OF BOARD (FOB): This means that the price covers all costs up to the ship, including charges payable for loading goods on the ship.

LOCO: Loco price includes the cost of goods at the factory of the seller.

FRANCO: Franco price includes the cost of goods plus all expenses up to the buyer’s warehouse.

ASSIGNMENT

Differentiate between LOCO and FRANCO

LESSON 12 ASSIGNMENT – CORRECTION

Loco price includes the cost of goods at the factory of the seller while Franco price includes the cost of goods plus all expenses up to the buyer’s warehouse.

JULY 26TH, 2020

Good day students and welcome to today’s online class. We shall be considering business turnover this morning.

Business Turnover

Turnover of a business is the total net sales during a particular period. e.g. a year. this is the value of total sales of an organisation during an accounting period, i.e. sales less returns inwards.

Rate of turnover or stock turn

rate of stock turnover is the number of times the value of average stock of a business is sold during a period. This is used to investigate the market success of the output of a firm. expensive goods have slow turnover rate while perishable goods have rapid rate.

Rate of Turnover = Cost of goods sold X 100

Average Stock

Factors that affect the turnover of a business

- Goodwill and reputation of the seller.

- Reduction in prices of goods (goods with high prices will have low sales, while products with low price will have high sales)

- The type of goods (foodstuff will have high turnover as compared with electronics)

- Advertising, publicity and sales promotion.

- Nearness of the business to consumers (there will be high turnover when a business is located near the consumers).

- Constant availability of goods

- Credit facilities

- Increase in the quantity of goods sold

- the variety of goods sold by the sellers.

OTHER IMPORTANT RATIO.

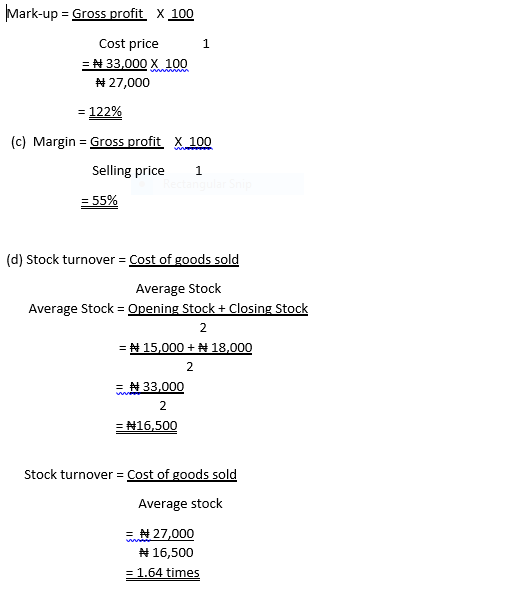

- MARGIN: This can be defined as the relationship between the profit and selling price. It is the profit expressed as a percentage of selling price.

Margin = Gross Profit X 100

Selling Price

2. Mark-up: This is the relationship that exist between the profit and the cost of goods sold.

Mark-up = Gross Profit X 100

Cost Price

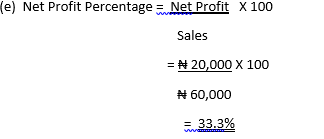

3. Net profit as a percentage of turnover = Net Profit X 100

Turnover

4. Gross profit as a percentage of turnover = Gross profit X 100

Turnover

5. Expenses as a percentage of turnover = Expenses X 100

Turnover

6. Managers’ Commission = Percentage Commission

100 + Percentage Commission

ILLUSTRATION

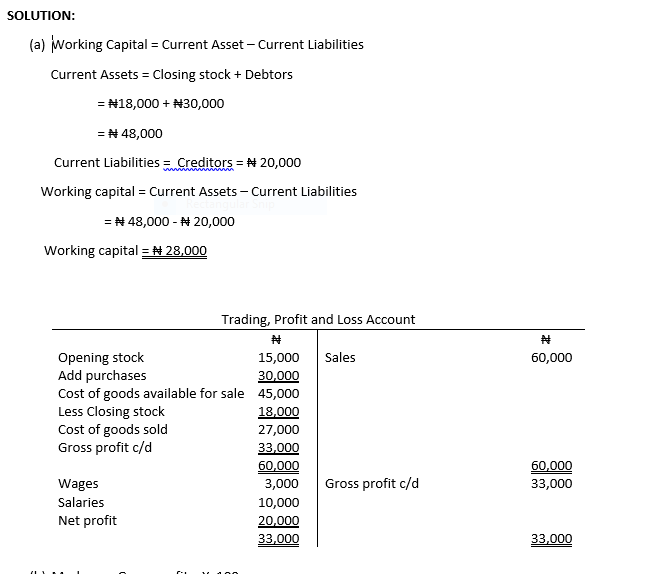

The following figures were extracted from the books of Estate Enterprises for the month of May, 2019.

N

Debtors 30,000

Creditors 20,000

Opening stock 15,000

Closing stock 18,000

Wages 3,000

Salaries 10,000

Purchases 30,000

Sales 60,000

Calculate the following:

(a) Working capital

(b) Mark-up

(c) Margin

(d) Stock turnover

(e) Net profit percentage

ASSIGNMENT

Use the following information from the books of Segun enterprises to answer the question below;

N

Sales 450,000

Opening stock 200,000

Closing stock 300,000

Expenses 150,000

Fixed assets 400,000

Debtors 100,000

Creditors 50,000

Purchases 250,000

Calculate;

(a) Cost of goods sold

(b) Net profit

(c) Current ratio

(d) Working capital

(e) Gross profit percentage

(f) Net profit percentage

(g) Rate of stock turnover

JULY 21ST, 2020

LESSON 10

You are welcome to this week class. Hope you are enjoying the lessons.

This week, we will be looking at another topic.

BUSINESS PROFIT

What is Profit?

Profit is the financial benefits which accrue to a business man from money invested in a business. The main purpose of a business organization is to make profit. Profit represents the gain, resulting from investing one’s capital in a business enterprise.

To an accountant, profit is the excess of income over expenditure.

To an economist, profit represents the reward of an entrepreneur.

Profit is a measure of business performance and a means of rewarding business managers for taking the risk.

TYPES OF PROFIT

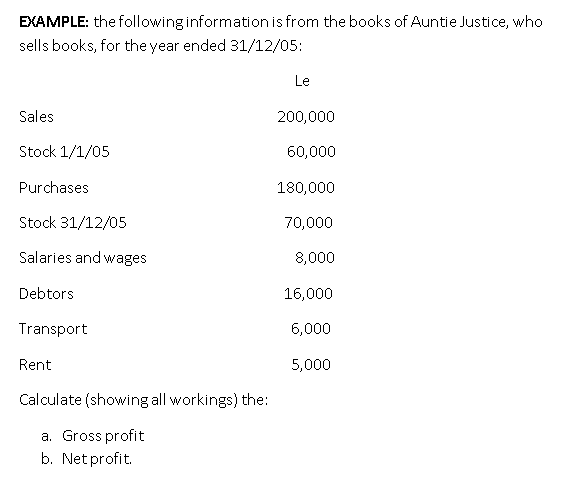

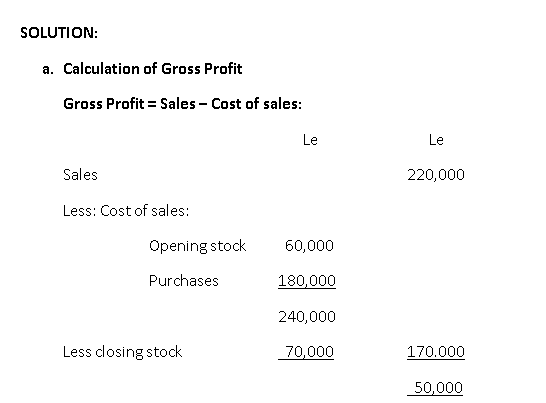

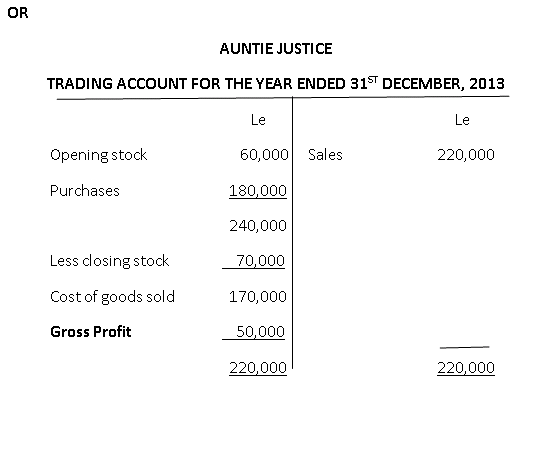

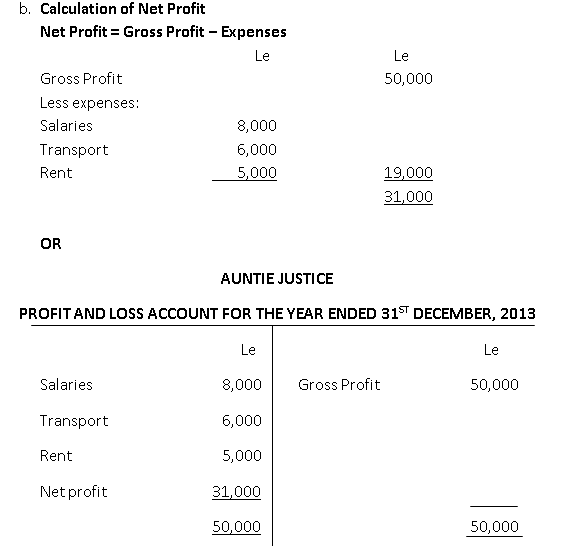

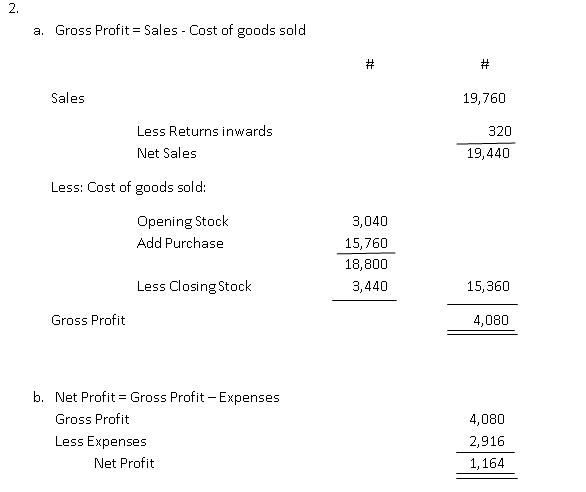

Gross Profit: This is the excess of turnover over the cost of goods sold. It is the difference between the selling price and cost price of a particular product. This is the total profit before any expense is deducted. The gross profit can be determined though the preparation of trading account.

Net Profit: This is the excess of gross profit over the expenses. It is arrived at after all expenses incurred in that period have been deducted from gross profit. This is ascertained in the profit and loss account.

FACTORS AFFECTING PROFIT

- The selling price of goods

- The cost of goods sold, i.e. cost price

- The number of competing firms

- Relationship between demand and supply

- The knowledge of the seller concerning the market.

Good morning students and welcome to today’s online Commerce class. Please, copy today’s note in your Commerce notebooks. Also, do your assignment and submit as at when due.

BUSINESS CAPITAL

Capital as a factor of production can be defined as wealth reserved or set aside for the production of more wealth.

In a business concerned, capital is money used in starting a business and as time goes on, the money is converted or used in acquiring different assets like premises, equipment, land and building, furniture and fittings, motor van, stock of goods, e.t.c.

FEATURES OF CAPITAL

(1) Capital is man-made.

(2) Capital can change form.

(3) Capital constitute wealth.

(4) The reward of capital is interest.

(5) Capital is highly durable.

(6) Capital is subject to depreciation.

Types of Capital

- Authorized/Registered/Nominal Capital: This is the total amount of capital in form of shares that a company is empowered to issue out to the public for subscription. This is usually stated in the Memorandum of Association.

Note: The company can only exceed this maximum amount if an amendment is made in the Memorandum of Association and approved by Corporate Affairs Commission. (CAC).

2. Issued Capital: This is the part of the of the authorized capital that the company decides to issue out to the public for subscription.

3. Unissued Capital: This is the part of the authorized capital that the company has decided not to issue out to the public for subscription. It is the remaining part of the authorized capital.

4. Called-up Capital: This is the part of the issued capital that the company has asked the shareholder to pay for. Example, the company may issue shares worth ₦ 600,000, the company may not require the total amount now, he might ask the shareholders to pay ₦ 400,000 worth of shares now.

5. Uncalled-up Capital: This is the part of the issued capital that is yet to be called up for payment.

6. Paid-up Capital: This is the part of the called-up capital which the shareholders have actually paid for.

7. Unpaid capital: This is the part of the called-up capital which the shareholders have not yet paid for.

8. Fixed capital: This is the type of capital that is used in purchasing the durable property of the firm. They are not intended for immediate consumption, but they are used continuously for further production. Fixed capital do not change form in the process of production. E.g. premises, machinery, motor van, buildings, furniture and fittings.

9. Loan capital: This is the total amount of money which the firm borrowed from external sources to form part of the money used in running the business.

10. Liquid Capital: This comprises of the current assets of the business enterprise that can be easily converted to money. i.e. it can be turned into cash at short time e.g. cash, stock, debtors, bank balance.

11. Working Capital: This is the amount of money or available funds kept by the business for his day-to-day expenditure or payment.

Working capital can be calculated thus:

Current Assets – Current Liabilities.

12. Capital Employed: This is the total assets, both fixed and current, less current liabilities. It is the actual amount of money and other assets used in the business.

Capital employed = Total Assets – Current Liabilities.

13. Capital Owned: Capital owned is the owner’s financial interest in a business. It is the excess of total assets of a business over the value of its short term and long term liabilities. It is the net worth of a business.

14. Loan Capital: This is the total amount of money a business borrowed from external sources.

15. Liquid Capital: This is made up of assets that can be easily converted to money, i.e. can be turned into short notice. This consists of cash, near money, debts, and bank balance.

16. Fixed Capital: This is the durable capital of an enterprise which is used continuously.

Importance of Working Capital

- It is used to measure the solvency of the business i.e. the ability of a business to settle its current liabilities or debts.

- It helps to determine the funds available for the day-to-day running of the business.

- It is used as basis for planning to avoid losses.

- It is a sign for viability of a business enterprise.

- It gives investor confidence in the business organization

- Since the working capital is used to buy stock from where profit is derived, the higher the working capital the higher the profit expected.

- It provides basis for profit making by the business since it is used to buy stock from where profit is derived.

Balance Sheet

A balance sheet can be described as a statement that shows the state of affairs or position of a business enterprise in a particular period of time.

Illustration 1:

Abiola International Limited has an authorized capital of ₦900,000, shares and capital worth ₦600,000 were made public for subscription. Out of this, the company received ₦ 400,000 almost immediately.

Calculate the following:

(a) Nominal Capital

(b) Issued Capital

(c) Paid-up Capital

(d) Unissued Capital.

SOLUTION:

(a) Nominal Capital = ₦ 900,000

(b) Issued Capital = ₦ 600,000

(c) Paid-up capital = ₦ 400,000

(d) Unissued capital = ₦ 300,000

Illustration 2

Adegoke Enterprises Financial position as at 31st December, 2018 is as follows

₦

Fixtures 10,000

Stock 31st December, 2018 80,000

Creditors 30,000

Debtors 50,000

Cash at hand 70,000

Bank overdraft 12,000

Typewriter 45,000

Furniture 25,000

Capital 180,000

One-year cooperative loan 41,000

Profit for the year 17,000

Required:

Calculate: (a) Capital owned

(b) Working capital

(c) Current liabilities

(d) Fixed Capital

(e) Capital employed

SOLUTION:

(a) Capital owned ₦

Capital 180,000

Add net profit 17,000

197,000

(b) Working Capital = Current Assets – Current liabilities

Current Assets ₦

Stock 80,000

Debtors 50,000

Cash at hand 70,000

Current Assets = 200,000

Current Liabilities ₦

Creditors 30,000

Bank overdraft 12,000

One-year cooperative loan 41,000

Current liabilities = 83,000

Working capital = current assets – current liabilities

₦200,000- ₦83,000

₦ 117,000

(c) Current liabilities ₦

Creditors 30,000

Bank overdraft 12,000

Cooperative loans 41,000

83,000

(d) Fixed Capital ₦

Fixtures 10,000

Typewriter 45,000

Furniture 25,000

80,000

(e) Capital employed = Total assets – Current liabilities

Total assets = Fixed assets + current assets

Fixed Assets ₦

Fixtures 10,000

Typewriter 45,000

Furniture 25,000 80,000

Current Assets ₦

Stock 80,000

Debtors 50,000

Cash at hand 70,000 200,000

Total Assets = 280,000

Less: Current liabilities

Creditors 30,000

Bank overdraft 12,000

Cooperative loans 41,000 83,000

Capital employed = 197,000

ASSIGNMENT

The following are the assets and liabilities of Monday Limited.

₦

Cash 8,000

Building 81,000

Creditors 6,500

Sales returns 12,000

Debtors 18,000

Capital 122,000

Overdraft 11,000

Motor vehicle 20,000

Sales 50,000

Net profit 20,000

Calculate the following:

(i) Working capital

(ii) Net sales

(iii) Net profit percentage

(iv) Capital owned

(v) Fixed assets.

COMMERCE SS 1

JULY 7TH, 2020 LESSON 8

TRADE ASSOCIATION II

You are welcome to this week on-line class. Are you following the lessons? We will be studying the other aspects of trade association.

OTHER ENTERPRISES

- MANUFACTURING ASSOCIATION: this is an association of business executives or entrepreneurs in a city, town or country that have common interest in the manufacturing of goods and other commodities e.g. the manufacturer’s Association of Nigeria (MAN).

FUNCTIONS OF MANUFACTURING ASSOCIATION

- It acts as a pressure group

- It settles disputes among its members.

- It finances research into the development of raw materials and production techniques

- It gives advice on the use of the products and on the safety and precaution on the use of the products.

- CARTEL: This is a monopolistic type of organization established originally by producers of similar product for the main purpose of restricting output of members in order to keep up the price of their product.

FEATURES OF A CARTEL

- Cartel is monopolistic in nature.

- Competition is removed

- They allocate quotas to members

- They restrict output in order to force the price up

REASONS FOR FORMING A CARTEL

- To keep up the price of their products.

- To ensure higher profit for members

- To reduce waste by eliminating competition

- To regulate output

- TRUST: This is an amalgamation of different competing firms in different lines of businesses under a single control. In trust, the firm will retain their identity but the trustee will take over the management and control.

- CONSORTIUM: A consortium is a group of independent firms formed to work on a particular project which requires large resources and is too complex for a single firm to undertake.

REASONS FOR FORMING A CONSORTIUM

- To finance a project which requires large capital outlay.

- When the project is complex in nature.

- MERGER/AMALGAMATION: Merger is the combination or coming together of two or more previously independent firms fo form one large firm.

REASONS FOR MERGER

- For larger market share

- To enjoy advantage of economies of scale

- To increase the efficiency of management

- To eliminate competition

- For financial stability

- To reduce overhead cost

DISADVANTAGES OF MERGER

- It leads to monopolistic situation.

- It discourages specialization

- The quality of their product may be reduced

ASSIGNMENT

- Differentiate between trust and cartel

- How can merger lead to low quality of product?

CORRECTION TO ASSIGNMENT GIVEN ON 30/6/2020

A cartel is an association of independent producers of similar products, formed mainly for the main purpose of regulating prices by controlling output.

Features of a cartel

- It is established by independent producers of similar products

- Cartel is monopolistic in nature

- Production output is restricted to the quota allocated to each producer.

- Member organization do not compete with one another on issue of price or output.

- They restrict output so as to force the price up.

JUNE 30, 2020

Good morning students. You are welcome to today’s online Commerce class. Please, copy today’s note in your Commerce notebooks. Also, do your assignment and submit as at when due. We shall be considering trade association and chamber of Commerce this morning. May God grant you understanding as we move on.

TRADE ASSOCIATION AND CHAMBER OF COMMERCE.

A trade association is a group of people or individuals in the same line of business who have voluntarily agreed to come together for the purpose of safeguarding and promoting their common interests.

A trade association has a local or regional outlook. They are formed by retailers or manufacturers. Membership to their non-profit organization is voluntarily. Examples are:

(i) Manufacturers association of Nigeria (MAN)

(ii) Nigeria Union of Journalist (NUJ)

(iii) Nigeria Bar Association (NBA)

(iv) Nigeria Medical Association (NMA)

(v) Nigeria Union of Road Transport Workers (NURTW)

(vi) Garri Seller Association.

(vii) Cement Dealers Association

(viii) Nigerian Union of Teachers (NUT)

AIMS AND OBJECTIVES OF TRADE ASSOCIATION

(1) To protect their trade or profession effectively from being infiltrated by quacks.

(2) To give information to members about the development in their trade of line.

(3) To ensure that members charge uniform price for their goods and services.

(4) To create uniformity in the way their members deal with people.

(5) To ensure that members enjoy good quality services.

(6) To assist members who are in need.

(7) To defend and advance the interest of their members.

(8) To safeguard the interest of their members from being maltreated by other employers and from the members of the society.

(9) To regulate the activities of their members.

(10) To act as pressure groups by influencing the government and political parties to take decisions that will be of benefits to the groups.

(11) To educate their members through the organization of seminars and workshops, conferences, etc.

FUNCTIONS OF TRADE ASSOCIATION

(1) They foster cooperation among members and settle disputes among them.

(2) They gather useful information and disseminate them to their members.

(3) They prevent limitation of their products e.g. Manufacturer Association of Nigeria

(4) They provide credit facilities and assistance to their members.

(5) They carryout research and publish out report for members’ use.

(6) They fix prices for their services or products.

(7) They put political pressure on government for the interest of their members.

(8) They also promote welfare services e.g. Nigeria Bar Association, Nigeria Medical Association.

(9) They negotiate with other trade associations on collective basis.

(10) They educate members on trade activities etc.

(11) They draw up standard for the practice of their trade.

CHAMBER OF COMMERCE

A chamber of commerce is defined as an association of businessmen of professionals from different lines of business in an urban area who agree to come together to protect their interests. It has national and international outlook. Example of chamber of commerce include:

i. Ibadan Chamber of Commerce

ii. London Chamber of Commerce

iii. International chamber of Commerce

iv. Lagos Chamber of Commerce

v. Ijebu Chamber of Commerce

vi. Oyo Chamber of Commerce

vii. Nigerian-American Chamber of Commerce

viii. Owerri Chamber of Commerce.

Aims and Objectives of Chamber of Commerce

- To influence the policy of the government relations to commercial activities in an area.

2. To promote business interest of the area.

3. To promote commercial activities in a community, town or country.

4. To liaise or relate or relate with other chamber of commerce in relation to their business interest.

FUNCTIONS OF CHAMBERS OF COMMERCE

1. They assist the development of commerce, trade and industry.

2. They provide support or oppose legislation which they feel will affect their members.

3. They provide information to members on their line of businesses.

4. They organize trade fairs, exhibitions, etc. for the enhancement of commercial activities.

5. They settle disputes among members.

6. They provide necessary information on legal, customs and other technical requirements of foreign countries to members.

7. They educate members on new techniques and technology by organizing seminars.

8. They promote home and foreign trade.

9. They cooperate with both domestic and foreign chamber of commerce.

10. They act as watchdogs in the administration of government laws.

Differences between Trade Association and Chamber of Commerce

| Trade Association | Chamber of Commerce | |

| 1. | Membership is restricted to those who engage in the same line of trade. | Membership is not restricted to a particular type of business or trade. |

| 2. | It has local or regional outlook | It has national or international outlook. |

NOTE: SUBMIT YOUR ASSIGNMENT ON OR BEFORE MONDAY, JULY 6, 2020.

ASSIGNMENT

1. (a) What is a cartel?

(b) State three features of a cartel.

COMMERCE

LESSON 6

CLASS: SS 1 DATE: JUNE 23RD, 2020

You are welcome to this week on-line class. Are you following the class? Please always ensure you do your assignment.

FOREIGN TRADE DOCUMENTS

There are various documents which facilitate international trade. Some of these documents are:

- Consular invoice: This is an invoice issued at the embassy of the importing country showing the original price of the goods in the country of origin. This is to avoid under-invoicing for correct import duties to be paid.

Purposes or Uses of Consular Invoice

- It is used by the Custom authority to ascertain duty payable on goods.

- It prevents falsification of prices of goods.

- Bill of lading: This is a document which contains the details of the goods being sent. It is an evidence of shipment and a document of the title to claim goods. It is a document of title giving the holder a right to take possession of the goods to which it refers. A bill of lading can also be used as a contract of carriage of goods between an exporter and the shipping company.

Types of Bill of Lading

- Clean Bill of Lading: A clean bill of lading is one signed by the transporter. It shows that the goods are in good order or condition or are free from irregularities or damage.

- Dirty or Foul Bill of Lading: A foul bill of lading is one which indicates some deficiencies, irregularities or damage on the goods.

Purpose or Uses of Bill of Lading

- Bill of lading is used as evident of shipment contract.

- It is used as proof of ownership.

- It shows details of all parties to the goods.

- It shows details of the goods.

- Certificate of Origin: This is a document signed by a custom officer of the exporting country to show the country from which the goods have been exported or where it originated from. The certificate of origin is prepared by the producer to accompany the goods in order to determine the place of origin.

Purpose of Certificate of Origin

- It shows where the goods come from

- It serves as an instrument for preferential tariff.

- It helps to determine outflow of foreign exchange to the country of origin.

- Shipping Note: This is a document containing instructions for transporting the goods to a named destination, sent to the shipping agent by the exporter.

- Indent: It is an order to buy goods conveyed by an importer to a potential supplier. It can be placed with the seller or his agent. It is a document which gives details of the goods required, approximate price and date of delivery.

Types of Indent

- Open Indent: This is an order from abroad to a merchant with freedom to purchase goods from any manufacturer he pleases.

- Closed indent: This is used where the foreign buyer will specify the manufacturer from whom the goods are to be purchased.

- Airway Bill: This is a numbered document made out by or on behalf of the consignor of goods to be transported by air freight.

- Shipping Manifest: This is a document to be completed by the captain of a ship and lodged with the custom authorities before the ship can leave the port and copies are sent to the ship’s agents at the port of destination.

- Mate Receipt: Mate receipt is a document used when goods are loaded on a ship by lighter. This document will be exchanged afterward for a bill of lading.

- Export Invoice: An export invoice is a document sent by the exporter to the imported, giving full description or complete summary of the goods dispatched. The exporter will send this document to the importer.

- Bill of Sight: This is the document used in the import trade where importers are required to complete the appropriate document if there is insufficient information about the cargo to determine correct duty in advance. That is, it is a document used in import trade if a full description of the imported goods cannot be provided.

Uses of Bill of sight

- It is used to determine the duty on the cargo

- It is very important when there is insufficient information about the cargo.

- Custom Specification: This is a document lodged with the customs authorities which shows the value of the goods exported and the country to which they have been consigned.

- Bill of Entry: This document contains detailed particulars of all imported goods into the country.

TERMS OF QUOTING PRICE IN INTERNATIONAL TRADE

- Cost, Insurance and Freight (CIF): this price quotation means that the price quoted includes the cost of the goods, the freight and insurance up to the port of the destination while the purchaser is responsible for other subsequent charges.

- Free on Board (FOB): This means that the price covers all costs up to the ship, including charges payables for loading goods on the ship.

- Free Alongside Ship (FAS): The price quotation includes all charges used to deliver the goods to the side of the ship but excludes charges for loading the ship which the buyer is responsible for.

- Free on Rail (FOR): This means that the seller has paid all charges, including loading the goods on rail. The buyer takes over other charges such as insurance from then on.

- Franco: Franco means that the price quoted includes the cost of insurance, freight and all delivery charges to the importer’s warehouse.

ASSIGNMENT

Differentiate between export invoice and consular invoice.

LESSON 6 – CORRECTION

Differentiate between export invoice and consular invoice.

An export invoice is a document sent by the exporter to the imported, giving full description or complete summary of the goods dispatched WHILE consular invoice is used by the Custom authority to ascertain duty payable on goods and it prevents falsification of prices of goods.

JUNE 16, 2020 LESSON 5

Good morning students, you are welcome to today’s online class. Please, copy your notes into your Commerce notebooks.

CONCEPT OF FOREIGN TRADE

Balance of Payment: This shows the relationship between a country’s total payments to other countries and its total receipts from them within a given period.

A country’s balance of payment of payment can be divided into three parts, namely:

(i) Current account

(ii) Capital account

(iii) Monetary movement account.

(i) Current Accounts: These are expenditures and incomes of a country of both visible and invisible import and export. It deals with a country’s total payment and import over a period of time usually a year. Visible goods are automobiles, cocoa, crude oil, insurance, transportation, etc.

(ii) Capital Goods: This means the movement of movement of money from one country to another. It is made up of the inflow and outflow of capital both long and short terms. It consists of capital movement in terms of investments, loans and grants.

(iii) Monetary movement account: This accounts shows how the balances of both the current and capital accounts are settled. If a surplus or a deficit occurs, this account will show how deficit is covered (settled) or how surplus is spent and balanced.

Favourable Balance of Payment: It occurs when the receipt of visible and invisible export trade is greater than payments to other countries on visible and invisible import trade.

Unfavourable Balance of Payment: It occurs when the payment of visible and invisible import is greater than the receipt on visible and invisible exports.

Balance of payment is said to be at equilibrium if exports or receipt = imports or expenditure

Causes of Unfavourable Balance of Payment

1. Inflation: When the goods produced by a country becomes too expensive to buy.

2. Drought: This can lead to poor harvest and yielding little or nothing for export.

3. High taste for foreign made goods.

4. Crude technology making mass production impossible

5. One product economy known as monopoly.

6. Bad and inefficient governance, such that the economy becomes a consumptive rather than a productive one.

Methods Adopted to Correct an Adverse or Unfavourable Balance of Payment.

(i) Export Promotion: This refers to government activities aimed at production of goods for export, e.g. creation of export free zone.

(ii) Discourage Exportation: Reduction in importation of goods through the imposition of restrictions like tariff, embargoes, exchange control measures, quota, etc.

(iii) Borrowing: The government can borrow from the international financial institutions like I.M.F. to settle deficit on her balance of payment.

(iv) Gifts and Debt Cancellation: Gifts and Debt Cancellation by friendly countries can be used in financing the balance of payment.

(v) Debt Postponement: Payment of debts in the current year can be postponed to another so as not to be used in the preparation of the balance of payment for the year consideration.

(vi) Devaluation: Devaluation of the country’s currency-bringing the value of the currency lower in relation to other currencies so as to attract foreign investment.

(vii) Sale of Assets abroad: Selling of gold reservesand assets overseas can be used to correct adverse balance of payment.

(viii) Counter Trade: Exchange of country’s goods for other country’s goods can also be used.

(ix) Encouraging Local Industries: This can be done through provision of subsidies and tax concessions to local producers.

PRINCIPLES OF COMPARATIVE COST ADVANTAGE

The principle was propounded by Richard David in the 19th century and it states that “countries of the world should specialize in the production of the commodity in which she has the greatest comparative of trade or lowest comparative cost than other countries of the world”

The assumption by Richard David is stated as follows:

(i) There are only two countries in the world.

(ii) Only two commodities are produced in the world.

(iii) The two countries have equal amount of labour.

(iv) Labour has the same efficiency.

(v) There is free transportation cost in the world.

(vi) Labour is the only productive asset.

(vii) There is free mobility of factors of production.

(viii) There is no trade restriction or barriers to trade.

ILLUSTRATION:

Before Specialization

| Country | Cost of production (man or labour hours) | Timber | Rubber |

| Nigeria | 400 | 3200 | 2000 |

| Ghana | 400 | 1200 | 4000 |

| World’s total | 800 | 4400 | 6000 |

If two countries decide to enter a trade agreement that leads to specialization, e.g. Nigeria and Ghana. Nigeria will use 400 labour on our timber farm to produce 3,200, while Ghana will use hers to produce 4,000 rubbers before specialization.

After Specialization

| Country | Cost of production (man or labour hours) | Timber | Rubber |

| Nigeria | 400 | 6400 | — |

| Ghana | 400 | — | 8000 |

| World’s total | 800 | 6400 | 8000 |

Nigeria will use 400 labour to produce 6400 timbers, while Ghana will use 400 labour to produce 8,000 rubbers after specialization.

ADVANTAGES OF SPECIALIZATION OR PRINCIPLE OF COMPARATIVE COST.

(1) It leads to increase in production of goods.

(2) It leads to efficient utilization of resources.

(3) It leads to reduction in production due to mass production.

(4) It leads to standardization of products.

(5) It increases revenue of countries involved.

(7) It increases interdependence of countries of the world

(8) It fosters good relationship between countries of the world.

LIMITATIONS OR DEMERITS OF PRINCIPLE OF COMPARATIVE COST.

(1) The more the countries, the more complex and unworkable the principle becomes.

(2) There are more than two commodities produced in the world.

(3) There are more factors of production to be considered other than labour.

(4) It is impossible for labour to have the same efficiency.

(5) It is impossible for countries to allow free transportation system.

(6) Perfect mobility of factors of production is not possible in foreign trade.

(7) There are trade restriction in international trade, e.g. embargo, quota system, tariff, etc.

TERMS OF TRADE: This is defined as the rate at which a country exchanges her export for import (i.e. visible & invisible export and visible & invisible import) expressed in price.

| The index of terms of trade = Price index of exports X 100 |

| Price index of imports 1 |

NOTE: This is designed to monitor the movement (increase or decrease of export and import price in a given period). If the prices of export are greater than those of import, the terms of trade are favourable, but if otherwise, it is unfavourable terms of trade.

Balance of Trade: It is the relationship between a country’s total payment (visible) import and its total receipt from visible exports within a given period usually a year. When a country is exporting a greater value of goods than it is importing, it is said to have a balance of trade surplus or favourable balance of trade and vice-versa. It is also referred to as VISIBLE BALANCE OF TRADE.

EXPORT DRIVE

This can be defined as the various activities of the government or its agent to promote or increase the amount of goods and services exported by the country. The government does this to avoid sufficiency from unfavourable balance of trade and payment.

Measures Government can take to Encourage or Promote Export

- Government can negotiate or join membership of international trade association aimed at removing barriers to free flow of trade.

- Reduction or total elimination of export duties.

- Establishment of new and improvement of the existing seas and airports facilities.

- Establishment and improvement of communication facilities

- Setting up of export promotion agency to direct and encourage intending exporters.

- Reduction of seas and air flights for exports

- Organization of international trade fairs and exhibitions to attract foreign buyers.

- The government could liberalise the process of granting credit facilities to exporters.

- Subsidies can be granted to industries producing exportable goods.

- Devaluation: the government can lower the value of her currencies vis-à-vis foreign currency thus making her country a cheap place to buy from.

- Provision of market intelligence to exporters by providing them with facts and trends in foreign market.

- Export credit guarantee: Government may provide an insurance cover against bad debts for exporters.

- The government can establish standard organization to help improve the quality of goods to meet international standards.

Functions of the Nigeria Export Promotion Council (NEPC)

- To assist exporters in the course of exporting goods to other countries.

- To ease up export procedure and documentation.

- To approve export and provide export license and set out procedures for exporting goods abroad.

- To use government export incentives in order to encourage and boost export trade.

- To work hand in hand with Central Bank of Nigeria and customs authority concerning the preparation of export document as well assisting in financing exporter.

ASSIGNMENT

1 (a) What is a bill of lading?

(b) State four contents in a bill of lading.

(c) Distinguish between a clean bill of lading and a foul or dirty bill of lading.

CORRECTION TO ASSIGNMENT GIVEN ON JUNE 16, 2020

1 (a) A bill of lading is a document signed by the ship owner specifying that certain goods have been shipped in one of his ships. It serves as a document of the title to the goods stated on the bill. It also serves as a contract of carriage between the exporter and the shipping company. It represents an acknowledgement of the receipt of goods by the ship owner.

(b) CONTENTS OF A BILL OF LADING

(i) The name of the ship carrying the goods.

(ii) Description of the goods such as the quantity, type, weight, etc.

(iii) The shippers name

(iv) The names of the consignor and consignee

(v) Addresses of both consignor and consignee.

(vi) The port of embarkation or loading.

(vii) Conditions of carriage, e.g. who pays the freight charges

(viii) Location of the goods in the ship

(ix) The expected time of arrival.

(c) The difference between a clean bill of lading and a foul bill of lading:

A clean bill of lading is one signed by the transporter. It shows that the goods are in good order or are free from irregularities or damages, while a foul bill of lading is one which indicates some deficiencies, irregularities or damages on the goods.

COMMERCE

LESSON 4

CLASS: SS 1 DATE: JUNE 9TH, 2020

You are welcome back. I hope you are following the lessons. For those of you who refuse to submit your assignment, please do, so that I can know that you are following the class.

Below is the scheme of work for 3rd term. Ensure you copy it in your note. Please, all the lessons we are treating should appear in your note. Now, let us go today’s lesson.

FOREIGN TRADE

MEANING OF FOREIGN TRADE

Foreign trade, otherwise known as international trade or external trade, is the exchange of goods and services between two or more countries. The principle underlying the buying and selling between one country and another is specialization. The theory of international trade, therefore, is based on the principle of comparative cost propounded by David Richards. The theory states that a country should specialize in the production of goods and services which it has advantage over another country.

TYPES OF FOREIGN TRADE

- Bilateral trade: This is a trade agreement in which two countries exchange goods and services.

- Multilateral trade: This is a type of international trade in which a country trades with many other countries.

REASONS FOR FOREIGN TRADE

- Natural resources are unevenly distributed.

- The climatic condition of the earth varies from one region to another.

- The level of technology differs from one nations of the world to another.

- The need for expansion of market for products.

- Differences between patterns of production and expansion

- Desire to improve the standards of living.

- Differences in taste

- Differences in skills.

ADVANTAGES OF INTERNATIONAL TRADE

- It serves as source of revenue for nations

- It provides employment opportunities

- It leads to international specialization

- It brings about increase in world output

- It brings about availability of variety of goods

- It helps with acquisition of new ideas, skills and techniques

- It brings about increase in standard of living

- It promotes foreign investment

- It brings about economies of scale

- It provides foreign exchange

DISADVANTAGES OF INTERNATIONAL TRADE

- It encourages dumping of goods

- It brings about competition with infant industries.

- It leads to cultural and social alteration

- It encourages the importation of dangerous or harmful goods

- It brings about unemployment

- It leads to over-dependence on foreign goods

- It leads to exploitation

DIVISIONS OF FOREIGN TRADE

- Import trade: This is the act of buying goods and services from other countries. It is divided into:

- Visible imports: This consists of goods that can be seen and touched i.e. tangible goods e.g. machinery, electronics, automobiles, etc.

- Invisible import: This consists of services that cannot be seen or touched, rendered by other countries e.g. banking, tourism, aviation, etc.

- Export trade: This is the act of selling goods and services to other countries. Export can equally be divided into:

- Visible export: This consists of goods which are sold in oversea’s market, i.e. to other countries e.g. cotton, cocoa, textiles, etc

- Invisible exports: It consists of services rendered to other countries, such as transport, banking, insurance, etc.

- Entrepot: This is a form of foreign trade in which goods are shipped to one country and subsequently re-exported and shipped to another country.

BARRIERS OR PROBLEMS ASSOCIATED WITH INTERNATIONAL TRADE

- Problem of distance

- Difference in currency

- Differences in language

- Differences in business laws and regulations

- Religious/cultural problems

- Political instability

- Government policy

- Transportation and communication

- Trade restrictions

- Documentation

- Imposition of tariffs – quotas, exchange rates control

ASSIGNMENT

State 4 similarities and 5 differences between foreign trade and home trade.

LESSON 4 ASSIGNMENT – CORRECTION

State 4 similarities and 5 differences between foreign trade and home trade.

SIMILARITIES

- Both international trade and internal trade involve the use of money as a medium of exchange.

- Both forms of trade involve the activities of middlemen

- Both trades involve the buying and selling of goods and services

- Both trades arise as a result of inequitable distribution of natural endowments and production resources.

- Both arise as a result of specialization between the trade partners.

DIFFERENCES

| Foreign Trade | Home Trade |

| 1. Goods are moved beyond geographical boundaries | Goods are moved within the same county. |

| 2. Different currencies are used. | One currency is used |

| 3. There is language barrier | There is no language barrier |

| 4. More complex documentation is required | Less documentation is required |

| 5. Different weight and measures are in use | The same weight and measures are in use |

| 6. Transport cost is higher | Transport cost is lower |

| 7. Foreign trade is subject to restrictions | Goods move freely within a country. |

COMMERCE

CLASS: SS 1 DATE: JUNE 9TH, 2020

SCHEME OF WORK FOR 3RD TERM

- a. Revision of 2nd term

b. Foreign trade

- Meaning

- Types of foreign trade

- Differences between home and foreign trade

- Reasons for and barriers to foreign trade

2. Foreign trade

- Concept of foreign trade: – Balance of payment; – Balance of trade; – Terms of trade; – Principles of comparative cost advantage

- Documents involved in foreign trade

3. Trade association and chamber of commerce

- Meaning

- Aims and functions of each

3. Trade association II

- Employers association

- Consumers association

- Manufacturers association

- Consortium

- Cartel

- Amalgamation/merger/combine

- Trust

- Holding

5. Business capital

- Meaning

- Types

6. Business profit

- Meaning

- Types

7. Business turnover

- Meaning

- Rate of turnover or stock turn

- Factors that affect the turnover of a business

8. Trade terms and abbreviations

- Discounts

- Cost, insurance and freight (C.I.F)

- Carriage paid (CP)

- Cost and freight (CF)

- Carriage Forward (CF)

- Free on rail (FOR)

- Free of board (FOB)

- Loco, etc

9. Career opportunities

- Types of occupation

- Career opportunities

- Requirements for different careers

10. Commodity exchange

- Meaning

- Types of commodities traded

- Requirement for trading

- Methods of trading

- Benefits of and constraints to commodity exchange

LESSON 3

Date: 2nd June, 2020

WAREHOUSING

Warehousing is an act of storing goods produced or bought until they are needed.

Importance of Warehousing

- It reduces risk of loss as warehouses guarantee the good condition of goods in their care.

- It ensures regular flow of goods to the market thus helping in stabilizing prices.

- It preserves goods because it prevents them from the vigorous activities of the weather.

- It serves as protection of goods against theft and fire.

- It encourages mass production in anticipation of demand.

- It facilities international trade because warehouses provide reliable storage facilities at both seas and airport.

- It provides employment opportunities for a large number of people.

- It is revenue generating for government and individuals who own private warehouses.

- It makes seasonal goods available in other seasons.

- It helps producers to embark on long term production planning.

- It enables the owners of goods in bonded warehouse to pay the duty gradually as they sell the goods.

- It promotes sales by allowing prospective buyers to inspect goods while in the warehouse.

- It facilitates continuity in production as it permits precautionary holding of inventory to respond to market conditions.

- Some goods are blended, graded and labelled while in the warehouse.

Features of a Warehouse

(a) Convenient location: It should be located as conveniently as possible to potentials users.

(b) There should be adequate mechanical appliances.

(c) Spacious accommodation to facilitate easy movement of goods, equipment and people.

(d) Adequate parking space inside the premises for free movement of vehicles, container trucks, etc.

(e) Effective security arrangement should be provided to prevent theft and burglary, fire, pests etc.

(f) Availability of office space for administrative staff.

Types of Warehouses

- Bonded warehouse

- State warehouse

- Public warehouse

- Producers’ or Manufacturers’ warehouse

- Wholesale warehouse

- Ordinary warehouse

ASSIGNMENT

Please ensure you submit your assignment on or before Thursday, 4th June, 2020.

- State four problems of warehousing.

- List five factors to be considered in siting a warehouse.

CORRECTION TO ASSIGNMENT GIVEN ON 2/6/2020.

- Problems of Warehousing.

- Lack of qualified manpower.

- Problem of pilfering

- Problem of deterioration

- Unreliable supply.

- Some warehouses are not accessible because of bad roads.

2. Factors to be Considered in Siting a Warehouse.

- It must be located very close to the factory.

- It must be located near the market.

- The mode of transportation must be considered.

- The cost of building or renting a warehouse must be considered.

- It must be cited near the consumers.

- It must be located where the operating cost is affordable.

- It must be cited near the distribution centers.

- The security network of such an area should be considered.

COMMERCE

LESSON 2

CLASS: SS 1

DATE: MAY 26TH, 2020

TRADE

Welcome to another week of online class. How have you been enjoying the classes? Mind you, I am still expecting your response for last week class. Please ensure you submit if you are yet to submit.

What is trade?

Trade is the act of buying and selling of goods and services.

DIVISION OF TRADE

- Foreign trade: this is the act of buying and selling of goods and services between two or more countries i.e. beyond the geographical boundary of a country. Foreign trade is divided into import trade, export trade, entrepot trade and counter trade.

- Home trade: this is the act of buying and selling of goods and services within a geographical area, usually a country. Home trade is divided into wholesaling and retailing.

RETAIL TRADE

This is the business activity of buying in small quantities from the wholesaler and selling to the final consumers in bits or units.

Who is a retailer?

A retailer is a trader who engages in retail trade.

CHARACTERISTICS OF THE RETAILER

- He/she renders door-to-door services.

- He/she stocks mainly consumers’ goods.

- He/she sells in small units.

- He/she is the last link in the chain of distribution.

FUNCTIONS OF A RETAILER

- He gives advice to the consumers.

- Ensures door-to-door service.

- He stocks variety of goods

- He sells at convenient locations and hours

FACTORS TO CONSIDER IN SETTING UP RETAIL TRADE

- Capital

- Pricing policy

- Source of supply

- Types of goods

- Experience

ASSIGNMENT

- Give 4 reasons for the survival of small scale retailers

- Give 4 reasons for the failure of retail trade.

CORRECTION OF LESSON 2 ASSIGNMENT

A. Give 4 reasons for the survival of small scale retailers

REASONS FOR THE SURVIVAL OF SMALL SCALE RETAILERS

- With small capital, a small scale retailer can start and carry on business.

- A small scale retailer can combine business with other works.

- Since the business is owned by individual, there is quick decision making.

- In small scale retailing, the business owner may employ the assistance of his/her family members.

- The retailer has a close contact with his/her customers.

- He/she renders door-to-door services

- He/she sells in small units.

B. Give 4 reasons for the failure of retail trade.

REASONS FOR THE FAILURE OF RETAIL TRADE

- When there is too much competition

- Where the business is not insured

- When there is insufficient capital

- When there is lack of technical knowledge on the part of the retailer

- Where there is not adequate advertisement.

LESSON 1

Good day students, I hope you are staying safe.

Introduction to Commerce.

Commerce can be define as the act of buying, selling and distribution of goods and services. It is also known as trade and aids or ancillary to trade.

Scope of Commerce: It means the totality of the activities which ensures the distribution and exchange of goods and services for the satisfaction of the people.

The Scope of Commerce is divided into two major groups, namely

(a) Trade

(b) Aids or ancillary to trade

(a) Trade: It can be defined as the buying and selling of goods and services. It is divided into two namely; home and foreign trade

Home / Domestic/ Internal Trade: This involves the exchange of buying and selling of goods and services within a country. It is divided into two, namely; (1) wholesale trade and retail trade.

Foreign/ External/ International Trade : This involves the exchange or buying and selling of goods and services between two or more countries. Foreign trade is divided into three, namely;

(1) Import

(ii) Export

(iii) Entrepot

(b) Aids or Ancillary to trade : These are services which enhance production and distribution of goods and services. They are activities which facilitate buying and selling (trade). These services are transportation, advertising, communication, banking, warehousing, insurance and tourism.

Classwork

- State and explain five functions of Commerce.

- State seven differences between home and foreign trade.

Kindly answer the questions in the form below, in the appropriate boxes, type your name and e-mail. In the message box, start by typing the name of the subject, topic and the answers to the given questions.

No Fields Found.CORRECTIONS ON WEEK I ASSIGNMENT

Five Functions of Commerce

1. Commerce facilitates mass production and thus people all over the world can enjoy goods and services produced both within and outside their countries.

2. It facilitates the raising of capital for individual needs and investment through the services of banks and other financial institutions.

3. It offers employment opportunities to a large number of people as traders, bankers, insurance brokers, etc.

4. It assists in moving people, raw materials and finished goods from production point to consumption points through transport.

5. It facilitates the storage of goods until they are needed, thus bridging the gap between demand and supply in the market.

6. It fosters unity among nations thus nations become interdependent as they engage in trading activities.

7. The availability of variety of goods and services leads to improvement in standard of living and quality of life.

8. The availability of insurance companies encourages entrepreneurs to venture into various business activities.

9. It facilitates the exchange of goods and services

10. It makes the public aware of the availability of goods and services through advertising.

11. Commerce through communication links buyers and sellers together to do business without physical contacts.

(2) Seven differences between home and foreign trade

Foreign Home

| i. There is language barrier in foreign trade | There is no language barrier in home trade. |

| ii. Goods are moved beyond geographical boundaries | Goods are moved within the same country. |

| iii. Different currencies are used in foreign trade | One currency is used |

| iv. Transport cost is higher | Transport cost is lower. |

| v. It is subject to restrictions | Goods are moved within a country. |

| vi. More complex documentation is required | Less documentation is required |

| vii. Different social standards, rules and regulations are in use | The same social standard, rules and regulations are in use. |

| viii. Different weights and measures are in use | The same weights and measures are in use. |