AUGUST 25, 2020

Good day students and welcome to today’s online Commerce revision class.

REVISION QUESTIONS

1 (a) What is production?

(b) Explain the following factors of production:

(i) Land

(ii) Labour

(iii) Capital

(iv) Entrepreneur.

(c) State three functions of an entrepreneur.

2 (a) State four steps that can be taken by a customer opening a current account.

(b) Explain six functions of commercial banks.

3 (a) State five features common to both public and private limited companies

(b) State five provisions of a memorandum of association.

4 (a) List any five member-countries of the Niger Basin Commission.

(b) State five objectives of the Niger Basin Commission.

5 Explain five benefits that would be derived and state five losses that would be suffered when a sole trader admits other partners.

6. State three differences between:

(i) Shareholders and debenture holders

(ii) Ordinary shares and preference shares

(iii) Explain four reasons for winding up a public limited company.

7 (a) Explain seven functions of a commercial bank.

(b) Explain three types of accounts that are operated in a commercial bank.

8 (a) What is foreign trade?

(b) Explain four ways by which foreign trade is different from home trade.

(c) State three reasons why countries restrict foreign trade.

9 (a) State five functions of a chamber of commerce

(b) Explain five functions of a trade association.

10. State two distinguishing features between each of the following:

(a) A commissioned agent and a del credere agent;

(b) Consular invoice and proforma invoice

(c) Insurance and assurance

(d) A broker and a factor.

11 (a) State three duties of an agent to his principal.

(b) Mention five duties of a principal to his agent.

11 (a) What is turnover in Commerce?

(b) State and explain six factors that determine the turnover of a product.

AUGUST, 11TH 2020.

Good day students and welcome to today’s online Commerce revision class.

1a. What is second-tier security market?

b. Discuss four advantages of the second-tier security market.

c. State five requirements for trading in a second-tier security market.

2a. Draw up an organizational chart of Peter’s Pure Water Production Ltd.

b. Briefly state two functions each of the following departments of the company:

(i) Accounts

(ii) Administration

(iii) Marketing

(iv) Production

3. The sale of a good costing Le 100,000 attracts a trade discount of 5% and a cash discount of 5%.

You are required to calculate the:

(a) Trade discount value

(b) Cash discount value

(c) Net amount payable by the buyer.

ASSIGNMENT

1(a) What is division of labour?

(b) List and Explain two factors that limit the application of division of labour.

(c) Enumerate two disadvantages of division of labour.

(d) Discuss any five advantages of division of labour.

AUGUST 4TH, 2020

LESSON 12

REVISION

You are welcome to this week on-line class. Hope you are enjoying the lessons.

a. Differentiate between:

- Authority and Power

- Accountability and Responsibility

- Void and Voidable contract

- Employee and Employer

b. Explain the four business resources.

JULY 26TH, 2020

Good day students and welcome to today’s online class. We shall be revising business turnover this morning.

Business Turnover

Turnover of a business is the total net sales during a particular period. e.g. a year. this is the value of total sales of an organisation during an accounting period, i.e. sales less returns inwards.

Rate of turnover or stock turn

rate of stock turnover is the number of times the value of average stock of a business is sold during a period. This is used to investigate the market success of the output of a firm. expensive goods have slow turnover rate while perishable goods have rapid rate.

Rate of Turnover = Cost of goods sold X 100

Average Stock

Factors that affect the turnover of a business

- Goodwill and reputation of the seller.

- Reduction in prices of goods (goods with high prices will have low sales, while products with low price will have high sales)

- The type of goods (foodstuff will have high turnover as compared with electronics)

- Advertising, publicity and sales promotion.

- Nearness of the business to consumers (there will be high turnover when a business is located near the consumers).

- Constant availability of goods

- Credit facilities

- Increase in the quantity of goods sold

- the variety of goods sold by the sellers.

OTHER IMPORTANT RATIO.

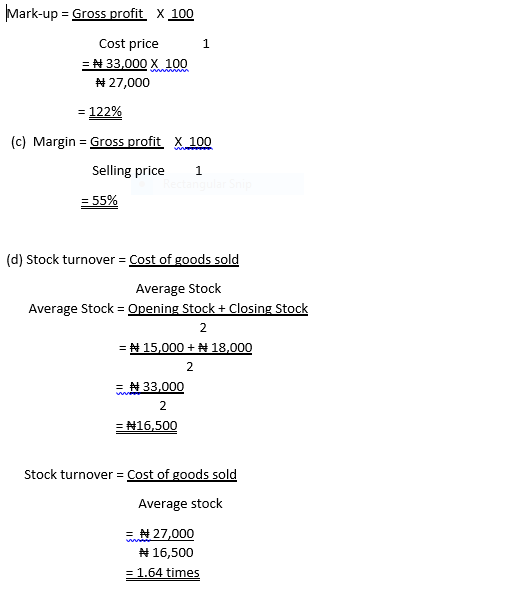

- MARGIN: This can be defined as the relationship between the profit and selling price. It is the profit expressed as a percentage of selling price.

Margin = Gross Profit X 100

Selling Price

2. Mark-up: This is the relationship that exist between the profit and the cost of goods sold.

Mark-up = Gross Profit X 100

Cost Price

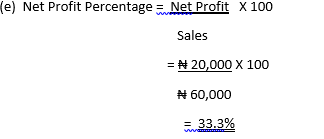

3. Net profit as a percentage of turnover = Net Profit X 100

Turnover

4. Gross profit as a percentage of turnover = Gross profit X 100

Turnover

5. Expenses as a percentage of turnover = Expenses X 100

Turnover

6. Managers’ Commission = Percentage Commission

100 + Percentage Commission

ILLUSTRATION

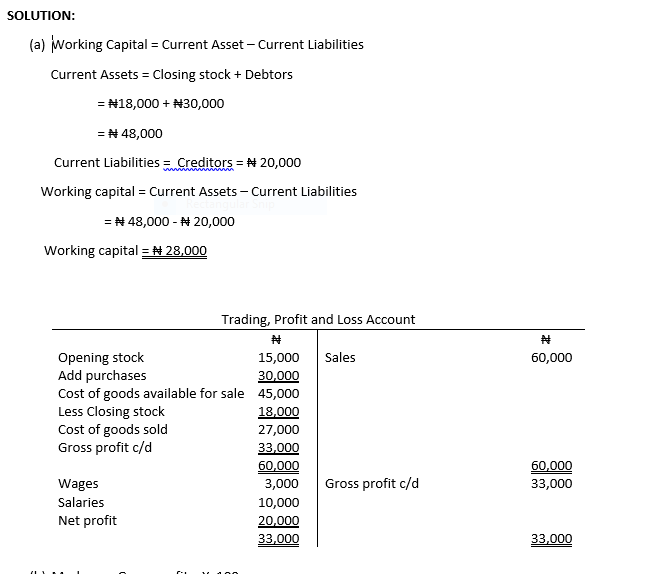

The following figures were extracted from the books of Estate Enterprises for the month of May, 2019.

N

Debtors 30,000

Creditors 20,000

Opening stock 15,000

Closing stock 18,000

Wages 3,000

Salaries 10,000

Purchases 30,000

Sales 60,000

Calculate the following:

(a) Working capital

(b) Mark-up

(c) Margin

(d) Stock turnover

(e) Net profit percentage

ASSIGNMENT

Use the following information from the books of Segun enterprises to answer the question below;

N

Sales 450,000

Opening stock 200,000

Closing stock 300,000

Expenses 150,000

Fixed assets 400,000

Debtors 100,000

Creditors 50,000

Purchases 250,000

Calculate;

(a) Cost of goods sold

(b) Net profit

(c) Current ratio

(d) Working capital

(e) Gross profit percentage

(f) Net profit percentage

(g) Rate of stock turnover

JULY 21ST, 2020

LESSON 10

You are welcome to this week class. Hope you are enjoying the lessons.

This week, we will be looking at another topic.

DEPARTMENTAL COMMUNICATION

Communication is the process which involves transmitting meaningful messages between senders and receivers. It promotes rapid transfer of information from one place to another. Communication process is thus the foundation for management functions.

TYPES OF DEPARMENTAL COMMUNICATION

INTER-DEPARTMENTAL COMMUNICATION

Inter-departmental communication is the process of sending and receiving messages or information from on department to another within an organization. It refers to communication among the various departments in an organization.

The various media of communication in an establishment include: Telephone, radiophone, loud speakers, circulars and computer terminals.

INTRA-DEPARTMENTAL COMMUNICATION

This involves the sending and receiving of information within the departments of an organization. In a department, there are various units and sections which must be co-ordinated through effective communication system.

The various media of communication available for intra-departmental communication are: intercom, circulars, direct communication, bells, buzzers and notice boards.

IMPORTANCE OF COMMUNICATION TO A BUSINESS

- It establishes and disseminates the goals of an enterprise.

- It facilitates official transactions between the various units, sections and departments

- It helps to organize human and other resources in the most effective and efficient way.

- It provides permanent records for reference purposes.

- It bridges the gap between the top management and the subordinates.

- Communication makes it possible for the day-to-day activities to be speedily attended to.

- It leads, directs, motivates and creates a climate in which people want to contribute to the growth of the enterprise.

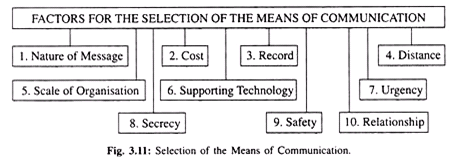

FACTORS TO BE CONSIDERED BEFORE CHOOSING A COMMUNICATION SYSTEM

1. Nature of Message: The means of communication depends upon the nature of the message. Urgent, confidential, private and important messages should be distinguished from ordinary, routine, open and less important messages and the means of communication are to be chosen accordingly.

2. Cost: The cost of sending a message is also to be considered while selecting a mode of communication. The result obtained should justify the expenditure.

3. Record: If the record of the communication is important it should be written, otherwise oral communication is sufficient.

4. Distance:

Distance is another factor for consideration. The mode of communication to be chosen depends on whether the message is to be sent to a nearby place or somewhere at a long distance.

5. Scale of Organisation:

Means of communication in large-scale business is different from that in the small-scale. In small business most communication is oral while in large business it is written.

6. Supporting Technology:

Both the sender and the receiver must have supporting technological communication tool to make communication through a particular medium. Suppose, A sends an e-mail to B, to get the e-mail B should have a personal computer.

Again, to get a fax message one should possess a fax machine. Therefore, while selecting a means of communication one has to consider whether supporting technological tool is available at the other end.

7. Urgency:

Selection of the means of communication is to be made keeping in view the urgency of the communication. Time available is the main factor here. Higher cost may be justified for sending the message in time.

8. Secrecy:

If the message to be communicated is secret or confidential, such means are required to be adopted that can maintain secrecy. A telephone call can be overheard, an e-mail or fax may not be appropriate, and an office memo may be less confidential. In such cases, face-to-face talking may solve the problem.

9. Safety:

The sender has to be careful about the safety of the message. He/she has to decide whether the message would be sent by ordinary post or by registered post; through courier or messenger, etc.

10. Relationship:

The relationship between the sender and recipient may be a decisive factor in the choice of the means of communication. Message of private nature may require personal contact whereas formal relationship demands official and conventional mode of communication.

Differentiate between inter-departmental communication and intra-departmental communication.

SOLUTION

The prefix “intra” means within, so intra-departmental communications are those that occur within a department. In many companies, most employees have few conversations outside of their own department. Departments may have communication problems, rivalries or even hostilities with one another. The prefix “inter” means between, so interdepartmental communications are those that occur between departments. One way to resolve bottlenecks in the company’s operations is to graph the interdepartmental and intra-departmental communications.

JULY 14TH, 2020

Good morning students and welcome to today’s online revision class. Please, do your assignment and submit as at when due.

Authority can be defined as the power which has legitimacy. It is the right to give directives or command and to ensure compliance.

Power can be defined as the ability to exert influence and to compel obedience.

Accountability simply means a situation whereby a subordinate is accountable to his superior in an organization for his actions and he is obliged to report to his superior how well he has discharged his responsibilities and use the authority delegated to him.

Responsibility: It is defined as the individual obligations to carry out the duties assigned to him or her. Responsibility cannot be delegated.

SPAN OF CONTROL

The span of control or span of management refers to the number of subordinates a manager can effectively control or number of subordinates working with him.

FACTORS DETERMINING SPAN OF CONTROL

- The Nature of work: The nature of work will determine the span of control. Complex jobs require more supervision and less number of subordinates, but routine jobs require less supervision but large number of subordinates.

- The Qualification, Training and Experience of the Manager: A well trained and experience manager will be able to manage effectively and efficiently large number of subordinates while an inexperienced manager cannot do so.

- The Personality of the manager: The style of leadership of the manager as well as the freedom to make decision will affect the span of control.

- The Size of the organization: The larger the organization, the larger the number of subordinates to be supervised.

- The Quality of Lateral Communication: The quality of lateral communication which may enable the subordinates to get job done without constant reference to the superior for consultations.

- Level of Technological Development: The level of technological development will determine the number of subordinates that will be put under direct supervision of a manager.

- The Calibre of Subordinates: The caliber of subordinates in terms of experience, exposure, skill and educational background can also determine the span of control.

- The Demands on a Manager’s Time in other jobs: The amount of time which a manger spends on non-managerial tasks will determine the number of subordinates he can effectively coordinate.

- Frequency of Interpersonal Relationship between a Manager and the subordinates: The frequency of interaction between a manger and the subordinates will determine how effective the span of management will be within an organization.

DELEGATION OF AUTHORITY

Delegation of authority is the transfer of power or right to a subordinate to give orders and enforce obedience in the performance of a particular job.

Delegation of authority is the transfer of responsibility to a subordinate, with sufficient authority to enable the subordinate carry out the assignment while the superior will consider himself accountable for the delegated authority.

PRINCIPLES OF DELEGATION OF AUTHORITY

- There must be balance of authority, responsibility, and accountability in an organization.

- Responsibility cannot be delegated.

- There must be clarity in the functions given to each department.

- The principle of scalar chain of command must be clearly specified.

Advantages of Delegation of Authority

- The work load of the superiors will be reduced.

- Training of Subordinates whom the authority is delegated to do certain jobs.

- It saves a lot of time as certain duties can be delegated to the subordinates.

- There is speedy execution of job.

- It makes smooth succession possible

- It ensures cordial relationship.

- It motivates subordinates.

- It helps to spread out work in an organization to every worker.

Disadvantages of Delegation

- It may lead to confusion

- Unfinished task

- It leads to duplication

- Delegation can be abused

- Delegation may affect the quality of job.

Why a Manager may Refuse to Delegate Authority

- Fear of expressing favouritism among the subordinates

- Fear of repercussion and personal judgement being called to question.

- Hardworking subordinates may take over the job of the manager.

- The fear of the subordinates detecting his fault.

- Fear of lack of capable subordinates.

- The fear of the subordinates performing better than the boss.

- The fear of the subordinates becoming more knowledgeable than the boss.

- The fear of losing touch with the department, work and staff.

- The fear of the subordinates making costly mistakes.

What a Manager cannot Delegate

- Setting policy objectives

- Motivating and communicating

- Checking and analysing result.

- Setting training objectives.

- Disciplinary and human relations matters.

Interdepartmental and Intra-departmental Communication

Communication is the process which involves transmitting meaningful messages between senders and receivers.

Interdepartmental Communication: This is the process of sending and receiving messages or information from one department to another within an organization. The various media available include; telephone, radiophone, loud speakers, circulars and computer terminals.

Intra-departmental Communication: This involves the sending and information within the departments of an organization. The various media available are intercom, circulars, direct communication, bells, buzzers and notice boards.

IMPORTANCE OF COMMUNICATION TO A BUSINESS

- It establishes and disseminates the goals of an enterprise.

- It helps to organize human and other resources in the most effective and efficient way.

- It helps to select, develop and appraise members of the organization.

- It provides permanent records for reference purpose.

- It bridges the gap between the top management and the subordinates.

- Communication makes it possible for the day-to-day activities to be speedily attended to.

- It leads, directs, motivates and creates a climate in which people want to contribute to the growth of the enterprise.

- It helps to develop plans for the achievement of the goals and objectives of the enterprise.

ASSIGNMENT

- Differentiate between;

(a) power and authority.

(b) inter-departmental and intra-departmental.

LESSON TWO

BUSINESS CAPITAL

Capital as a factor of production can be defined as wealth reserved or set aside for the production of more wealth.

In a business concerned, capital is money used in starting a business and as time goes on, the money is converted or used in acquiring different assets like premises, equipment, land and building, furniture and fittings, motor van, stock of goods, e.t.c.

FEATURES OF CAPITAL

(1) Capital is man-made.

(2) Capital can change form.

(3) Capital constitute wealth.

(4) The reward of capital is interest.

(5) Capital is highly durable.

(6) Capital is subject to depreciation.

Types of Capital

- Authorized/Registered/Nominal Capital: This is the total amount of capital in form of shares that a company is empowered to issue out to the public for subscription. This is usually stated in the Memorandum of Association.

Note: The company can only exceed this maximum amount if an amendment is made in the Memorandum of Association and approved by Corporate Affairs Commission. (CAC).

2. Issued Capital: This is the part of the of the authorized capital that the company decides to issue out to the public for subscription.

3. Unissued Capital: This is the part of the authorized capital that the company has decided not to issue out to the public for subscription. It is the remaining part of the authorized capital.

4. Called-up Capital: This is the part of the issued capital that the company has asked the shareholder to pay for. Example, the company may issue shares worth ₦ 600,000, the company may not require the total amount now, he might ask the shareholders to pay ₦ 400,000 worth of shares now.

5. Uncalled-up Capital: This is the part of the issued capital that is yet to be called up for payment.

6. Paid-up Capital: This is the part of the called-up capital which the shareholders have actually paid for.

7. Unpaid capital: This is the part of the called-up capital which the shareholders have not yet paid for.

8. Fixed capital: This is the type of capital that is used in purchasing the durable property of the firm. They are not intended for immediate consumption, but they are used continuously for further production. Fixed capital do not change form in the process of production. E.g. premises, machinery, motor van, buildings, furniture and fittings.

9. Loan capital: This is the total amount of money which the firm borrowed from external sources to form part of the money used in running the business.

10. Liquid Capital: This comprises of the current assets of the business enterprise that can be easily converted to money. i.e. it can be turned into cash at short time e.g. cash, stock, debtors, bank balance.

11. Working Capital: This is the amount of money or available funds kept by the business for his day-to-day expenditure or payment.

Working capital can be calculated thus:

Current Assets – Current Liabilities.

12. Capital Employed: This is the total assets, both fixed and current, less current liabilities. It is the actual amount of money and other assets used in the business.

Capital employed = Total Assets – Current Liabilities.

13. Capital Owned: Capital owned is the owner’s financial interest in a business. It is the excess of total assets of a business over the value of its short term and long term liabilities. It is the net worth of a business.

14. Loan Capital: This is the total amount of money a business borrowed from external sources.

15. Liquid Capital: This is made up of assets that can be easily converted to money, i.e. can be turned into short notice. This consists of cash, near money, debts, and bank balance.

16. Fixed Capital: This is the durable capital of an enterprise which is used continuously.

Importance of Working Capital

- It is used to measure the solvency of the business i.e. the ability of a business to settle its current liabilities or debts.

- It helps to determine the funds available for the day-to-day running of the business.

- It is used as basis for planning to avoid losses.

- It is a sign for viability of a business enterprise.

- It gives investor confidence in the business organization

- Since the working capital is used to buy stock from where profit is derived, the higher the working capital the higher the profit expected.

- It provides basis for profit making by the business since it is used to buy stock from where profit is derived.

Balance Sheet

A balance sheet can be described as a statement that shows the state of affairs or position of a business enterprise in a particular period of time.

Illustration 1:

Abiola International Limited has an authorized capital of ₦900,000, shares and capital worth ₦600,000 were made public for subscription. Out of this, the company received ₦ 400,000 almost immediately.

Calculate the following:

- Nominal Capital

- Issued Capital

- Paid-up Capital

- Unissued Capital.

SOLUTION:

- Nominal Capital =

₦900,000 - Issued Capital =

₦600,000 - Paid-up capital =

₦400,000 - Unissued capital =

₦300,000

Illustration 2

Adegoke Enterprises Financial position as at 31st December, 2018 is as follows

₦

Fixtures 10,000

Stock 31st December, 2018 80,000

Creditors 30,000

Debtors 50,000

Cash at hand 70,000

Bank overdraft 12,000

Typewriter 45,000

Furniture 25,000

Capital 180,000

One-year cooperative loan 41,000

Profit for the year 17,000

Required:

Calculate: (a) Capital owned

(b) Working capital

(c) Current liabilities

(d) Fixed Capital

(e) Capital employed

SOLUTION:

(a) Capital owned ₦

Capital 180,000

Add net profit 17,000

197,000

(b) Working Capital = Current Assets – Current liabilities

Current Assets ₦

Stock 80,000

Debtors 50,000

Cash at hand 70,000

200,000

Current Liabilities ₦

Creditors 30,000

Bank overdraft 12,000

One-year cooperative loan 41,000

83,000

Working capital = current assets – current liabilities

₦200,000- ₦83,000

₦ 117,000

(c) Current liabilities ₦

Creditors 30,000

Bank overdraft 12,000

Cooperative loans 41,000

83,000

(d) Fixed Capital ₦

Fixtures 10,000

Typewriter 45,000

Furniture 25,000

80,000

(e) Capital employed = Total assets – Current liabilities

Total assets = Fixed assets + current assets

Fixed Assets ₦

Fixtures 10,000

Typewriter 45,000

Furniture 25,000 80,000

Current Assets ₦

Stock 80,000

Debtors 50,000

Cash at hand 70,000 200,000

Total Assets = 280,000

Less: Current liabilities

Creditors 30,000

Bank overdraft 12,000

Cooperative loans 41,000 83,000

Capital employed = 197,000

ASSIGNMENT

The following are the assets and liabilities of Monday Limited.

₦

Cash 8,000

Building 81,000

Creditors 6,500

Sales returns 12,000

Debtors 18,000

Capital 122,000

Overdraft 11,000

Motor vehicle 20,000

Sales 50,000

Net profit 20,000

Calculate the following:

(i) Working capital

(ii) Net sales

(iii) Net profit percentage

(iv) Capital owned

(v) Fixed assets.

COMMERCE

JULY 7TH, 2020 LESSON 8

ORGANIZATIONAL STRUCTURE

You are welcome to this week on-line class. Are you following the lessons? We will be studying the structure of business.

ORGANISATIONAL SET UP

The organizational setup of a business involves the allocation of responsibilities and functions to different components of the organization and delegating authority to each position in order to ensure the smooth operation of the business so as to achieve the planned objectives.

PRINCIPLES OF MANAGEMENT

- Clarity of objectives: the aims and objectives of an organization, the strategies and means of achieving them must be clearly stated.

- Span of control: this is the number of subordinates under the direct supervision of a manger to ensure efficiency and effectiveness.

- Unity of command: this principle states that subordinates should receive instructions from their boss only as dual command affect effectiveness.

- Division of labour: The organization will achieve efficiency if work is divided into the smallest possible units as specialization increases productivity.

- Unity of direction: People engaged in the same kind of activities must have objectives in a single plan. This means that the corporate interest must supersede individual interest.

- Espirit de corps: Management should foster the morale of its employees and build up a team spirit. Management should be guided by the popular slogan: “United we stand, divided we fall.”

- Evaluation principle: this principle helps to determine or measure the contributions of every worker to the attainment of the organizational objectives.

ORGANISATIONAL CHART

Organizational chart is a diagrammatic representation of the relationship between the various organs of the organization. It shows the line of authority and responsibility.

USES OF ORGANIZATIONAL CHART

- Organizational chart shows the flow of line of authority and responsibilities.

- It shows the various positions in an organization.

- The boundaries of each position holder will be shown.

- A chart shows the relationship between various organs in an organization.

TYPES OF ORGANIZATIONAL STRUCTURE

- Line organization: This refers to the direct working relationship between the subordinates and the supervisors in which the line of authority and responsibilities flow from the top executives to the lowest subordinates. A line manager has unlimited authority over a subordinate to whom he gives orders.

ADVANTAGES OF LINE ORGANIZATION

- It is simple and is easily understood by the employees and management

- Decision-making at all levels is made easy and simple.

- Discipline is always maintained.

- There is clear cut identification of duties, responsibilities and division of labour.

- It is good for small organizations where specialization is not very important.

DISADVANTAGES OF LINE ORGANIZATION

- Lack of specialization at the supervisory level.

- It is autocratic.

- There may be much pressure and demands on the top managers.

- Functional organization: Functional organization is a set up where certain functional relationships exist between specialist or functional managers and line managers e.g. the personal manager has a functional responsibility for all activities concerning personnel in all the departments of the organization, even though each employee has his own manager in their department.

ADVANTAGES OF FUNCTIONAL ORGANISATION

- Experts are allowed to make use of their expertise for the betterment of the company.

- It encourages division of labour and therefore promotes efficiency.

- There are several supervisors and this makes for better co-ordination.

DISADVANTAGES OF FUNCTIONAL ORGANISATION

- Authority can overlap

- There is lack of fixed line of responsibility

- There may be lack of effective control

- Line and staff organization: This is a combination of line and direct executives and the specialist’s auxiliary services (functional) whereby a line organization engages experts who are to advise the line managers in the performance of their duties.

ADVANTAGES OF LINE AND Staff ORGANISATION

- There is efficiency through specialization

- Decision making can be enriched because ideas can be shared

DISADVANTAGES OF LINE AND STAFF ORGANISATION

- Their ideas may be unrealistic and unpracticable.

- Staff managers have no line of authority and no responsibility for what actually happened.

- Staff manager may attempt to usurp line authority.

ASSIGNMENT

“Committee” is another type of organisational structure. Briefly explain with three advantages and disadvantages.

JUNE 30, 2020

Good morning students. You are welcome to today’s online Commerce class. This morning, you shall be having two lessons for your Commerce revision class. We shall be revising trade association, chamber of Commerce and business management. Please, make sure you submit your assignment on or before MONDAY, JULY 6, 2020. Also, always check for your correction below the NINJA FORMS before the next online Commerce class. May God grant you understanding as we move on.

TRADE ASSOCIATION AND CHAMBER OF COMMERCE.

A trade association is a group of people or individuals in the same line of business who have voluntarily agreed to come together for the purpose of safeguarding and promoting their common interests.

A trade association has a local or regional outlook. They are formed by retailers or manufacturers. Membership to their non-profit organization is voluntarily. Examples are:

(i) Manufacturers association of Nigeria (MAN)

(ii) Nigeria Union of Journalist (NUJ)

(iii) Nigeria Bar Association (NBA)

(iv) Nigeria Medical Association (NMA)

(v) Nigeria Union of Road Transport Workers (NURTW)

(vi) Garri Seller Association.

(vii) Cement Dealers Association

(viii) Nigerian Union of Teachers (NUT)

AIMS AND OBJECTIVES OF TRADE ASSOCIATION

(1) To protect their trade or profession effectively from being infiltrated by quacks.

(2) To give information to members about the development in their trade of line.

(3) To ensure that members charge uniform price for their goods and services.

(4) To create uniformity in the way their members deal with people.

(5) To ensure that members enjoy good quality services.

(6) To assist members who are in need.

(7) To defend and advance the interest of their members.

(8) To safeguard the interest of their members from being maltreated by other employers and from the members of the society.

(9) To regulate the activities of their members.

(10) To act as pressure groups by influencing the government and political parties to take decisions that will be of benefits to the groups.

(11) To educate their members through the organization of seminars and workshops, conferences, etc.

FUNCTIONS OF TRADE ASSOCIATION

(1) They foster cooperation among members and settle disputes among them.

(2) They gather useful information and disseminate them to their members.

(3) They prevent limitation of their products e.g. Manufacturer Association of Nigeria

(4) They provide credit facilities and assistance to their members.

(5) They carryout research and publish out report for members’ use.

(6) They fix prices for their services or products.

(7) They put political pressure on government for the interest of their members.

(8) They also promote welfare services e.g. Nigeria Bar Association, Nigeria Medical Association.

(9) They negotiate with other trade associations on collective basis.

(10) They educate members on trade activities etc.

(11) They draw up standard for the practice of their trade.

CHAMBER OF COMMERCE

A chamber of commerce is defined as an association of businessmen of professionals from different lines of business in an urban area who agree to come together to protect their interests. It has national and international outlook. Example of chamber of commerce include:

i. Ibadan Chamber of Commerce

ii. London Chamber of Commerce

iii. International chamber of Commerce

iv. Lagos Chamber of Commerce

v. Ijebu Chamber of Commerce

vi. Oyo Chamber of Commerce

vii. Nigerian-American Chamber of Commerce

viii. Owerri Chamber of Commerce.

Aims and Objectives of Chamber of Commerce

- To influence the policy of the government relations to commercial activities in an area.

2. To promote business interest of the area.

3. To promote commercial activities in a community, town or country.

4. To liaise or relate or relate with other chamber of commerce in relation to their business interest.

FUNCTIONS OF CHAMBERS OF COMMERCE

1. They assist the development of commerce, trade and industry.

2. They provide support or oppose legislation which they feel will affect their members.

3. They provide information to members on their line of businesses.

4. They organize trade fairs, exhibitions, etc. for the enhancement of commercial activities.

5. They settle disputes among members.

6. They provide necessary information on legal, customs and other technical requirements of foreign countries to members.

7. They educate members on new techniques and technology by organizing seminars.

8. They promote home and foreign trade.

9. They cooperate with both domestic and foreign chamber of commerce.

10. They act as watchdogs in the administration of government laws.

Differences between Trade Association and Chamber of Commerce

| Trade Association | Chamber of Commerce | |

| 1. | Membership is restricted to those who engage in the same line of trade. | Membership is not restricted to a particular type of business or trade. |

| 2. | It has local or regional outlook | It has national or international outlook. |

NOTE: SUBMIT YOUR ASSIGNMENT ON OR BEFORE MONDAY, JULY 6, 2020.

ASSIGNMENT

1. (a) What is a cartel?

(b) State three features of a cartel.

CORRECTION TO ASSIGNMENT GIVEN ON 30/6/2020

A cartel is an association of independent producers of similar products, formed mainly for the main purpose of regulating prices by controlling output.

Features of a cartel

- It is established by independent producers of similar products

- Cartel is monopolistic in nature

- Production output is restricted to the quota allocated to each producer.

- Member organization do not compete with one another on issue of price or output.

- They restrict output so as to force the price up.

LESSON TWO

BUSINESS MANAGEMENT

A business is any occupation or activity formed with the aim of making and in which there is risk of loss. It can be owned privately or by the government e.g. Edo line Transport, Danax, etc.

OBJECTIVES OF A BUSINESS

1. To make maximum profit.

2. To provide goods and services to satisfy the needs of people.

3. To provide employment opportunities to the members of the public.

4. To protect the interest and well-being of their employees.

5. To find use for their utilized resources.

6. To provide quality and cheap goods to the consumers.

BUSINESS RESOURCES

These are the elements put together in order to start and run a business enterprise.

Business resources are the inputs which are required for effective and efficient running of a business concern.

CLASSIFICATIONS OF BUSINESS RESOURCES

- Money Resources: These involve the money or capital that is used in starting and the smooth running of the business. Money is important because without it, a business cannot take off. The importance of money cannot be over-emphasized, because all resources used in the business are acquired with money. It can be obtained by borrowing, buying shares, etc.

- Material Resources: These include raw materials, tools, machines, equipment used in the business. When the capital for a new business is released, part of it is turned into materials which help the business to operate economically and efficiently.

3. Human Resources: This refers to personnel or manpower i.e. labour needed for the operation of the business enterprise. They plan, organize, direct and control the operation of the business enterprise in order to achieve its objectives. It can also be referred to as human factor of production or management resources.

4. Opportunities or Goodwill: These refer to the identifiable chances calling for acquisition. It can also be referred to as the facilities within the environment which the business uses. These are roads, electricity, water and telephone services. Goodwill means the name and reputation of a business and which also aids business operation.

MANAGEMENT

This can be defined as the process of using authority to organize, direct and control subordinates in order to achieve the objectives of the business.

Management is the resources of the business that perform the function of planning, directing, controlling and leading in order to attain the objectives of the business.

Business Management

This can be defined as the planning, organizing and controlling of any occupational activity that is profit oriented in which there is risk of loss.

Functions of Management

(I) Planning: This involves the establishment of objectives for organization and determining the best procedure and methods of achieving the objectives.

Benefits of Planning

- It enables an organization to set up goals to be achieved.

- It helps the organization to set up policies procedures and schedules to meetup the set objectives.

- It helps the organization to accomplish its goals and objectives.

- Planning helps in accepting decisions.

- It helps in predicting the activities of an organization over a period of time.

(II) Organizing: This is the process of developing the organization structure, i.e. arranging resources, e.g. people, time, money and equipment, etc. to carry out the organization’s plan in an efficient way.

(III) Controlling: It ensures that the organizational objectives are actually being obtained and the corrections are effected where deviations are found. Controlling, therefore, is aimed by making what is planned to happen.

Elements of Controlling

a. Establishing Standards: This involves setting of goals against which performance can be measured later.

b. Measuring Performance: Building up a feedback system whereby data is collected on the actual performance of the business enterprise.

c. Interpreting Result: Making a judgement as to whether the set standards are attained and if not, why?

d. Taking corrective measures: Taking steps to eliminate causes of flaws that has been found.

(IV) Directing: This is the process of aiding the employees of an enterprise to perform their jobs effectively with confidence. It involves motivation, leadership and other skills to ensure that people in the organization know what their work is and have it done.

(V) Staffing: This involves the provision of qualified managerial, efficient and skill personnel to manage the affairs of the organization. It involves putting the right people in the right place or position at the right time to achieve their objectives.

(VI) Motivating: This involves the ways the leaders get subordinates to willingly carry out their responsibilities to the business, by inspiring them through monetary and non-monetary welfare packages.

(VII) Communication: This is the process of transferring information and ideas with feedback between people.

NOTE: SUBMIT YOUR ASSIGNMENT ON OR BEFORE MONDAY, JULY 6, 2020.

ASSIGNMENT

- List any ten business environment.

CORRECTION TO ASSIGNMENT GIVEN ON 30 TH JULY, 2020.

- Economic environment

- Political environment

- Infrastructural environment

- Socio-Cultural environment

- Demographical environment

- Financial environment

- Technological environment

- Legal environment

- International environment

- Natural condition and ecological environment

- Industrial environment

COMMERCE

LESSON 6

CLASS: SS 3 DATE: JUNE 23RD, 2020

You are welcome to this week on-line class. Are you following the class? Please always ensure you do your assignment.

CONTRACT OF EMPLOYMENT

MEANING OF EMPLOYEE AND EMPLOYER

THE EMPLOYER

The employer is someone or an institution that hires or provides work for another person called employee for an agreed remuneration.

DUTIES OF THE EMPLOYER

- Payment of remuneration to the employee

- Provision of training facilities

- Provision of job security

- He must indemnify his employee where required

- Provision of safe place of work

- Provision of necessary working tools and equipment

RIGHTS OF THE EMPLOYER

- Right to fix remuneration

- Right to relieve employee of his job

- Right to employ or hire anyone

- Right to use invention of employee

THE EMPLOYEE

The employee is someone who agrees to perform services to an employer in exchange for the payment of an agreed remuneration. The employee works for another person called the employer for an agreed sum of money and is accountable to his employer.

DUTIES OF THE EMPLOYEE

- Performance of duties according to terms

- Keeps the secret of his employer

- No secret profit or acceptance of bribes

- Must serve faithfully and honestly

- Obeys orders and instructions.

RIGHTS OF THE EMPLOYEE

- Right to annual leave

- Right to accept or reject offer.

- Right to receive on agreed remuneration

- Right to receive compensation for loss.

GOVERNMENT REGULATION OF BUSINESS

The government lays down certain rules and regulations that will help to control and regulate business activities in a country in order to ensure uniformity in commercial policies and to encourage smooth operation.

METHODS OF GOVERNMENT REGULATION OF BUSINESS

- Business License/Registration: In Nigeria, it is mandatory for all business enterprises to be registered with the CAC before commencing operation according to Company Act.

- Patent Rights: This is an exclusive right granted by government to a person to make use/sell an invention for a certain period of years. This gives the owner some degree of monopoly of the invention. Nobody can make use of such invention without permission from the right owner.

- Copyrights: This is an exclusive/sole right granted to writers of literary works (authors), musicians and artists to produce his work for a specified period of time. Literary copyright will last for 50 years after the death of the author while musical right will only last for 50 years after its release.

- Trade Mark: This is a distinctive symbol, special mark or design that is given to a producer to distinguish or identify its products from other products.

- Approval of Business Location: Government can also control and regulate business by giving approval for the location of a business enterprise. Sometimes they do this by establishing industrial estates.

- Ensure Production of Safe Goods: Another way is to ensure that goods offered for consumption are safe and of high quality.

- Use of Standard Weights and Measures: All business enterprises are mandated to use standard weights and measures for the products offered for sale.

REASONS FOR GOVERNMENT REGULATION OF BUSINESS

- To ensure uniformity in commercial and economic policies.

- To ensure industrial harmony between the employers and workers.

- To ensure provision of quality products.

- To ensure the development of the economy.

- To ensure regular supply of essential goods and services.

ASSIGNMENT

- List 4 right of an employee

- Give 4 duties of an employer.

LESSON 6 – CORRECTION

- List 4 right of an employee

- Give 4 duties of an employer

RIGHTS OF THE EMPLOYEE

- Right to annual leave

- Right to accept or reject offer.

- Right to receive on agreed remuneration

- Right to receive compensation for loss.

DUTIES OF THE EMPLOYER

- Payment of remuneration to the employee

- Provision of training facilities

- Provision of job security

- He must indemnify his employee where required

- Provision of safe place of work

- Provision of necessary working tools and equipment

JUNE 16, 2020

Good morning students, you are welcome to today’s online class. This morning we shall be having two lessons as usual for our revision class. Please, ensure you submit your assignments for the two lessons on or before FRIDAY, JUNE 19, 2020.

LESSON 1

TERMINATION OF A CONTRACT

The following are the methods through which a contract can be terminated.

(1) Breach of Contract: A contract ends if one party fails to perform his own part of the contract.

The aggrieved party has three options.

- He can sue for damages

- He can bring an action for specific performance.

- Discharge the offending party.

(2) Operation of Law: Contracts could be discharged when it becomes legally impossible to operate. E.g. a court declaring one party bankrupt, insane or subsequent illegality of the object of the contract.

(3) Performance: A contract is automatically brought to an end, if each party has performed his own part of the agreement, e.g. contract to supply machinery to end when the machinery is supplied and paid for. It is more or less execution of the contract.

(4) Frustration: A contract is ended when factors that are not only beyondcontrol but also not contemplated upon by both parties prevent any partly from performing his own part of the contract.

(5) Mutual Agreement: Both parties may decide to end the contract by mutually agreeing that the contract be ended.

(6) Lapse of time: A contract can be brought to an end, if the time fixed for its performance has elapsed.

(7) Operation of Law: Contracts could be discharged when it becomes legally impossible to operate. e.g. a court declaring one party bankrupt, insane or subsequent illegality of the object of the contract.

(8) Act of God: Contracts can be terminated by the occurrence of natural events like flooding, earthquake and storm.

SALE OF GOODS ACT 1893

The sale of Goods Act of 1893 defined the sale of goods as a contract whereby the seller transfers or agrees to transfer the right of the goods to the buyer for an amount of money called the price.

Contents of a Contract of Sale

(i) Price: The amount for which the goods are sold must be stated.

(ii) Quality: Qualities must be stated where there are many types of the same goods, but the rule is caveat emptor i.e. let the buyer beware.

(iii) Terms of Payment: It must be stated whether it is cash and carry or on credit sales.

(iv) Means of Payment: It should contain the payment method acceptable, credit cards, cash, money order, bank draft.

(v) Warranty: This is a guarantee from the seller to the buyer that the goods are in conformity with the quality staged.

(vi) Subject Matter: The item being sold must be stated so that the buyer can make himself available.

(vii) Quantity: This must be stated to show the quantity bought and the quality to be delivered.

(viii) Packaging: The type of packaging to be used should include the description of the goods.

(ix) Delivery: How the goods are to be handed over to the buyer whether it should be actual, symbolic or constructive delivery.

Parties to a Sale

(1) The owner of the goods being sold is known as transferor or the vendor

(2) The buyer of the goods is called the transferee or the vendee

Sale and Agreement to Sell

A sale occurs where the ownership of the goods is transferred to the buyer at the time of the contract.

Agreement to sell means the transfer of ownership of goods at a future date or time due to fulfilment of some conditions.

PROVISION OF THE SALE OF GOODS ACT 1893

(1) The seller has a right to pass a good title to the buyer

(2) The buyer must enjoy a quiet possession without any third party threat

(3) If the goods are sold by sample description, the goods must correspondence with the description.

(4) If the goods are sold by sample as well as by description, the goods must agree with both the sample and the description.

(5) Where goods are sold by sample, the bulk of the goods must be same a s the sample in quality.

(6) Where the buyer, expressly or by implication makes known to the seller the particular purpose for which the goods are required, the goods must be fit for such purpose

(7) The goods must be of merchantable quality.

RIGHTS OF AN UNPAID SELLER

(1) Right to retain goods: The seller has a right to retain the possession of the goods if not paid for.

(2) Right of stoppage in transit: The seller has the right to stop the goods going to the buyer in order to regain and retain the possession of the goods until he is paid.

(3) Right of resale: The seller has the right to resell the goods especially perishables when he has notified the defaulting buyer who despite the notice still failed to pay.

(4) Legal action: The seller has the right to sue the buyer for the price of the if the buyer has taken possession of the goods.

(5) Recovery of possession from the buyer: An unpaid seller has the right to recover the goods already delivered to the buyer.

(6) Issue of ultimatum: Unpaid seller has right to give ultimatum to the buyer compelling him to pay.

Rights of the Buyer

1. Right to sue for damages for none delivery of the goods

2. Right to sue for specific performance

3. When there is a breach of warranty, claim against the seller

4. He may maintain an action for conversion.

GOVERNMENT REGULATIONS OF BUSINESS

(1) Registration of Business: The government registers all business units not only to give the business legal backing, but also to determine the strength of the economy in the various industrial spheres.

(2) Approval of Business Location: Government also controls and regulates business by approving the location of the business in order to ensure that such are not sited in a place that would cause harm to the citizens.

(3) Patent: This is the exclusive right of an inventor of a product over his invention in order to prevent others from copying the invention, once it is dully registered for a specified number of years e.g. 20 years and above. The owner of the patent right is called Patentee.

(4) Trade Mark: A trade is an identification mark registered by the owner to distinguish his products from those of other competitors. It is a distinguished mark or symbol given to a product which is dully registered to prevent another person from using it. It gives the product easy identification as it differentiates it from similar products of other manufacturers. Example of trademarks are lux, elephant, omo, klin, etc.

(5) Copyright: This is a monopoly or an exclusive right by government to an author or a publisher. Copyright is also granted to musicians, artists, photographers, film producers, etc. to protect their works from being copied or reproduced without prior permission. Copyright does not last forever, but it is limited to 50 years in the case of musical works from the date of release, or 50 years in the case of intellectual properties after the demise of the owner. Example of copyright statement can be seen on page (ii) of most books.

AGENCY

Agency is an agreement that exists between two partners known as the agent and the principal in order to bring the principal into a legal relationship with the third party.

An agent is defined as a person who is employed to act on behalf of another person known as the principal.

An agent is a person who effects a contract between his principal and the third party. He may or may not be an employee of his principal. He has power to make a binding contract between the principal and the third party without himself becoming a party to the contract.

The principal is the person that the agent is answerable to, the person who delegates business activities to another.

DUTIES OF AN AGENT

(1) He must obey or carry out all lawful instructions by the principal.

(2) He has to exercise reasonable care, skill and diligence in performing his duties.

(3) He must act in good faith and honesty by not engaging in any competing business to the detriment of the principal.

(4) He must act personally, i.e. he must not delegate his duties as an agent to an unauthorized person.

(5) The agent must not disclose to the third party any secret of the principal’s business.

(6) He must not allow his own interest to compete with that of his principal.

(7) He must not misuse the confidential information in respect to the affairs of the principal.

(8) He must not take any secret gain beyond the authorized commission and any other remuneration.

(9) He must render an account (i.e. stewardship) to the principal whenever required.

(10) He must at all times keep the principal informed.

(11) He must keep proper book of account on behalf of his principal.

(12) He must not convert the property of his principal allocated to him to enable him to carry out his duties to his personal use.

RIGHTS OF AN AGENT

(1) He has the right to receive his commission or remuneration.

(2) He has the right to be indemnified for losses incurred in the course of the agency.

(3) He has the to obtain refund for expenses incurred on behalf of the principal.

(4) He has the right of lien over the goods he sells.

(5) He has the right to stop goods in transit to the principal, provided he has assumed liability for payment of the purchase price.

FUNCTIONS AN AGENT CANNOT PERFORM ON BEHALF OF HIS PRINCIPAL

(1) He cannot vote on behalf of the principal.

(2) He cannot execute an affidavit on behalf of his principal.

(3) He cannot give testimony in the court on behalf of his principal.

(4) He cannot make a will on behalf of his principal.

APPOINTMENT OF AGENTS

(1) Appointment by Necessity: The appointment of this agency arises as a result of emergency situations which requires some actions to be taken to prevent too much damages. A person who is in possession of another person’s property has to do something to prevent it from being destroyed.

(2) Appointment by Ratification: This arises when the principal approves or ratifies the action of a person having no authority to act as his agent. The agent must disclose all details of the transactions of the contract to the principal and the ratification must be done within a reasonable time.

(3) Appointment by Implication: This occurs when the principal impliedly without conferring authority on the agent, thereby places him in a position where his services are needed to act on his behalf.

(4) Appointment by Estoppel: This occurs when somebody by his conduct allows the third party to believe that somebody is acting as his authorized agent. If the third party on the strength of this, enters into a contract with the agent, the principal will be stopped from denying the agency.

(5) Expressly: This happens when the principal appoints an agent verbally or in writing.

Duties of the Principal

(1) The principal must abide by the terms of their contract.

(2) He must make all facilities available to the agent in order to enable him perform his duties satisfactorily.

(3) He must not hinder or interfere with the agent’s efforts as long as the agent obeys his instructions.

(4) He must pay the agent all approved expenses carried out during the process.

(5) He must pay the agent as at when due, the agreed commission.

(6) The principal is obliged to accept responsibilities of all actions the agent takes on his behalf.

Right of the Principal

(1) He can sue the third party for damages.

(2) He has the right to sue the agent for default.

(3) He can recover any secret profit from the agent.

(4) He can dismiss the agent for breach of agreement.

(5) The principal has the right to refuse to pay the agent his agreed commission provided the agent has made some secret profits which he did not declare.

CONDITIONS FOR TERMINATION OF AGENCY

(1) By Frustration: Agency is terminated when the object of agency has been destroyed or no longer available or affected by change in government

(2) By Breach: If either the principal or the agent breaches the contract.

(3) By Performance: Agency is terminated when the agent has successfully performed the duties and obligations of his appointment.

(4) By Death: When either the principal or the agent dies, the agency is automatically dissolved.

(5) By Expiration: If the period fixed for the agency agreement has lapsed or expired, the agency is declared terminated.

(6) War: If war breaks out and makes the sustenance of the agency impossible, then the agency can be terminated.

(7) By Operation of Law: The law of the country can render a trade or service illegal, if the object of agency agreement is in line with such prohibited trade or service, it is rendered terminated.

(8) Bankruptcy: When the principal is declared bankrupt, the agency automatically becomes terminated.

(9) Agreement: When both parties to the agency agreement mutually agrees to terminate it.

(10) Insanity: Agency is brought to an end, if any of the parties has mental disability.

ASSIGNMENT

ENSURE YOU SUBMIT YOUR ASSIGNMENT ON OR BEFORE FRIDAY, JUNE 19, 2020.

1 (a) Who is a broker

(b) State six differences between a broker and a factor.

CORRECTION TO ASSIGNMENT GIVEN ON JUNE 16, 2020.

LESSON 1

1 (a) A broker is a commercial agent who links his principal with potential buyers. The broker receives commission known as BROKERAGE from his principal.

(b) Differences between a Broker and a Factor

| BROKER | FACTOR | |

| (1) | An agent that does not take possession | An agent that takes possession |

| (2) | He does not sell in his own name | He sells in his own name and issue receipts |

| (3) | He has no right of lien over the goods. He merely brings buyers and sellers together. | He has lien or legal claims over the goods of his principal. |

| (4) | A broker is not liable, if the buyer defaults in payment. | A factor is liable if the buyer defaults in payment. |

| (5) | A broker receives a commission known as brokerage | A factor receives a commission known factorage. |

| (6) | A broker operates on the stock exchange as an agent | A factor is merchant who sells goods on behalf of his principal. |

LESSON 2

JUNE 16, 2020

CONCEPT OF FOREIGN TRADE

Balance of Payment: This shows the relationship between a country’s total payments to other countries and its total receipts from them within a given period.

A country’s balance of payment of payment can be divided into three parts, namely:

(i) Current account

(ii) Capital account

(iii) Monetary movement account.

(i) Current Accounts: These are expenditures and incomes of a country of both visible and invisible import and export. It deals with a country’s total payment and import over a period of time usually a year. Visible goods are automobiles, cocoa, crude oil, insurance, transportation, etc.

(ii) Capital Goods: This means the movement of movement of money from one country to another. It is made up of the inflow and outflow of capital both long and short terms. It consists of capital movement in terms of investments, loans and grants.

(iii) Monetary movement account: This accounts shows how the balances of both the current and capital accounts are settled. If a surplus or a deficit occurs, this account will show how deficit is covered (settled) or how surplus is spent and balanced.

Favourable Balance of Payment: It occurs when the receipt of visible and invisible export trade is greater than payments to other countries on visible and invisible import trade.

Unfavourable Balance of Payment: It occurs when the payment of visible and invisible import is greater than the receipt on visible and invisible exports.

Balance of payment is said to be at equilibrium if exports or receipt = imports or expenditure

Causes of Unfavourable Balance of Payment

1. Inflation: When the goods produced by a country becomes too expensive to buy.

2. Drought: This can lead to poor harvest and yielding little or nothing for export.

3. High taste for foreign made goods.

4. Crude technology making mass production impossible

5. One product economy known as monopoly.

6. Bad and inefficient governance, such that the economy becomes a consumptive rather than a productive one.

Methods Adopted to Correct an Adverse or Unfavourable Balance of Payment.

(i) Export Promotion: This refers to government activities aimed at production of goods for export, e.g. creation of export free zone.

(ii) Discourage Exportation: Reduction in importation of goods through the imposition of restrictions like tariff, embargoes, exchange control measures, quota, etc.

(iii) Borrowing: The government can borrow from the international financial institutions like I.M.F. to settle deficit on her balance of payment.

(iv) Gifts and Debt Cancellation: Gifts and Debt Cancellation by friendly countries can be used in financing the balance of payment.

(v) Debt Postponement: Payment of debts in the current year can be postponed to another so as not to be used in the preparation of the balance of payment for the year consideration.

(vi) Devaluation: Devaluation of the country’s currency-bringing the value of the currency lower in relation to other currencies so as to attract foreign investment.

(vii) Sale of Assets abroad: Selling of gold reservesand assets overseas can be used to correct adverse balance of payment.

(viii) Counter Trade: Exchange of country’s goods for other country’s goods can also be used.

(ix) Encouraging Local Industries: This can be done through provision of subsidies and tax concessions to local producers.

PRINCIPLES OF COMPARATIVE COST ADVANTAGE

The principle was propounded by Richard David in the 19th century and it states that “countries of the world should specialize in the production of the commodity in which she has the greatest comparative of trade or lowest comparative cost than other countries of the world”

The assumption by Richard David is stated as follows:

(i) There are only two countries in the world.

(ii) Only two commodities are produced in the world.

(iii) The two countries have equal amount of labour.

(iv) Labour has the same efficiency.

(v) There is free transportation cost in the world.

(vi) Labour is the only productive asset.

(vii) There is free mobility of factors of production.

(viii) There is no trade restriction or barriers to trade.

ILLUSTRATION:

Before Specialization

| Country | Cost of production (man or labour hours) | Timber | Rubber |

| Nigeria | 400 | 3200 | 2000 |

| Ghana | 400 | 1200 | 4000 |

| World’s total | 800 | 4400 | 6000 |

If two countries decide to enter a trade agreement that leads to specialization, e.g. Nigeria and Ghana. Nigeria will use 400 labour on our timber farm to produce 3,200, while Ghana will use hers to produce 4,000 rubbers before specialization.

After Specialization

| Country | Cost of production (man or labour hours) | Timber | Rubber |

| Nigeria | 400 | 6400 | — |

| Ghana | 400 | — | 8000 |

| World’s total | 800 | 6400 | 8000 |

Nigeria will use 400 labour to produce 6400 timbers, while Ghana will use 400 labour to produce 8,000 rubbers after specialization.

ADVANTAGES OF SPECIALIZATION OR PRINCIPLE OF COMPARATIVE COST.

(1) It leads to increase in production of goods.

(2) It leads to efficient utilization of resources.

(3) It leads to reduction in production due to mass production.

(4) It leads to standardization of products.

(5) It increases revenue of countries involved.

(7) It increases interdependence of countries of the world

(8) It fosters good relationship between countries of the world.

LIMITATIONS OR DEMERITS OF PRINCIPLE OF COMPARATIVE COST.

(1) The more the countries, the more complex and unworkable the principle becomes.

(2) There are more than two commodities produced in the world.

(3) There are more factors of production to be considered other than labour.

(4) It is impossible for labour to have the same efficiency.

(5) It is impossible for countries to allow free transportation system.

(6) Perfect mobility of factors of production is not possible in foreign trade.

(7) There are trade restriction in international trade, e.g. embargo, quota system, tariff, etc.

TERMS OF TRADE: This is defined as the rate at which a country exchanges her export for import (i.e. visible & invisible export and visible & invisible import) expressed in price.

| The index of terms of trade = Price index of exports X 100 |

| Price index of imports 1 |

NOTE: This is designed to monitor the movement (increase or decrease of export and import price in a given period). If the prices of export are greater than those of import, the terms of trade are favourable, but if otherwise, it is unfavourable terms of trade.

Balance of Trade: It is the relationship between a country’s total payment (visible) import and its total receipt from visible exports within a given period usually a year. When a country is exporting a greater value of goods than it is importing, it is said to have a balance of trade surplus or favourable balance of trade and vice-versa. It is also referred to as VISIBLE BALANCE OF TRADE.

EXPORT DRIVE

This can be defined as the various activities of the government or its agent to promote or increase the amount of goods and services exported by the country. The government does this to avoid sufficiency from unfavourable balance of trade and payment.

Measures Government can take to Encourage or Promote Export

- Government can negotiate or join membership of international trade association aimed at removing barriers to free flow of trade.

- Reduction or total elimination of export duties.

- Establishment of new and improvement of the existing seas and airports facilities.

- Establishment and improvement of communication facilities

- Setting up of export promotion agency to direct and encourage intending exporters.

- Reduction of seas and air flights for exports

- Organization of international trade fairs and exhibitions to attract foreign buyers.

- The government could liberalise the process of granting credit facilities to exporters.

- Subsidies can be granted to industries producing exportable goods.

- Devaluation: the government can lower the value of her currencies vis-à-vis foreign currency thus making her country a cheap place to buy from.

- Provision of market intelligence to exporters by providing them with facts and trends in foreign market.

- Export credit guarantee: Government may provide an insurance cover against bad debts for exporters.

- The government can establish standard organization to help improve the quality of goods to meet international standards.

Functions of the Nigeria Export Promotion Council (NEPC)

- To assist exporters in the course of exporting goods to other countries.

- To ease up export procedure and documentation.

- To approve export and provide export license and set out procedures for exporting goods abroad.

- To use government export incentives in order to encourage and boost export trade.

- To work hand in hand with Central Bank of Nigeria and customs authority concerning the preparation of export document as well assisting in financing exporter.

ASSIGNMENT

1 (a) What is a bill of lading?

(b) State four contents in a bill of lading.

(c) Distinguish between a clean bill of lading and a foul or dirty bill of lading.

CORRECTION TO ASSIGNMENT GIVEN ON JUNE 16, 2020

LESSON 2

1 (a) A bill of lading is a document signed by the ship owner specifying that certain goods have been shipped in one of his ships. It serves as a document of the title to the goods stated on the bill. It also serves as a contract of carriage between the exporter and the shipping company. It represents an acknowledgement of the receipt of goods by the ship owner.

(b) CONTENTS OF A BILL OF LADING

(i) The name of the ship carrying the goods.

(ii) Description of the goods such as the quantity, type, weight, etc.

(iii) The shippers name

(iv) The names of the consignor and consignee

(v) Addresses of both consignor and consignee.

(vi) The port of embarkation or loading.

(vii) Conditions of carriage, e.g. who pays the freight charges

(viii) Location of the goods in the ship

(ix) The expected time of arrival.

(c) The difference between a clean bill of lading and a foul bill of lading:

A clean bill of lading is one signed by the transporter. It shows that the goods are in good order or are free from irregularities or damages, while a foul bill of lading is one which indicates some deficiencies, irregularities or damages on the goods.

COMMERCE

LESSON 4

CLASS: SS 3 DATE: JUNE 9TH, 2020

You are welcome back. I hope you are following the lessons. For those of you who refuse to submit your assignment, please do, so that I can know that you are following the class.

BUSINESS LAW

Business laws are sets of rules and regulations which govern the operation of business activities. These laws are as well classified as commercial laws.

BRANCHES OF COMMERCIAL LAWS

- Contract law: This law has to do with matters that involve contracts among people.

- Law of tort: This law deals with injuries caused to a person by other individual or company.

- Property law: This law deals with the ownership and use of property.

- Inheritance/Succession law: This law deals with the right of inheritance of property.

- Family law: This governs the legal aspect of the family, such as the rules of adoption, marriage, divorce and duly support.

- Corporate law: This law deals with business and stockholders.

CONTRACT LAW

A contract is defined as an agreement between two or more persons which is intended to be enforced by law. It is an agreement creating an obligation i.e. a legal agreement between two parties. All contracts therefore involve some sort of agreement but not all agreements are contract. The vital thing which turns an agreement into a contract is when the parties intend to be legally bound to carry out their agreements.

TYPES OF CONTRACT

- Oral contract: This is a contract entered into by the use of verbal communication or spoken words. Oral contracts are informal in nature.

- Written: This are documented contract in the sense that the terms are written down. It can be formal or informal depending on the circumstances of the case.

- Implied: This is a contract entered into through the act and conduct of parties. There is no written or oral evidence expect the act/conduct of the parties.

- Expressed contract: this is a contract in which both parties have exercise their freedom, duties or obligations and terms of agreement orally or through written declaration.

- Valid contract: This is a contract that has all the essential conditions and elements to make it binding and enforceable.

- Void contract: This is a type which has no legal effect and is incapable of enforcement because the subject matter is prohibited by law.

- Voidable contract: This is a contract that may be binding and enforceable. It may be rejected by one party due to the absence of an essential element such as signing under duress or one party not having legal capacity at the time of making the contract.

- Executed contract: This is contract that has been fully performed or completed.

- Executory contract: This is a contract that is in process of been fully performed in which something remains to be done.

- Unenforceable contract: This, although valid, cannot be enforced in the court because of the absence of some written evidence or the time stipulated for bringing action has elapsed.

- Illegal contract: This is not only a void contract but any other contract related to it will also be void, if the main contract was strictly illegal.

- Severable contract: Where a contract can be divided into several parts, payment for part that has been completed can be claimed.

- Quasi contract: This is an exceptional case where a court feels compelled to impose obligation upon a person even though the person has no intention of making a contract.

CONDITIONS/ELEMENTS OF A VALID CONTRACT

- Offer and acceptance

- Consideration

- Intention to create legal relations

- Legal capacity of the parties

- Genuiness of consent

- Legality of objects

- Certainty of terms of contact

- Possibility of performance

- Formality of a contract.

OFFER

An offer is a definite statement (by one party, called the offeror) of the terms and conditions under which he will contract with another party called the offeree.

Characteristics of an offer

- An offer must be definite

- It must be communicated by the offeree

- It may be expressly made or implied by the conduct of the parties

- It can be specific or general

- An offer, once made, remains open until it is accepted, lapsed rejected or revoked

Termination of an offer

- Lapse of offer/time

- A refusal

- A counter offer

- Revocation i.e. withdrawal of the offer

- Notification of rejection

- Death of either party before acceptance

- Loss of contractual capacity with either party (e.g. becoming insane) before acceptance

ACCEPTANCE

Acceptance is the mutuality of contract. It can also be seen as giving of one’s consent of an offer.

Rules of Communication of Acceptance

Acceptance can be void, voidable or not effective if:

- Communicated in ignorance of the offeror

- Not made by the person to whom the offer was made or someone with his authority

- Not communicated to the offeror by the offeree

- The acceptance comes with modification to the original offer (counter offer)

TERMINATION OF CONTRACT

A contact can be discharged or brought to an end in the following ways

- By performance

- By breach

- By consensus/agreement

- By frustration

- By lapse of time

- Death/insanity of the party

- Bankruptcy

- Illegality of object

REMEDIES FOR BREACH OF CONTRACT

The injured parties can sue for:

- Damages

- Action for an agreed sum

- Injunction

- Justice

- Quantum merit (as much as he deserve)

ASSIGNMENT

Explain how a contract can be discharged by the following:

- By breach

- By bankruptcy

- By frustration

LESSON 4 ASSIGNMENT – CORRECTION

Explain how a contract can be discharged by the following:

- By breach: A contract can be discharged when one of the parties refuses/fails to perform his own part of the contract e.g. if he does not perform on the agreed date or he delivers inferior goods.

- By bankruptcy: A contract can be discharged when either of the parties is declared bankrupt by the court of law, i.e. the party cannot pay his debt.

- By frustration:A contract is ended when factors that are not only beyond control but also not contemplated upon by both parties prevent any partly from performing his own part of the contract.

LESSON 3 (PART ONE)

Date: 2nd June, 2020

WAREHOUSING

Warehousing is an act of storing goods produced or bought until they are needed.

Importance of Warehousing

- It reduces risk of loss as warehouses guarantee the good condition of goods in their care.

- It ensures regular flow of goods to the market thus helping in stabilizing prices.

- It preserves goods because it prevents them from the vigorous activities of the weather.

- It serves as protection of goods against theft and fire.

- It encourages mass production in anticipation of demand.