AUGUST 20,2020.

REVISION QUESTIONS

Good day students and welcome to today’s online class.

1. A business is considering the introduction of a computer accounting system.

(a) State four;

(i) benefits of a computer accounting system.

(ii) disadvantages of a computer accounting system

(b) List three areas of application of computer in accounting.

(2) Explain each of the following:

(a) Authorized Share Capital

(b) Issued Share capital

(c) Called-up capital

(d) Call-in-arrears

3.(a) Define and list two classifications of each of the following:

(i) assets

(ii) liabilities.

(b) Explain how the following items are treated in the profit and loss account and balance sheet.

(i) provision for doubtful debt;

(ii) depreciation on fixed assets;

(iii) accrued income;

(iv) prepaid expenses.

AUGUST 13, 2020

LESSON 12

You are welcome to this week on-line class.

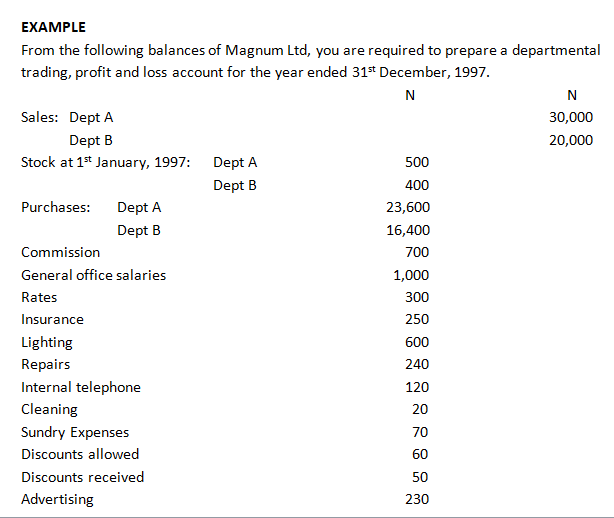

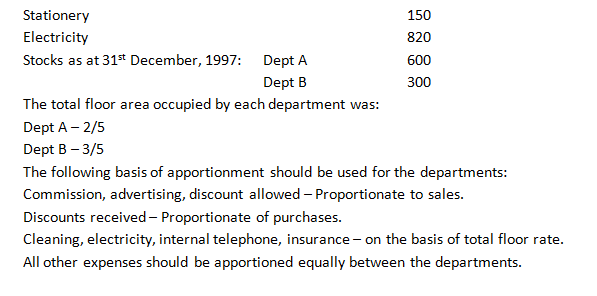

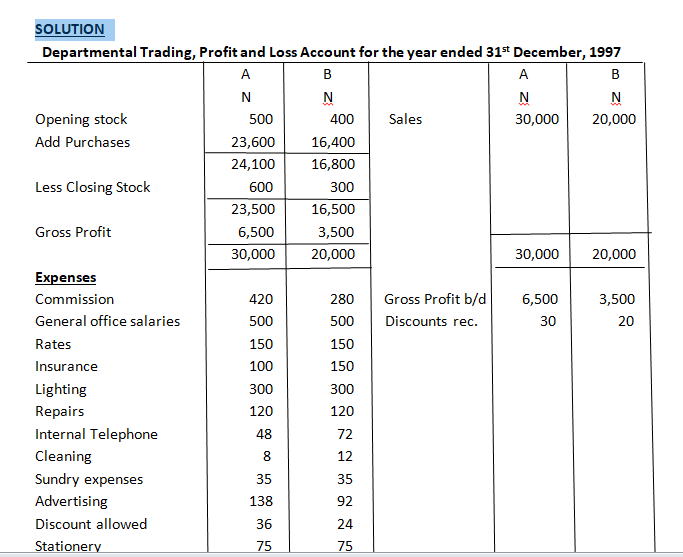

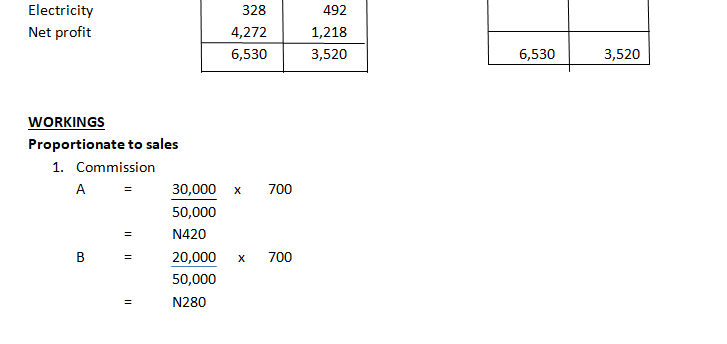

DEPARTMENTAL ACCOUNT

Departmental account aims at separating the several activities of a business in order to compare results and to assist the proprietor in formulating policies e.g. a dealer selling radio, television, record players can prepare the accounts separately to deal with each department.

OBJECTIVES OF DEPARTMENTAL ACCOUNTING

- To have comparison of the results of a particular department with the previous year and also with the other departments of the same concern.

- To help the proprietor in formulating policy to expand the business on proper lines so as to optimize the profits of the concern.

- To generate information, which may be helpful for planning, control, and evolution of performance of each department for taking various managerial decisions.

ADVANTAGES OF DEPARTMENTAL ACCOUNTS

- The gross profit of each department can be ascertained.

- Unprofitable departments will be revealed.

- The result of operation can be used to pay the managers of each department.

- The progress of each department can be monitored.

- It helps to calculate the stock turnover of each department.

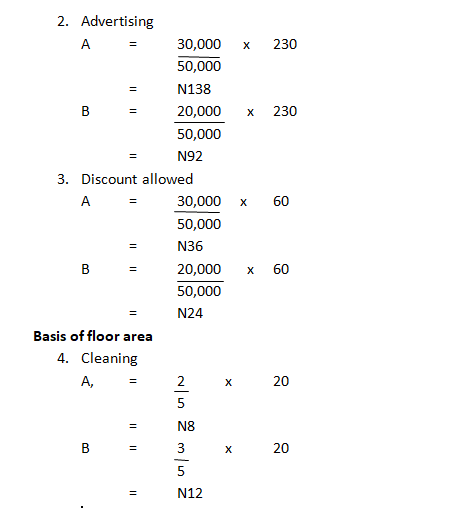

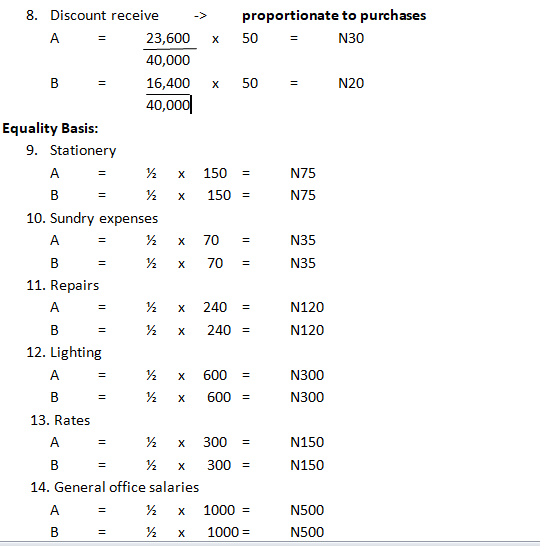

METHODS OF APPORTIONMENT OF EXPENSES

Some of the methods of apportioning expenses among departments are:

- Turnover basis

- Floor space basis

- Number of articles sold basis

- Direct analysis basis

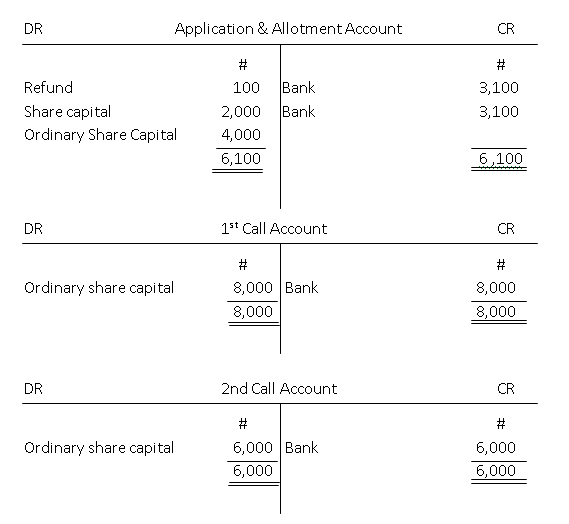

ASSIGNMENT

Essential Financial Accounting; Revision Question 38.1

AUGUST, 6TH 2020

Good day students and welcome to online Financial Accounting revision class.

Revision Questions

1(a) Explain five events that may lead to the dissolution of a partnership.

(b) State how the proceeds from dissolution of partnership are applied.

2 (a) state two differences between hardware and software in electronic data processing

(b) Outline Four functions of the Central Processing Unit (CPU) of a computer.

3. Explain the following:

a. Computer error

b. Garbage-in garbage-out

c. Downtime

d. Debugging

e. Computer service bureau or cyber-cafe

4. Bola and Kemi had been in partnership for several years sharing profits and losses in the ratio of capitals. On 31st December, 2016, they decided to dissolve to dissolve their partnership on which date their balance sheet was as follows:

Bola and Kemi

Bola and Kemi Balance sheet as at 31st December, 2016.

| Le | Le | ||

| Capital: | Fixed assets | ||

| Bola | 300,000 | Plant and machinery | 325,000 |

| Kemi | 275,000 | Delivery van | 140,000 |

| Current Account | Fixtures and fittings | 85,000 | |

| Bola | 75,000 | 550,000 | |

| Current liabilities | Current assets | ||

| Trade creditors | 50,000 | Stock 45,000 | |

| Debtors 27,500 | |||

| Cash 22,500 | 95,000 | ||

| Current account | |||

| Kemi | 55,000 | ||

| 700,000 | 700,000 |

Additional information:

- The following were realized from the assets:

Le

Plant and machinery 280,000

Delivery van 112,500

Stock 55,000

Debtors 25,000

- Creditors were paid in full.

- Dissolution expenses totaled Le 25,000

- Fixtures and fittings were taken over by bola for le 50,000

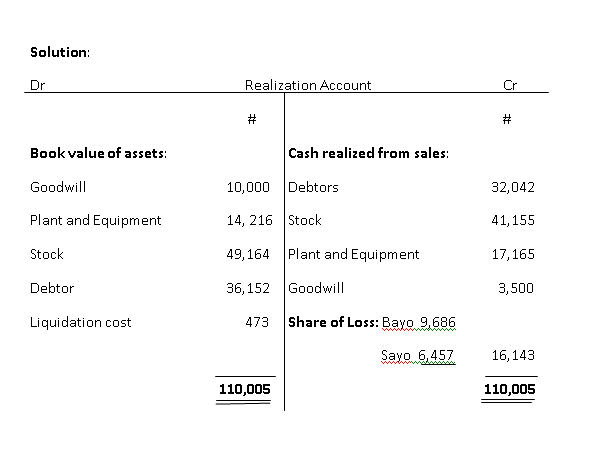

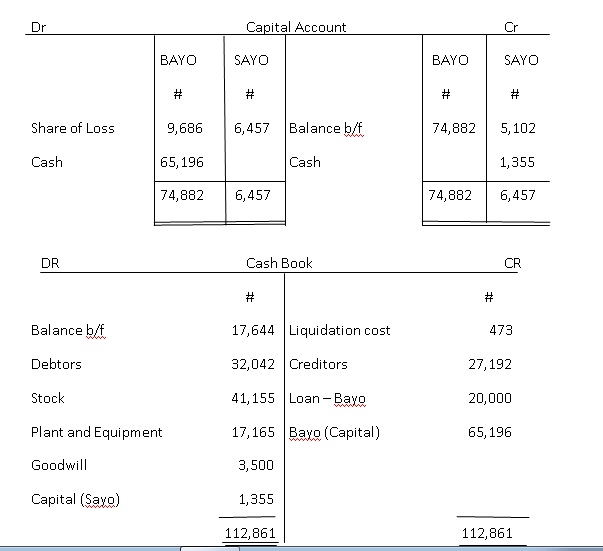

You are required to prepare:

- Realization Account

- Partners’ Capital Account in columnar form

- Cash accounts.

JULY 29TH, 2020

Good day students and welcome to online Financial Accounting revision class.

Revision Questions

The following relates to the books of accounts of David Ltd.

Trading, Profit and Loss Account for the Year Ended 31st December, 2019

| Le | Le | ||

| Opening Stock | 20,000 | Sales | 240,000 |

| Add purchases | 160,000 | ||

| Cost of goods available for sale | 180,000 | ||

| Less closing stock | 36,000 | ||

| Cost of goods sold | 144,000 | ||

| Gross profit | 96,000 | ||

| 240,000 | 240,000 | ||

| Wages and salaries | 73,200 | Gross Profit b/d | 96,000 |

| Office expenses | 14,800 | ||

| Net Profit | 8,000 | ||

| 96,000 | 96,000 |

Balance Sheet as at 31st December, 2109

| Le | Le | Le | Le | ||

| Share capital | Fixed Asset at cost | 125,000 | |||

| Ordinary shares | 100,000 | Less Depreciation | 25,000 | ||

| Preference shares | 10,000 | 100,000 | |||

| General reserves | 24,000 | Current Assets | |||

| Profit and Loss Account | 8,000 | 32,000 | Stock | 36,000 | |

| 142,000 | Debtors | 39,000 | |||

| Current Liabilities | Cash at bank | 7,000 | 82,000 | ||

| Trade creditors | 28,000 | ||||

| Accruals | 12,000 | 40,000 | |||

| 182,000 | 182,000 |

You are required to calculate the following:

(a) Gross profit percentage;

(b) Net profit percentage;

(c) Return on capital employed;

(d) Current ratio;

(e) Acid test ratio;

(f) Rate of stock turnover;

(g) Working capital;

(h) Shareholders fund;

(i) Liquid assets.

- (a) List four main groups of accounting ratios.

(b) Outline three uses of accounting ratios.

(c) State four limitations in the use of accounting ratios.

JULY 23RD, 2020

LESSON 10

You are welcome to this week class. Hope you are following the lesson. If you are, please, do your assignment and always submit.

INTRODUCTION OF ACCOUNTING RATIO

Ratio can be defined as the relationship that exists between two figures. Accounting ratio is used in the interpretation of financial statements and they provide means by which various items in the final account are compared to other items. It will be considered under the following headings:

1. Liquidity Ratios

2. Leverage or Capital Structure Ratios

3. Activity Ratios

4. Profitability Ratios.

Uses of accounting ratios are summarized below:

1. Accounting ratios may be very useful for forecasting likely events in the future since past ratios indicate trends in costs, sales, profit and other relevant facts.

2. Ideal ratios can be established and the relationships between primary ratios may be used to establish the desirable co-ordination or balance. Normally, this is linked with the Budgetary Control.

3. Control may be materially assisted by the use of ratios and can be made effective.

4. “Communication” is the process used to impart knowledge within the business or to outside shareholders or other interested parties. Accounting ratios can play vital role in informing what has happened from one period to another.

5. Accounting ratios may be used as measures of efficiency. In fact, accounting ratios aid uniformity and, therefore, can made comparisons much more valid.

6. Ratio analysis helps investment decisions. An investor is interested in both solvency and profitability of a firm. The investor can take his investment decision studying both solvency as well as profitability ratios.

INTERPRETATION OF ACCOUNTS USING ACCOUNTING RATIOS

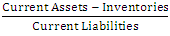

1. Liquidity Ratios (They are also know as Balance Sheet Ratios):

The very object of liquidity ratio is to measure the firm’s short-term solvency. It measures the firm’s capability to pay off its current liabilities. A firm must have sufficient current assets so that it can liquidate current liabilities as and when required.

The following are the liquidity ratios which are determined from the figures of the Balance Sheet:

(i) Current Assets consist of:

a. Cash in hand;

b. Cash at Bank;

c. Sundry Debtors or Book Debts;

d. Bills Receivable;

e. Inventories;

(i) Raw Materials

(ii) Work-in-progress

(iii) Finished goods

f. Prepaid expenses.

(ii) Current Liabilities include the following:

a. Sundry creditors

b. Bills payable

c. Outstanding liabilities

d. Provision for taxation

e. Proposed Dividend.

Current assets are those which are expected to be converted into cash or are realisable within the next financial year in the usual course of business activities.

Current liabilities are those financial obligations of the firm that are payable in the next financial year.

2. Leverage Ratios (they are also known as Balance Sheet Ratios):

The object of leverage ratios is to measure the long-term solvency of the firm.

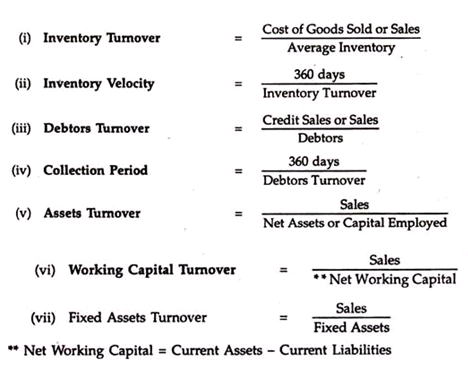

3. Activity Ratios: These Ratios indicate how the Resources of the Firm have been used for Earning Profits:

4. Profitability Ratios:

Now, we propose to discuss the nature of each ratio their interpretation.

Liquid Ratios:

1. Current Ratio = *Current Assets/*Net Liabilities

a. Current Assets include cash, bank, and other assets that can be converted into cash within a year, such a marketable securities, debtors and inventories. Prepaid expenses are also treated as current assets as they have to be paid in the near future.

b. Current liabilities include all financial obligations that have to be made within a year, such as trade creditors, bills payable, short-term loans, outstanding expenses, income-tax liability and long-term debts maturing in the current year.

Interpretation:

Current ratio measures the firm’s ability to meet short-term obligations. It indicates the availability of current assets in rupees to meet the current liabilities.

The higher the ratio, the greater the margin of safety. In fact, the main weakness of this ratio is that it does not reckon the quality of assets but the quantity of assets, which is not rational. Therefore, too much of reliance on current ratio should not be placed in measuring firm’s short- term solvency.

Conventionally, a current ratio of 2: 1 is ideal ratio but in practice there is no logic to follow this ratio. Firm with less than 2 to 1 ratios may do well. The current ratio fails to measure the quality of assets. For example, if the firm’s currents assets consist of slow paying debtors or slow moving stock or obsolete stock, then the firm’s ability to pay its current obligations will be impaired.

Nonetheless, the current ratio is a crude-and-quick measure of the firm’s liquidity.

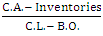

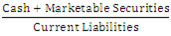

2. Acid Test Ratio or Quick Ratio =

In the opinion of some authors =

Interpretation:

Acid Text Ratio establishes a relationship between quick or liquid assets and current liabilities. Liquid assets refer to those assets, which can be converted into cash quickly and easily without a loss in value. In that sense, cash and bank balances are more liquid than the other assets.

Other current assets that are reckoned relatively liquid are book debts, bills receivable and marketable securities. For this purpose inventories normally cannot be or may not be converted into cash immediately.

Normally, one is to one ratio is considered as an ideal quick ratio. It does mean liquid assets = current liabilities. It is a more penetrating test of liquidity than the current ratio but is to be used cautiously. Practically speaking, in some cases inventories may be more liquid than book debts in case of some firms.

Nevertheless, the quick ratio is an important index of measuring firm’s liquidity.

3. Cash Ratio =

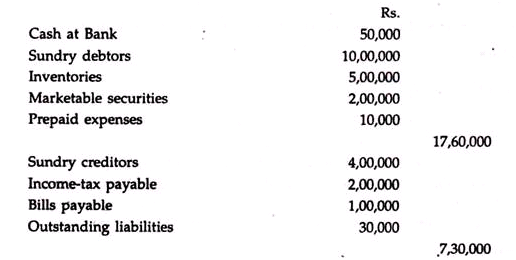

Problem1:

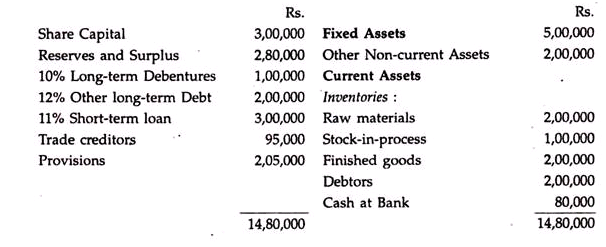

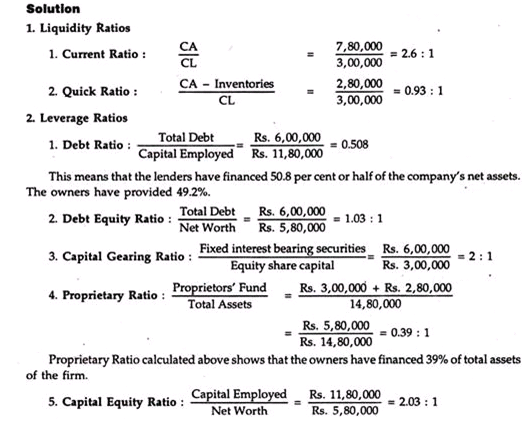

The Balance Sheet of Y Ltd. shows the following current assets and liabilities as on 31.3.2003:

From the above data you are required to find out the liquid ratios.

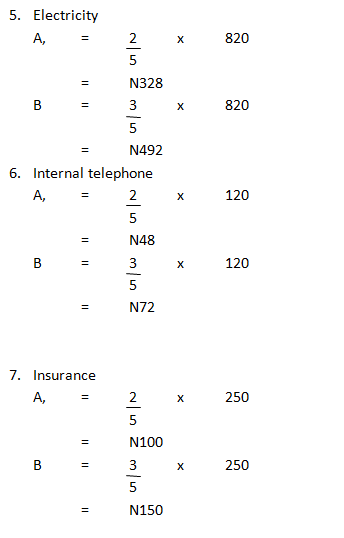

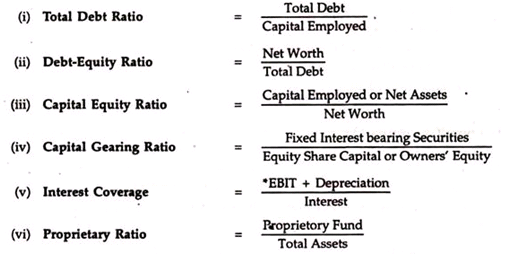

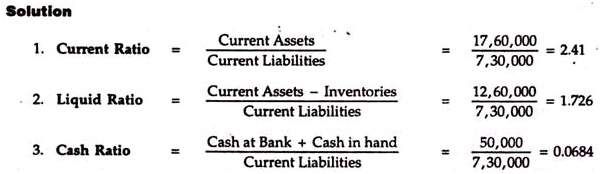

Leverage Ratios:

There are two types of leverage ratios. They are structural ratios and coverage ratios. Structural ratios are based on the proportions of debt and equity in the capital structure of the firm, whereas coverage ratios are derived from the relationship between debt servicing commitments and sources of funds for meeting theses obligation.

Interpretations:

(i) Total Debt Ratio or Debt Equity Ratio:

The above ratio is an important tool of financial analysis to appraise the financial structure of a firm. It has important implications from the view point of creditors, owners and the firm itself.

The high Debt Equity Ratio indicates a danger signal for creditors because in case of failure of business, the creditors will lose heavily.

This ratio indicates the relationship or role of outsiders in financing the business of the firm.

In case of low debt-equity ratio, creditors claim a high stake and implies sufficient safety margin against shrinkage in assets.

On the other hand, the servicing of debt becomes less burdensome for the company. It is evident that both high and low debt-equity ratios are not desirable. It can be rationally said that other’s money should be in reasonable proportion to the owner’s capital and the owners should have sufficient stake in the fortunes of the firm.

Capital structure ratios establish the relationship between the Creditors’ Fund and Owners’ Capital. Therefore, to judge the long-term financial position of the firm, financial leverage or capital structure ratios are calculated.

Problem 2:

Following is the Balance Sheet of X Ltd. as on 31.3.2003:

You are required to calculate Liquidity and Capital Structure ratios.

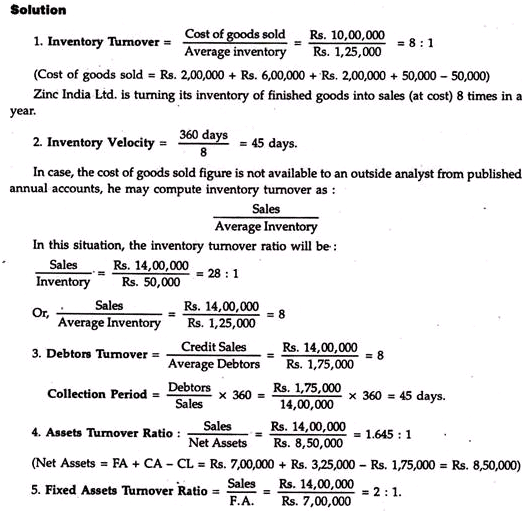

3. Activity Ratios:

The activity ratios are applied to evaluate the efficiency of management in utilizing the assets to generate sales and profits. These ratios are also known as turnover ratios because they indicate the speed with which assets are being turned-over or converted into sales. In this sense, activity ratios involve a relationship between sales and assets. These ratios are derived from both income statements and Balance Sheet.

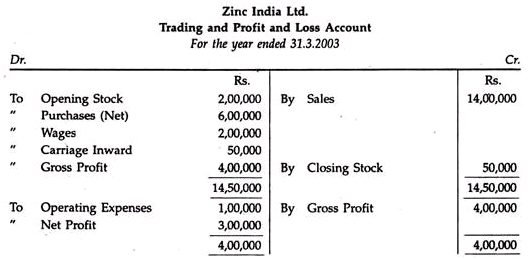

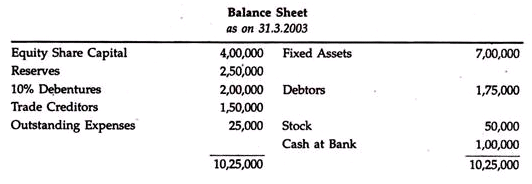

Problem 3:

You are required to show the activity ratios of X Ltd. and comment on them.

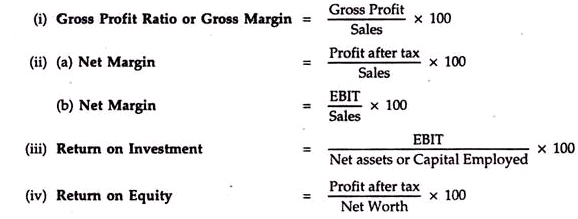

4. Profitability Ratios:

A company should earn sufficient profits for its survival and growth. It is an established fact that “sufficient profit must be earned by a business unit and sustain the operations of the business, to be able to obtain funds from investors for expansion and growth and to contribute towards the social overheads for the welfare of the society”.

The profitability ratios are calculated to measure the operating efficiency of the company. Moreover, management, creditors and owners are equally interested in the profitability of the firm.

Creditors like to receive interest and repayment of principal regularly. Shareholders want to get a reasonable return on their investments and management wants to satisfy all interested parties thereby to create goodwill for the organisation. All these are possible when the company earns substantial profits.

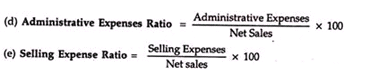

There are generally two types of profitability ratios:

1. Profitability in relation to sales.

2. Profitability in relation to investment.

1. Profitability in relation to Sales:

(a) Gross Profit Margin:

Gross Profit/Sales x 100

The gross profit margin reflects the efficiency with which the management produces each unit of product. It measures also the efficiency of both purchase and sales departments. The efficiency of these two departments reduces the cost of goods sold and thereby increases the efficiency of competitiveness in competitive and global markets.

Obviously, a high gross profit margin is a sign of good management.

A gross profit margin ratio may be higher due to any of the following factors:

(i) Higher sale price, cost of goods sold remaining constant;

(ii) Lower cost of goods sold, sales prices remaining constant;

(iii) A combination of variations in sales prices and costs; and

(iv) An increase in the proportionate volume of higher margin items.

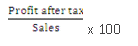

(b) Net Profit Margin =

The net profit margin establishes relationship between net profit and sales and points out management’s efficiency in manufacturing, administration and selling its products.

The high net profit margin enables a company to survive in a situation of adverse economic conditions. A firm with high net profit margin can make better use of favourable market and economic conditions such as rising sales prices, falling cost of production or increasing demand for the product. Such a firm has the ability to accelerate its profits at a faster rate.

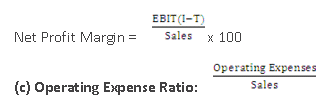

Net profit margin for evaluating operating performance may be computed in the following manner:

(i) Operating Expenses = Cost of goods sold + office and administrative expenses + selling expenses. Interest is not considered.

This ratio is a yardstick of operating efficiency. A higher operating expense ratio is unfavourable since it will leave a small amount of operating income to meet interest and dividends.

Interpretation:

The operating expense ratio is used for measuring the operating efficiency. It is advisable to use this ratio very cautiously since it is affected by a number of factors, such as external uncontrollable factors, internal factors.

Taxes are not controllable by a firm, and also one may not know the marginal corporate tax rate while analysing the published data, it is more appropriate to use the following measures of ROI for comparing the operating efficiency of firm.

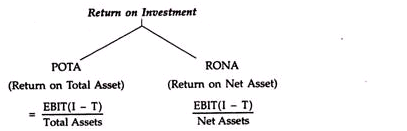

2. Profitability in relation to investment:

Since taxes are not controllable by management and since opportunities for availing tax incentives differ from firm to firm, it is more prudent to use before tax measure of Return on Investment. The term investment may refer to total assets or net assets. Net assets mean capital employed.

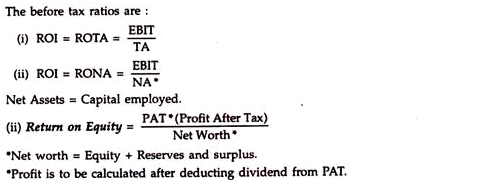

(iii) Earning per Share (EPS):

The earning per share is calculated by dividing the profit after taxes by the total number of Equity shares. Therefore, EPS is equal to

EPS calculations made over the years indicate the trend of profitability of the firm. This trend can easily guide the investors in taking investment decisions. But, it fails to reflect how much is paid as dividend and how much is retained in the business.

(iv) Dividend per Share (DPS):

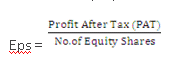

The net profits after taxes belong to shareholders. But the income which they actually receive is the amount of earnings distributed as cash dividend (including interim dividend, if any).

This ratio indicates investor’s judgement or expectations about the firm’s performance. Management is also interested in this market appraisal of the firm’s performance and will like to identity the causes of weak performance if the P/E ratio declines.

ASSIGNMENT:

Essential Financial Accounting, Revision Question 37.2

JULY 16TH, 2020

LESSON 9

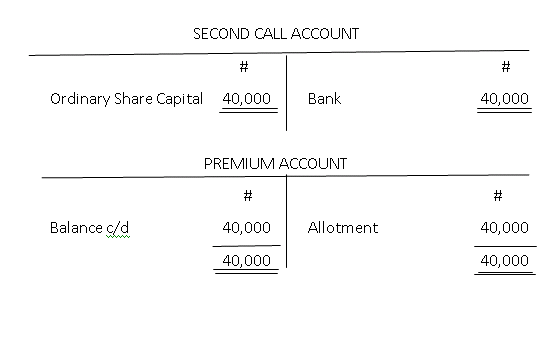

ISSUES OF SHARES (PART I)

You are welcome to this week on-line class. How are you? I hope you are following the lessons.

WHAT IS SHARES?

Shares can be defined as the units of capital or ownership of a limited liability company. It is the division of the company’s ownership into numerous equal parts, i.e. the interest which the shareholder has in the company.

CLASSES OF SHARES

- ORDINARY SHARES: These are the shares that are entitled to the totality of the profit after all other shareholders have been settled. They are the risk bearers and not entitled to a fixed rate of interest. They are often known as equalities. Ordinary shares can be divided into two: a. Preferred Ordinary Shares: They are entitled to a fixed rate of dividend after payment of dividend to preference shareholders. b. Deferred Ordinary Shares: They share dividend after preferred ordinary shareholders have been paid.

- PREFERENCE SHARES: They are those that have preference over other shares. The preference shares have a fixed rate of dividend before any other class of shares. Preference shares can be: a. Cumulative preference shares: This is a preference share whose annual fixed-rate dividend, if it cannot be paid in any year, accrues until it can. b. Non-cumulative preference shares: This refers to a type of preference shares that does not pay the holder any unpaid or omitted dividends. c. Participating preference shares: Participating preference shares are those shares which are entitled in addition to preference dividend at a fixed rate, to participate in the balance of profits with equity shareholders after they get a fixed rate of dividend on their shares. d. Non-participating preference shares: is one in which a dividend is paid, usually at a fixed rate, and not determined by a company’s earnings. Holders of this type of share do not participate in the distribution of profits to equity investors. e. Redeemable preference shares: Redeemable Preferences shares are type of preference shares issued to shareholders who have a callable option embedded, meaning they can be redeemed later by the company. f. Irredeemable preference shares: These shares cannot be redeemed during the life of the company. They do not have a maturity date.

ISSUES OF SHARES

Share can be issued on the following terms:

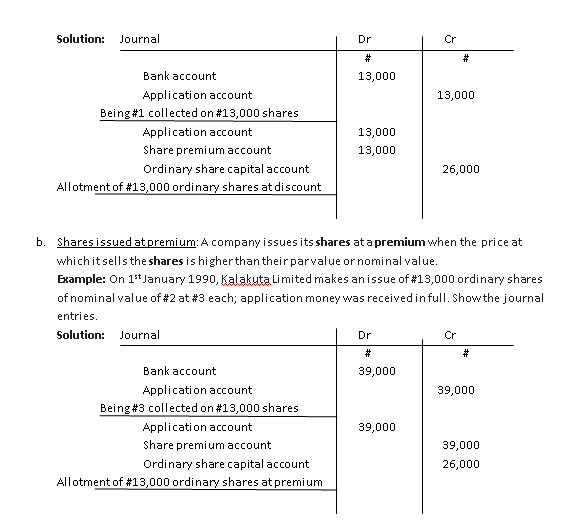

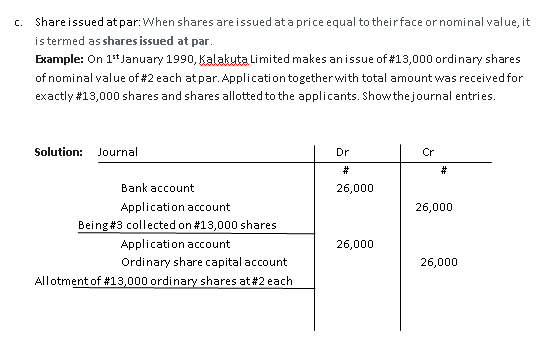

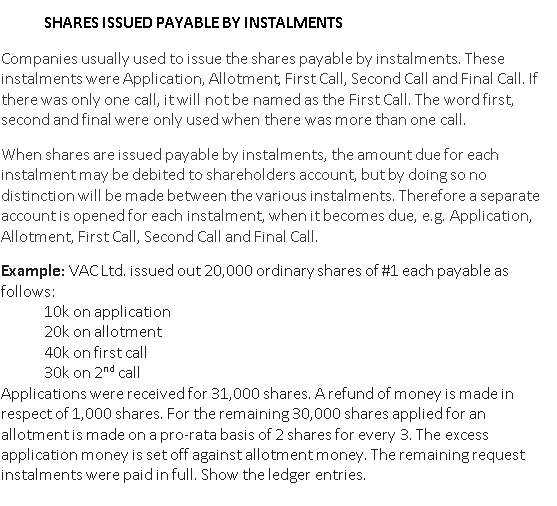

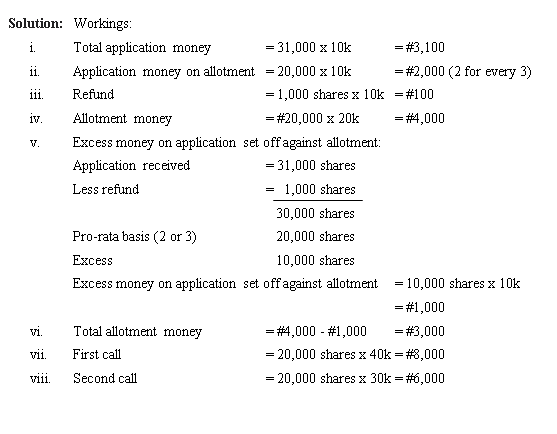

- Shares issued at discount: When Shares are issued at a price lower than their face value or nominal value, they are said to have been issued at a discount.

Example: On 1st January 1990, Kalakuta Limited makes an issue of #13,000 ordinary shares of nominal value of #2 at #1 each; application money was received in full. Show the journal entries.

9/7/2020

Good day students. You are welcome to today’s online Financial Accounting revision class. Today, we shall be revising Joint Venture Account and correction of errors.

JOINT VENTURE ACCOUNT

A joint venture is simply undertaken jointly by two or more persons with a view to gaining a profit.

Venture may seem to be exactly the same as partnership but it is limited to a particular transaction and partners maintain account of his joint venture with his partner(s).

Similarities between Joint Venture and Partnership Business.

- Both involve two or more people coming together.

- Both share profits and losses equally except if otherwise stated.

- Both are with the aim of making profit.

- They both have all the rights and duties of a partner.

DIFFERENCES BETWEEN JOINT VENTURE AND PARTNERSHIP BUSINESS

i. Joint venture is for a specific venture, while in partnership there is perpetual existence.

ii.In partnership, all the partners maintain one account while in joint venture, every individual maintains account of his joint venture with his partners.

iii. In joint venture, the partners maintain the individual business, while in partnership, the individual business becomes one.

iv. Partnership is formed with the aim of making long term profit, while joint venture is only for immediate profit.

v. In partnership, there is limitation to membership, while in joint there is no limitation to membership.

vi. The participant in joint venture is known as co-venture, while the participant in partnership is known as partners.

vii. Joint venture is temporary in nature, while partnership is going concern.

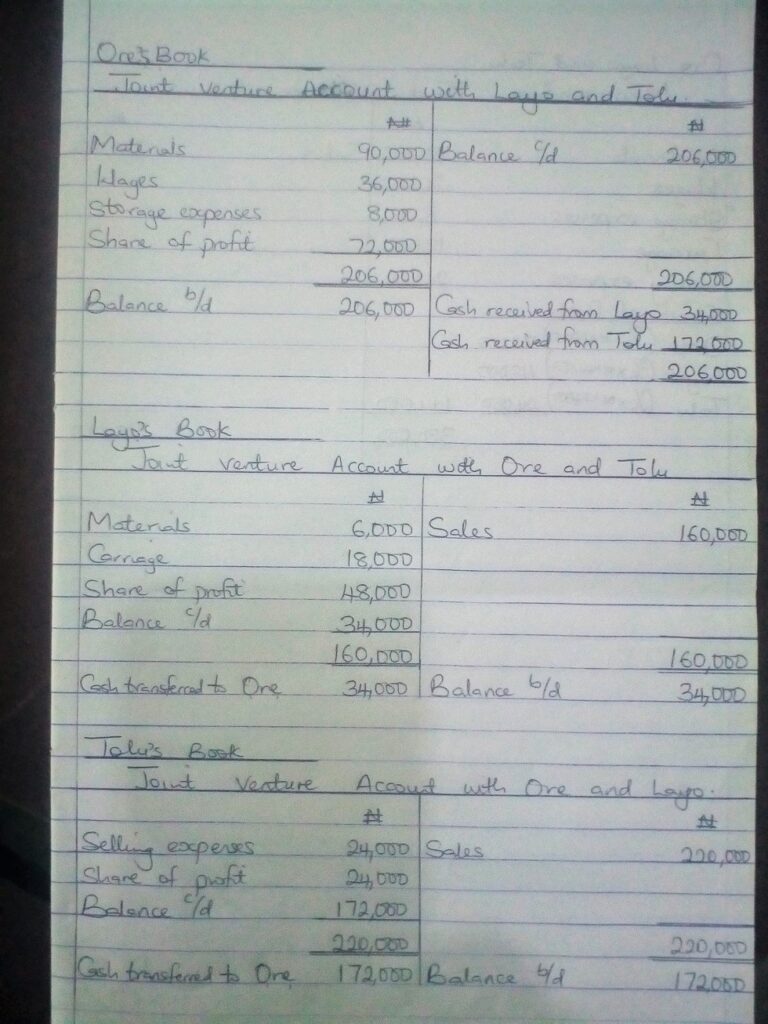

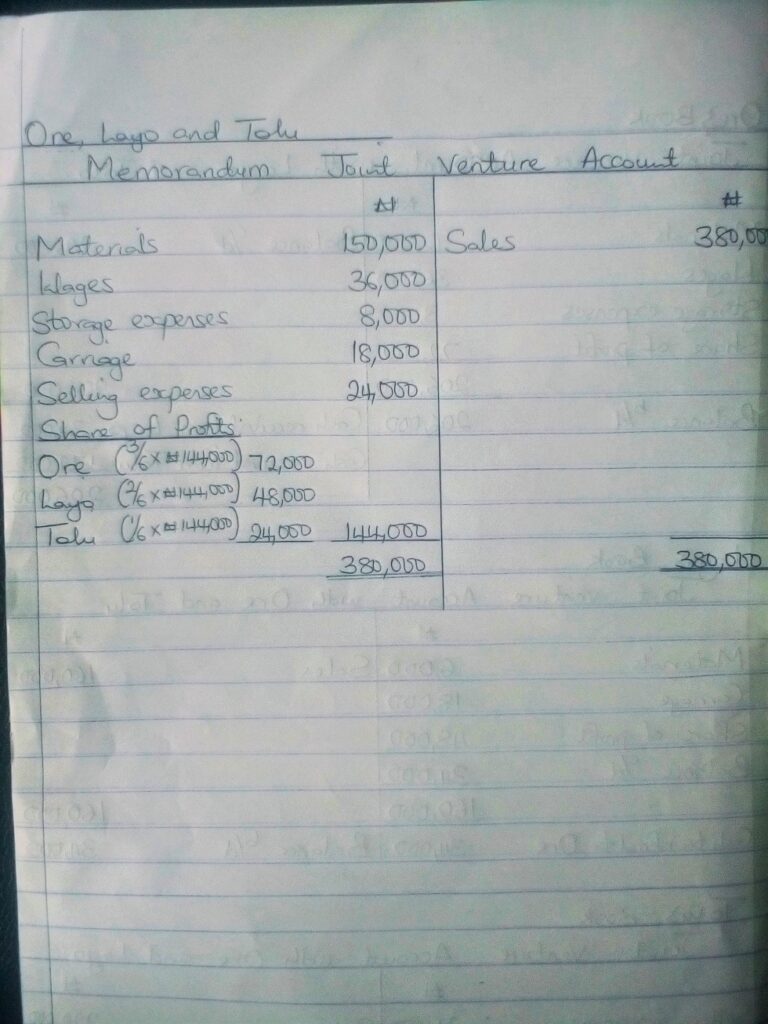

Illustration 1

Ore, Layo and Tolu entered into a joint venture, Ore and Layo are both to supply some of the materials, while only Tolu and Layo will sell the finished goods. Profits are to be shared: ore, 3; Lay0 2; Tolu 1. Details of the transactions are as follows:

Ore supplied materials costing ₦90,000

Layo supplied material costing ₦60,000

Ore paid wages ₦36,000

Layo paid for carriage ₦18,000

Ore paid for storage expenses ₦8,000

Tolu paid selling expenses ₦24,000

Layo received cash from sales ₦16,000

Tolu received cash from sales ₦220,000

You are required to prepare:

- Joint venture account in the books of each of the venturers

- Memorandum Joint Venture account

SOLUTION:

NOTE: At the close of the joint venture or end of the year, the joint venture account of each venture is combined together in a memorandum joint venture account in which the profit or loss on the joint venture account is ascertained. This account does not form part of the double entry records in any set of books being prepared purely for the purpose of ascertaining the profit or loss. When all these entries have been, the balances remaining on the various joint venture account show the indebtedness (money) owing of one venture to another. If there are only two venturers, cash will be paid by one venture to the other and the joint venture comes to a close. Any partner that has balance carried down (bal c/d) at the end debit (dr) side of his joint venture account will have to transfer to the other partner’s joint venture account. It means that is the money owing i.e. indebtedness to her partners.

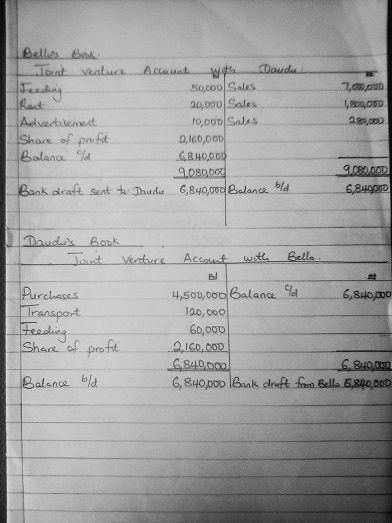

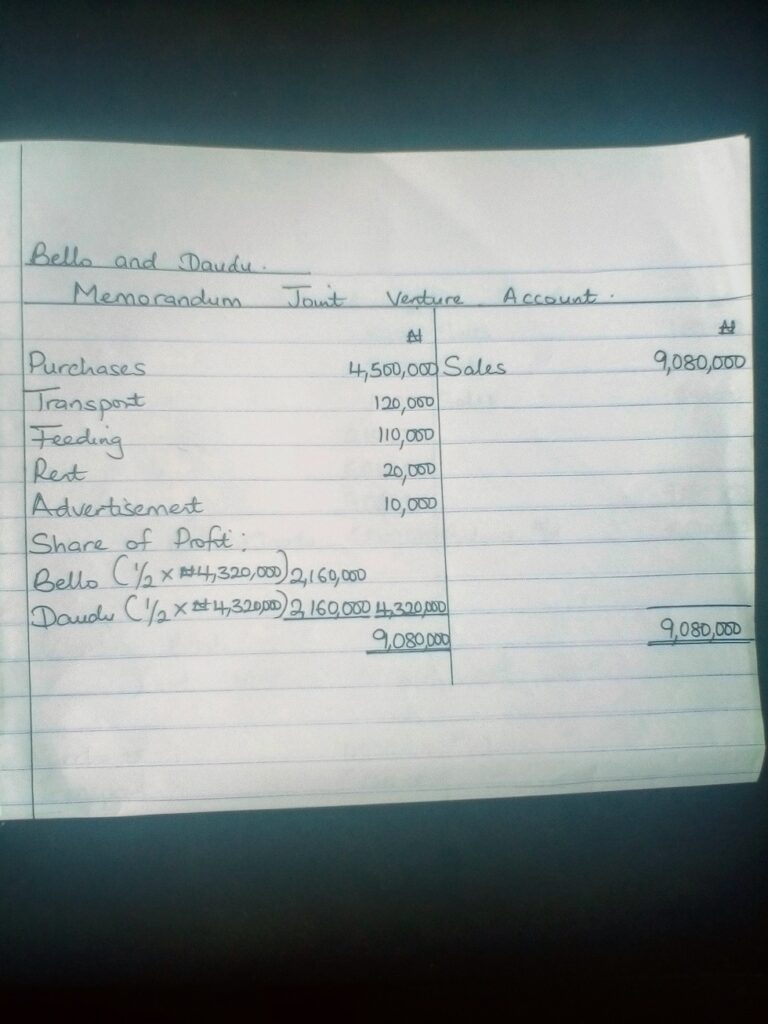

ILLUSTRATION 2

Bello and Daudu entered into a joint venture as cow dealers. Profits and losses are to be shared equally. Daudu purchased 30 cows at ₦ 150,000 each. He spent ₦120,000 to transport them to Bello. He paid ₦60,000 for feeding and other expenses. On receipt of the cows, Bello incurred the following expenses.

₦

Feeding 50,000

Rent 20,000

Advertisement 10,000

Bello sold 20 cows of the cows for ₦350,000 each; 6 for ₦300,000 each; and 2 for ₦250,000 each. He took the remaining (2) two that could not be sold at ₦140,000 each. At the end of the venture, Bello settled Daudu by sending a bank draft to him.

Required:

Prepare the Joint Venture Accounts in the books of both parties and the Memorandum Joint Venture Account.

SOLUTION:

ASSIGNMENT

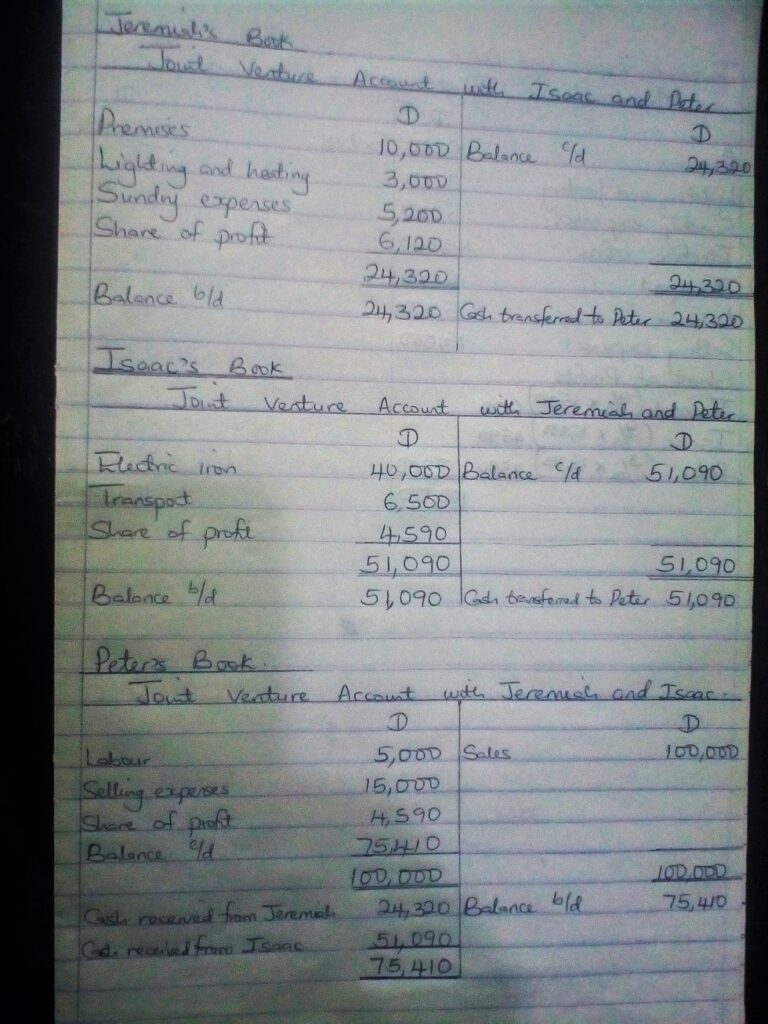

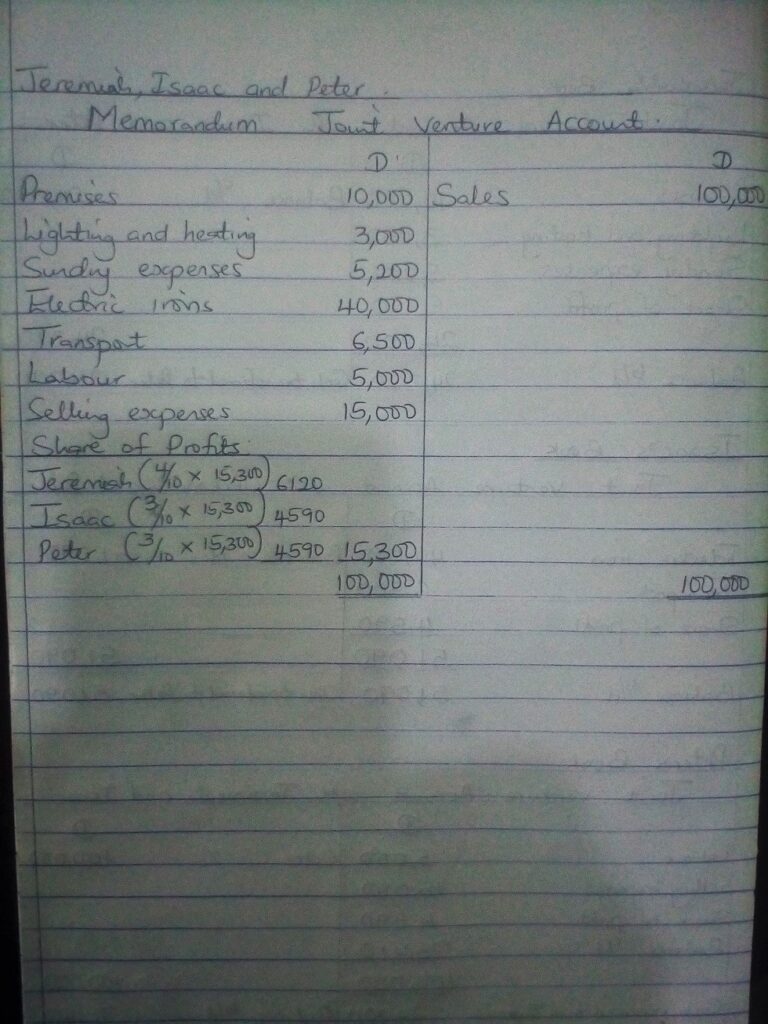

Jeremiah., Isaac and Peter entered into a joint venture for dealing in second-hand electronic materials. Profits and losses were to be shared among Jeremiah, Isaac and Peter in the ratio of 4:3:3.

The following transactions took place in the month of November, 2017.

November 1: Jeremiah rented premises for D10,000

November 3: Isaac supplied electric irons D40,000

November 7: Peter engaged labour for off-loading irons D5,000

November 9: Isaac paid for transport D6,500

November 12: Jeremiah paid for lighting and heating of the business premises D3,000

November 15: Jeremiah paid for further sundry expenses D5,200

November 25: Isaac paid for selling expenses D15,000

November 30: Isaac received cash from the sales of electric irons D100,000

You are required to prepare:

- Joint venture in the books of each of the venturers

- Memorandum joint venture account.

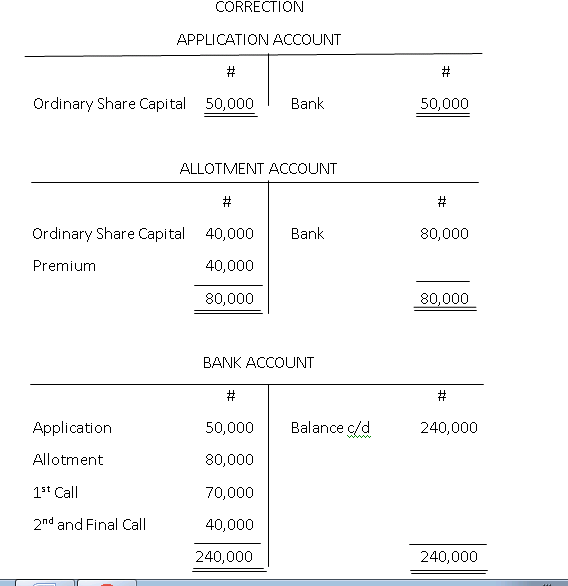

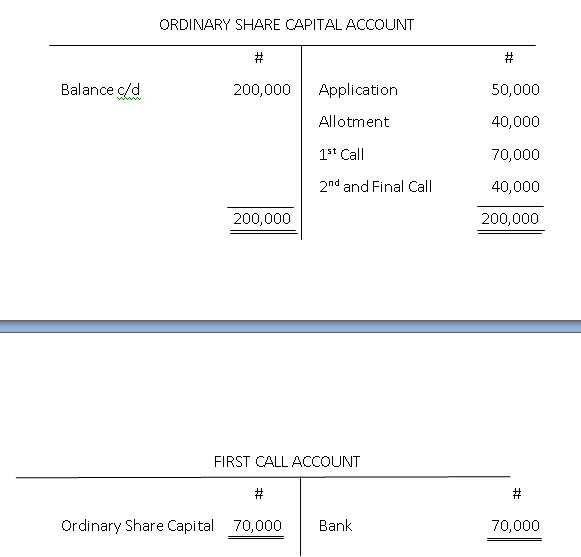

CORRECTION TO ASSIGNMENT GIVEN ON 9/07/2020

LESSON TWO

CORRECTION OF ERRORS

Errors can be defined as mistakes made in the preparation of accounts. The main purpose of the trial balance is to show the arithmetical accuracy of the entries in the ledgers. The two sides (debit and credit sides must be equal. If the debit side is not equal with the credit side, then there is an indication of error. Errors can be grouped into two, namely

Errors that affect the agreement of a trial balance

(1) Errors that do not affect the agreement or totals of the trial balance.

(2) Errors that do not Affect the Agreement of the Trial Balance

(1) Error of Omission: This error occurs when transactions are completely omitted from the debit and credit sides of the books of accounts. Since there is omission on both the debit and credit sides, the trial balance will still balance. E.g. Payment of rent ₦2,000 to Ayo has been omitted from the books of account.

(2) Error of Commission: This occurs when correct amount is entered in a wrong person’s account e.g. Sales of goods to Ola was entered in Olu’s account.

(3) Error of Original Entry: This error occurs when a wrong amount is entered on the debit and credit sides. The original amount is transposed and passed through the double entry system. For example, purchase of goods ₦4,900 from Tayo entered in the accounts as₦9,400.

(4) Error of Principle: This is an error whereby transactions are entered in a wrong class of accounts, e.g. payment of₦60,000 for motor van entered in motor expenses.

(5) Compensating Errors: This occurs when errors of the same amount are posted to the two sides of the ledgers, therefore, they cancelled out each other. The two sides may be overcast or undercast by the same amount e.g. Sales account is undercast so also is salaries account.

(6) Complete Reversal of Entry: This error occurs when the double entry for a transaction is reversed, resulting in a situation whereby the account that ought to be debited is credited and the account that ought to be credited is debited. E.g. a receipt of cash from Biodun ₦20,000 has been entered on the credit side of cash account and debit side of Biodun account.

(7) Error of Duplication: This error occurs when the same transaction is recorded more than once in the books of account e.g. payment of cash ₦3,000 to Olu had been entered twice in the two accounts.

PROCEDURES TO BE FOLLOWED WHEN CORRECTING ERRORS

In order to correct errors, the following procedures must be followed:

(i) Assets account Dr balance

Income account Cr balance

Expenses account Dr balance

Sales account Cr balance

Purchases account Dr balance

Liabilities account Cr balance

(ii) Identification of the types of errors

(iii)Identification of the two accounts involved.

(iv) Interpretation of errors in the ledger

(v) Preparation of Journal

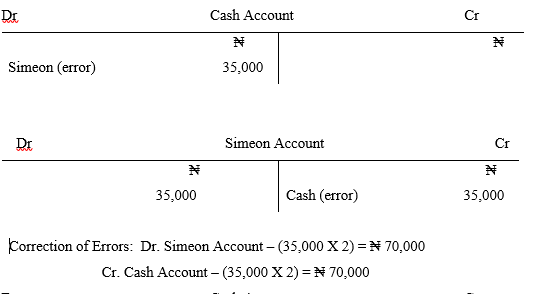

ILLUSTRATION I:

(a) Cash paid to Simeon ₦35,000 was entered on the credit side of his account and debited to cash account.

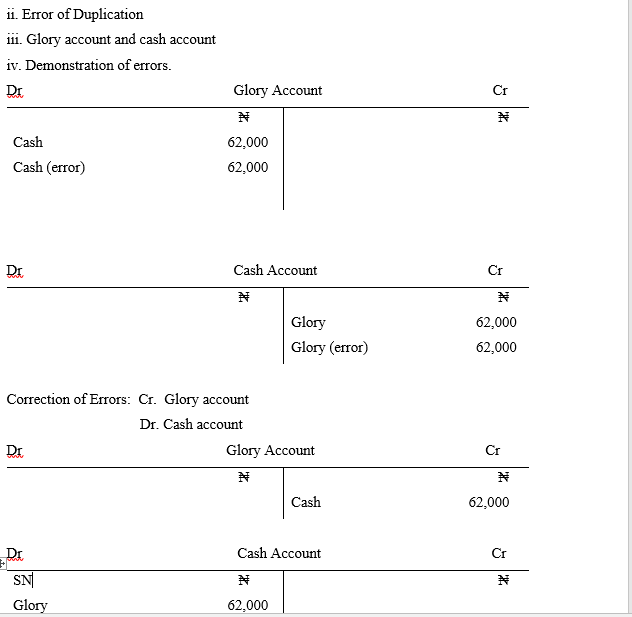

(b) Payment of cash ₦62,000 to Glory has been entered in the two accounts.

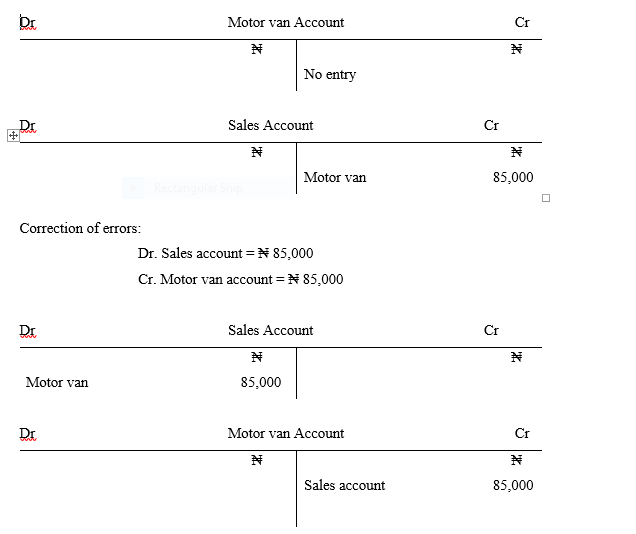

(c) Sales of motor van ₦85,000 had been entered in the sales account.

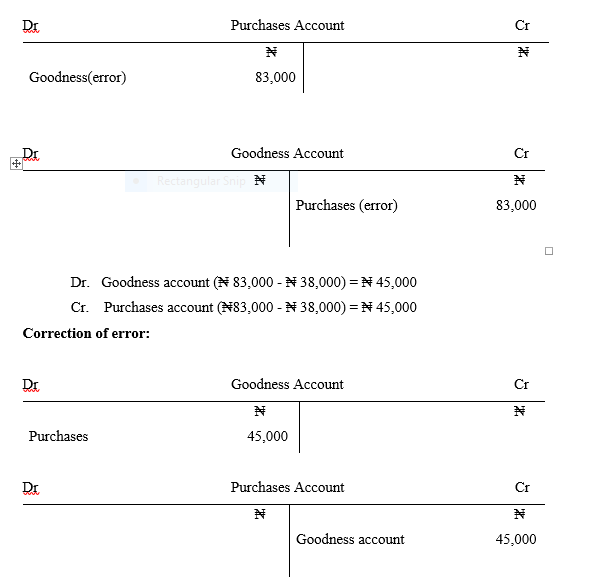

(d) Purchases of goods from Goodness ₦38,000 has been entered in the account as ₦83,000.

(e) Sales were overcast by ₦36,000 so also were motor expenses

(f) Purchase of goods from Gideon ₦95,500 was completely omitted from the account.

(g) Goods of ₦90,000 returned by Adeola has been entered in Adeolu’s account.

SOLUTION:

The question above will be used for our illustration and the procedures will be followed:

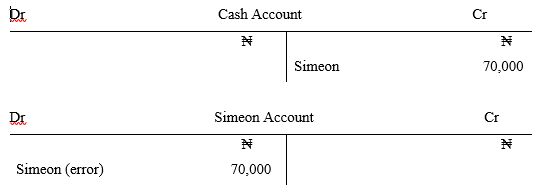

(a) ii. Complete Reversal of Entry.

iii. Cash account and Simeon account

iv. Interpretation of errors in the ledgers

(c) ii. Error of Principle

iii. motor van account and sales account

iv. Interpretation of error in the ledger

d. ii. Original Entry

iii. Purchases account and Goodness account

iv. Interpretation of error in the ledgers.

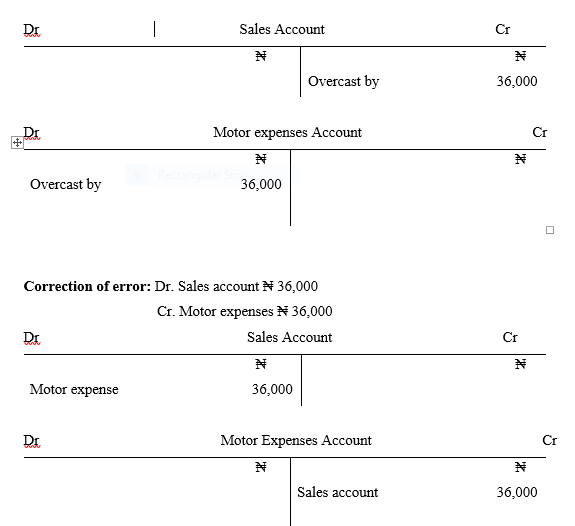

e. ii. Compensating error

iii. Sales account and Motor expenses account

iv. Interpretation of error in the ledgers.

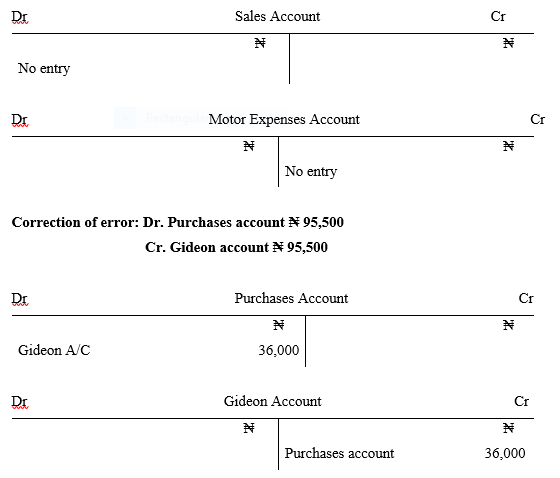

f. ii. Error of Omission

iii. Purchases account and Gideon account

iv. Interpretation of error in the ledgers.

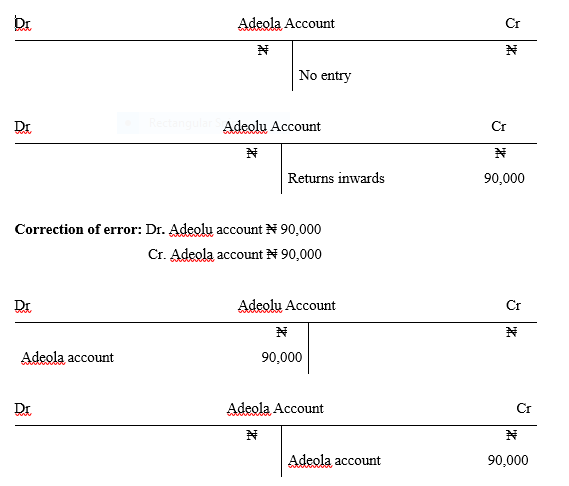

g. ii. Error of Commission

iii. Adeola account and Adeolu account

iv. Interpretation of error in the ledgers.

JOURNAL

| Dr | Cr | ||

| ₦ | ₦ | ||

| a. | Simeon account | 70,000 | |

| Cash account | 70,000 | ||

| Payment of cash to Simeon mistakenly reversed now corrected. | |||

| b. | Glory account | 62,000 | |

| Cash account | 62,000 | ||

| Recording of a transaction twice in the accounts now corrected | |||

| c. | Sales account | 85,000 | |

| Motor van account | 85,000 | ||

| Sales of motor van entered in sales account now corrected | |||

| d. | Goodness account | 45,000 | |

| Purchases account | 45,000 | ||

| Correction of error of wrong amount | |||

| e. | Sales account | 36,000 | |

| Motor expenses account | 36,000 | ||

| Correction of overcast of sales and motor expenses | |||

| f. | Purchases account | 95,500 | |

| Gideon account | 95,500 | ||

| Purchases of goods from Gideon omitted now corrected | |||

| g. | Adeola account | 90,000 | |

| Adeolu account | 90,000 | ||

| Goods returned by Adeola mistakenly entered in Adeolu account now corrected |

ILLUSTRATION 2

The following errors were discovered from the book of Jessy:

(a) Discount allowed of 30,000 was entered in error on the debit side of discount received.

(b) Sales of ₦ 331,000 to Elijah has been entered in the books, both credit and debit as ₦313,000.

(c) Cash paid to Toyin ₦5,500 was entered on the credit side of her account and debited to cash account

(d) Sales account is undercast by ₦38,000 so also is salaries account.

(e) Rent receivable of ₦100,000 had been entered in the sales account.

(f) Purchases of goods on credit from Sanjo ₦80,000 has been entered in error in the fittings account.

SOLUTION:

JOURNAL

| Dr | Cr | ||

| ₦ | ₦ | ||

| (a) | Discount allowed account | 30,000 | |

| Discount received account | 30,000 | ||

| Correction of errors on the debit side now entered on the credit side of discount received | |||

| (b) | Sales account | 18,000 | |

| Elijah account | 18,000 | ||

| Correction of undercast of sales and Elijah | |||

| (c) | Toyin account | 11,000 | |

| Cash account | 11,000 | ||

| Payment of cash to Toyin mistakenly reversed now corrected. | |||

| (d) | Salaries account | 38,000 | |

| Sales account | 38,000 | ||

| Correction of undercast of salaries and sales account | |||

| (e) | Sales account | 100,000 | |

| Rent receivable account | 100,000 | ||

| Rent receivable entered in sales account now corrected | |||

| (f) | Purchases account | 80,000 | |

| Fittings account | 80,000 | ||

| Purchases of goods from Sanjo entered in fittings account now corrected |

ASSIGNMENT

The following errors were discovered from the books of Goodness:

- Returns inwards from Dennis ₦8,000 was entered in Daniel account.

- Cash payment for rent ₦75,000 was omitted from the books

- The sales account was overcast by ₦10,500 and the purchases account was also overcast by ₦10,500.

- A machine was purchased for ₦8,000 and debited to the purchases account.

- A receipt of cash from Joy ₦56,000 has been entered on the credit side of the cash book and the debit side of Odeyemi account.

CORRECTION TO ASSIGNMENT GIVEN ON 9/07/2020

GOODNESS

JOURNAL

| Dr | Cr | ||

| D | D | ||

| a. | Daniel account | 8,000 | |

| Dennis account | 8,000 | ||

| Goods returned by Dennis mistakenly entered in Daniel’s account now corrected. | |||

| b. | Rent account | 7,500 | |

| Cash account | 7,500 | ||

| Cash payment for rent accounts omitted now corrected. | |||

| c. | Sales account | 10,500 | |

| Purchases account | 10,500 | ||

| Correction of overcast of sales and purchases account. | |||

| d. | Machine account | 8,000 | |

| Purchases account | 8,000 | ||

| Correction of purchased of machine entered in purchases account. | |||

| e. | Cash account | 56,000 | |

| Joy account | 56,000 | ||

| A receipt of cash from Joy mistakenly reversed now corrected. |

LESSON 7

JULY 2ND, 2020

DISSOLUTION OF PARTNERSHIP

You are welcome to this week on-line class. How are you? I hope you are following the lesson.

This week, we will be looking at another topic.

MEANING

Dissolution of partnership is when a partnership business is automatically dissolved or brought to an end by the happenings of any event which makes it unlawful to carry on the business.

REASONS FOR DISSOLUTION

- Bankruptcy of a partner

- Death of one of the partner

- Expiration of the fixed agreement time

- A joint decision to discontinue withdrawal or retirement of a partner

- Withdrawal or retirement of a partner.

Sample question:

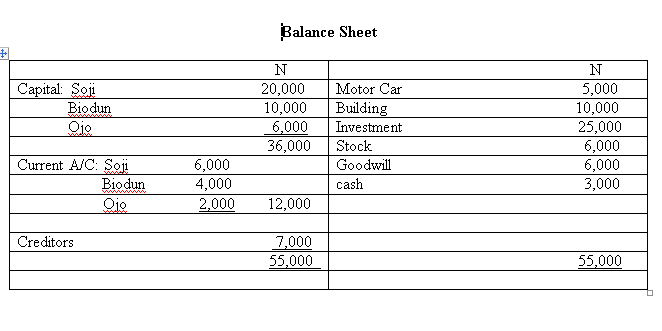

Soji, Biodun and Ojo are into retail business sharing profit or loss equally. They agreed to dissolve the business. The balance sheet as at 31st December, 1997 is as follows;

The partners agreed that the partnership should be dissolved based on the following terms

- One motor car to be taken over by Soji at a value of N3,000 and the other to be taken over by Ojo at N4000

- The investment were all sold for N7000

- The building realized N20,000, stock N3,000

- The creditors were settled in full

- Goodwill was realized at N3,000

- Cost of dissolution N1000 was paid

You are required to prepare:

- Realization account

- Partners capital account

- Cash account

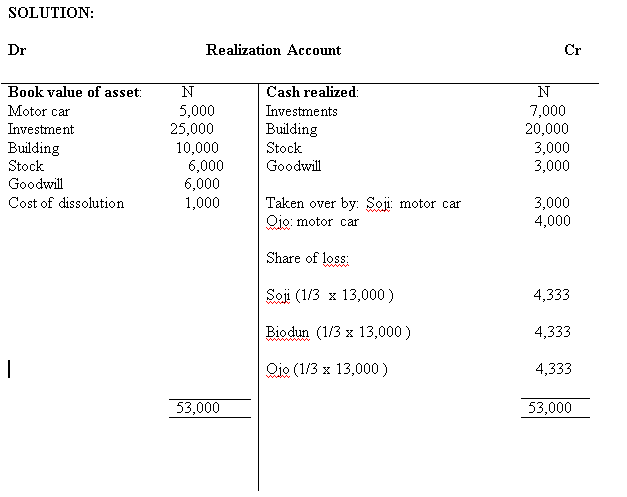

SOLUTION:

ASSIGNMENT

Essential Financial Account, Exercise 28.1

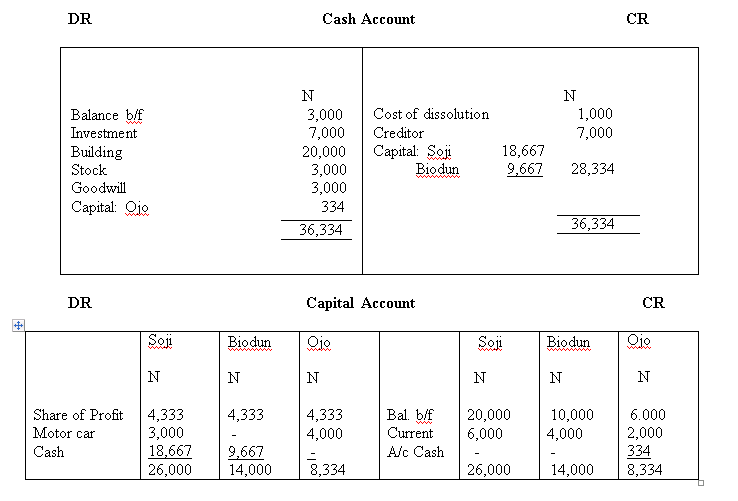

Correction to Lesson 7 Assignment

Essential Financial Account, Exercise 28.1

Good day students. You are warmly welcome to today’s online class. Make sure you copy your notes into your Financial Accounting notebooks.

Please ensure that you submit your assignment on or before Monday, June 29, 2020.

Also, always check for the correction to the previous assignment below the NINJA FORMS before the next online Financial Accounting class. This morning, we shall be revising adjustments in the final account and revaluation account.

ADJUSTMENTS IN THE FINAL ACCOUNT.

- PREPAYMENT: This can be categorized into prepaid income and prepaid expenses.

- Prepaid income: This is when revenue is collected in advance. Prepaid income is deducted from incomes shown on the trial balance to obtain income earned. It is treated as a liability in the balance sheet.

- Prepaid Expenses: This is the prepayment for services in account which have not been enjoyed. It is otherwise known as advance payment. It is a benefit paid for, but not used up at the end of the period. It is deducted from the expenses in the profit and loss account so that the actual profit or loss can be ascertained. It is treated as a current asset in the balance sheet.

- ACCRUALS: These are classified into accrued income and accrued expenses.

- Accrued Income: This is the revenue due, but cash has not yet been received as at the trial the balance date. Accrued income is added to income shown on the trial balance to obtain income earned. It is treated as a current asset in the balance sheet.

- Accrued Expenses: These are expenses for benefit received before the cash payment is made. It is otherwise known as outstanding expenses or arrears. It is expenses due, but not yet paid as at the trial balance date. It is added to the expenses in the profit and loss account so that the actual profit or loss can be ascertained. It is treated as a current liability in the balance sheet.

- Discounts Allowed: These are reductions given by a business to his customers. They are debited in the profit and loss account.

- Discounts Received: They are reductions by a business from suppliers. Discounts received are credited in the profit and loss account.

- Provision for Depreciation: This is the provision made for the part of the cost of a fixed tangible or non-current asset consumed during its period of use by an organization.

OR

It is the provision made for the reduction in the economic value of a fixed tangible or non-current asset as a result of wear and tear, usage, effluxion and passage of time. In the final accounts, provision for depreciation is debited to Profit and Loss Account; but in the Balance Sheet it is deducted from the cost of the fixed tangible asset.

10. Drawings by the owner: Traders will often take items from their business for own use without payment. Therefore, goods withdrawn by the owners should be deducted from purchases and added to drawings.

11. Provision for Discounts on Creditors: This is the percentage calculated on the total amount of creditors. In the final accounts, it is credited to Profit and Loss Account; but in the Balance Sheet the amount is deducted from the creditor’s total. It is known as provision for discount receivable

12. Provision for Discount on Debtors: This is the amount set aside out of profit to provide for discounts that are likely to be allowed to debtors who settle their debts within a stipulated period. The percentage is calculated on the total amount of debtors after the deduction of provision for doubtful debts. Provision for discount on debtors is debited to the Profit and Loss Account; but in the Balance Sheet the amount is deducted from the debtor’s balance.

13. Increase in Provision for Doubtful Debts: This occurs when the current year’s provision for doubtful debts is more than the previous year’s provision. In the final accounts, increase in provision for doubtful debts is charged as an expense, hence debited to profit and Loss Account; but in the Balance Sheet, the increase is added to any previous provision and the total subtracted from the debtor’s balance to disclose the estimated realizable value of debtors.

14. Decrease in Provision for Doubtful Debts: This occurs when the current year’s provision for doubtful debt is less than the previous year’s provision. In the final accounts, decrease in provision for doubtful debts should be treated as an income, therefore credited to Profit and Loss Account; but in the balance sheet, it is deducted from the previous provision and the balance subtracted from the debtors total.

15. Bad Debts: Debts which at the trial balance date, is considered to be irrecoverable. Charge the total bad debt as an expense. If the bad debt is given as additional information, it should be deducted from debtor before showing the balance of debtors under current assets. If the bad debt is on the trial balance, there is no need to deduct it from debtors because that has been done already.

16. Provision for Bad Debts: This is an amount set aside out of profit to provide for debts that cannot be recovered. Increase in the provision of bad debts is treated as an expense, hence debited to the Profit and Loss Accounts, while the decrease is treated as an income and credited to the Profit and Loss Account. In the Balance Sheet, it is deducted from debtors to disclose the estimated realizable value of debtors.

REASONS FOR END-OF-YEAR ADJUSTMENTS

(1) To ensure that the incomes of a particular period relate to that year.

(2) To ensure that financial statements are prepared in accordance with accounting concepts and conventions.

(3) To ensure that the double entry principle is applied.

(4) To provide for depreciation of fixed assets.

(5) To ensure proper classification of capital items from revenue items.

(6) To ensure that expenses of a particular period relate to that year.

(7) To take into consideration any stock valuation at the end of the year.

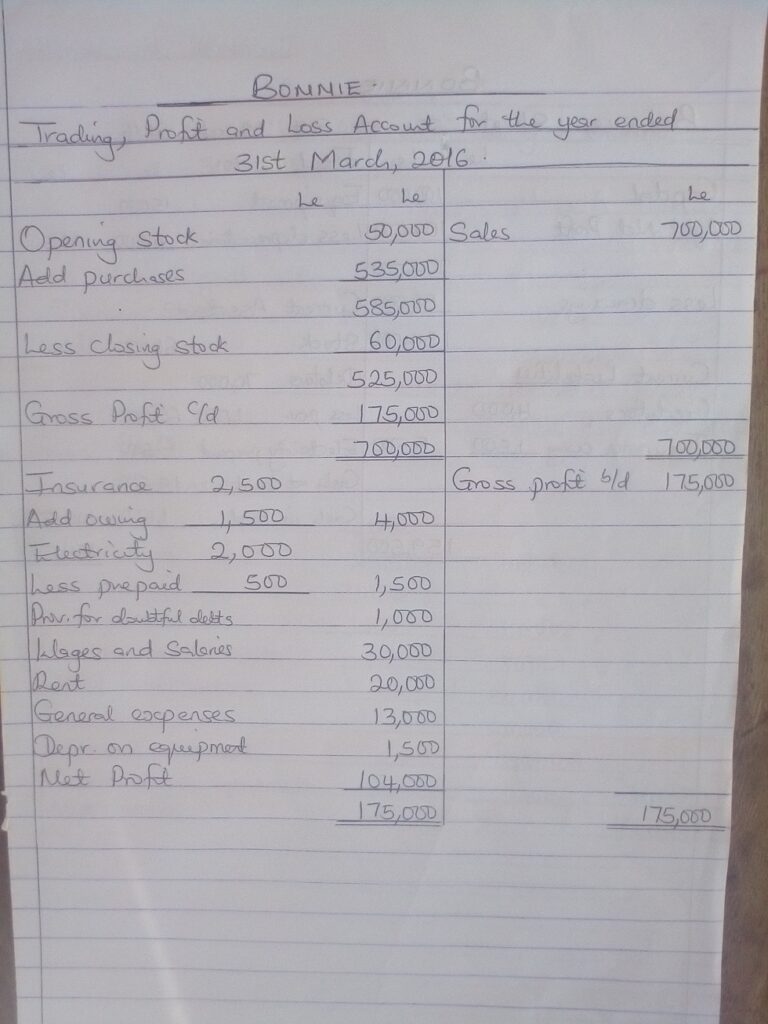

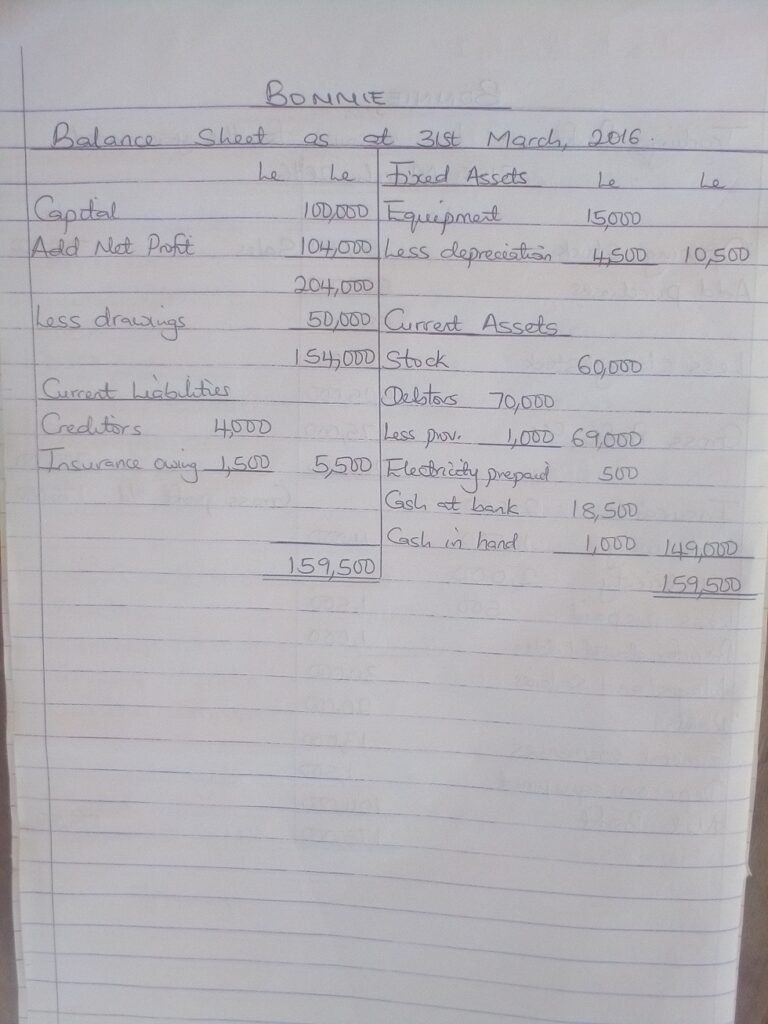

ILLUSTRATION 1:

The following balances were extracted from the books of Bonnie, a retailer as at 31st March, 2016.

| Dr | Cr | |

| Le | Le | |

| Capital | 100,000 | |

| Drawings | 50,000 | |

| Cash in hand | 1,000 | |

| Cash at bank | 18,500 | |

| Debtors and Creditors | 70,000 | 4,000 |

| Insurance | 2,500 | |

| Purchases and Sales | 535,000 | 700,000 |

| Stock: 1st April, 2015 | 50,000 | |

| Electricity | 2,000 | |

| General Expenses | 13,000 | |

| Equipment at cost | 15,000 | |

| Provision for depreciation of Equipment – 1st April, 2015 | 3,000 | |

| Wages and salaries | 30,000 | |

| Rent | 20,000 | |

| 807,000 | 807,000 |

Additional Information:

- Stock on 31st March, 2016 was valued at Le 60,000

- At 31st March, 2015; Le 1,500 was outstanding on insurance; electricity was prepaid by Le 500 and there was am doubtful debt of Le 1,000.

- Depreciation is to be provided on equipment at 10% on cost.

You are required to prepare:

(a) Trading, Profit and Loss Account for the year ended 31st March, 2016

(b) Balance Sheet as at that date.

SOLUTION:

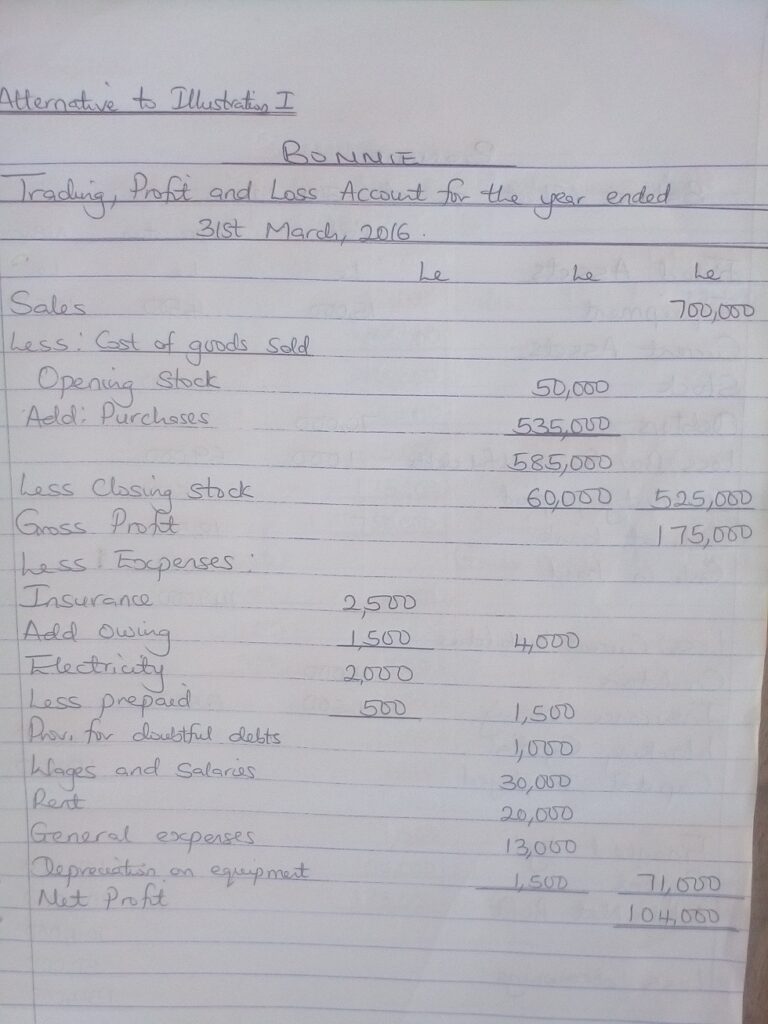

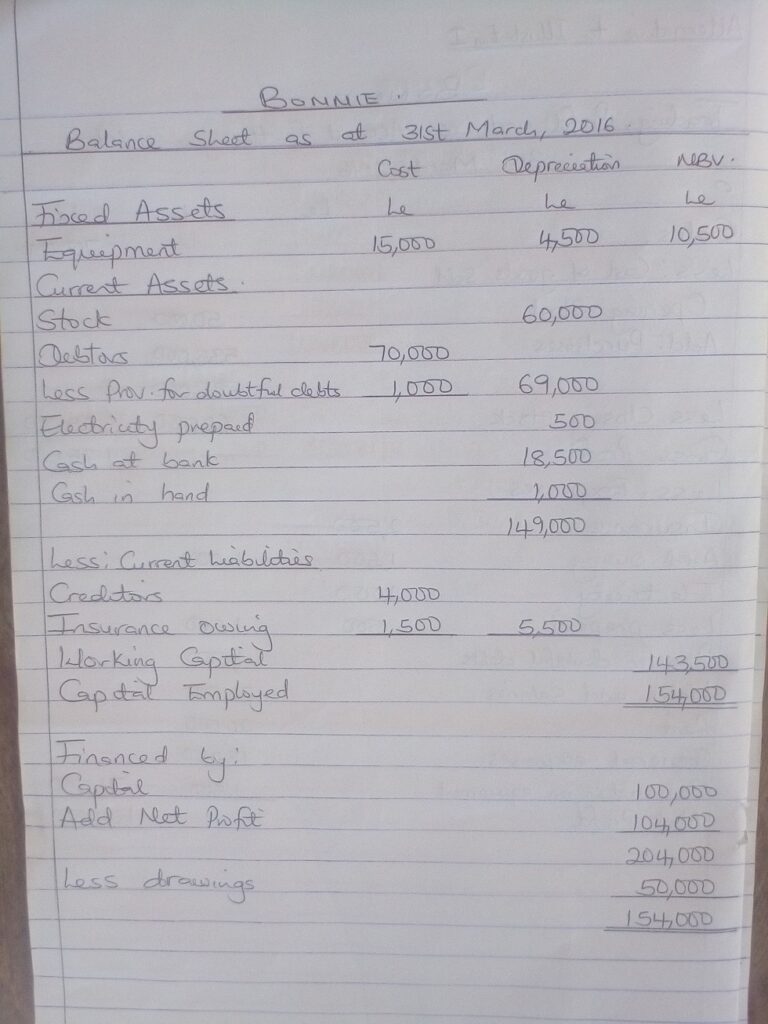

ALTERNATIVE SOLUTION TO ILLUSTRATION I

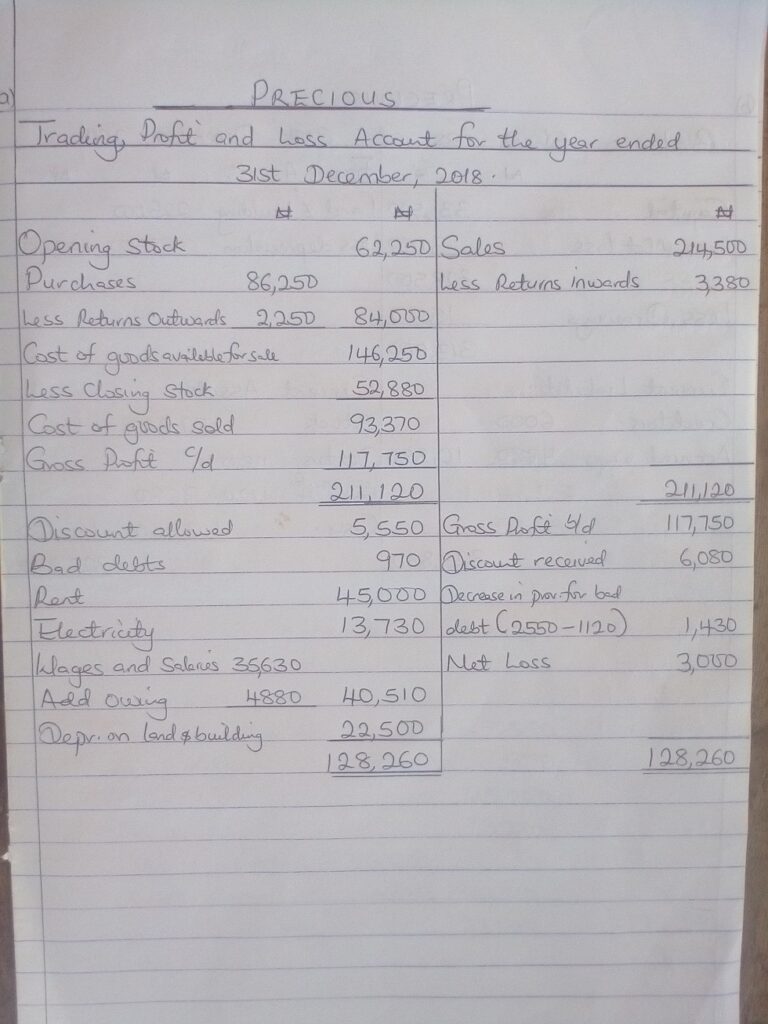

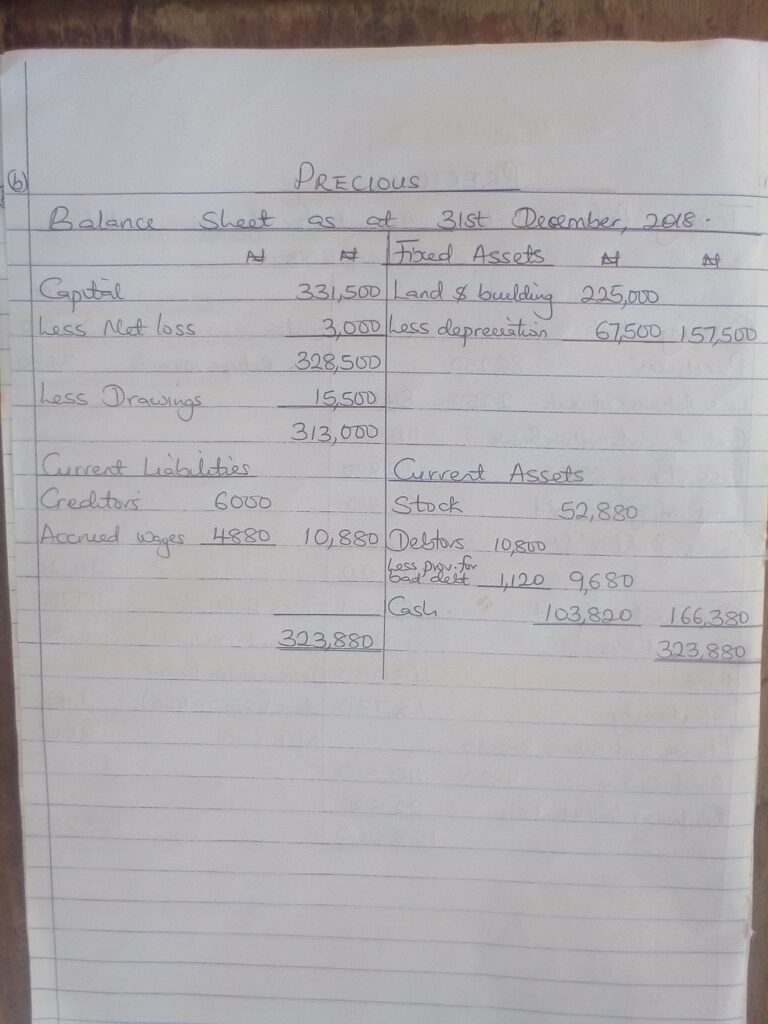

ILLUSTRATION II:

The following is an extract of Precious Trial Balance as at 31st December, 2018.

| ₦ | ₦ | |

| Stock | 62,250 | |

| Purchases | 86,250 | |

| Sales | 214,500 | |

| Returns inwards | 3,380 | |

| Returns outwards | 2,250 | |

| Discount received | 6,080 | |

| Discount allowed | 5,550 | |

| Land and Buildings at cost | 225,000 | |

| Provision for depreciation: Land and Building | 45,000 | |

| Debtors | 10,800 | |

| Bad debts | 970 | |

| Creditors | 6,000 | |

| Provision for bad debts – 1st January,2018 | 2,550 | |

| 45,000 | ||

| Electricity | 13,730 | |

| Wages and salaries | 35,630 | |

| Drawings | 15,500 | |

| Cash at hand | 103,820 | |

| Capital | 331,500 | |

| 607,880 | 607,880 |

Additional information:

- Stock at hand at 31st December, 2017 was ₦52,880

- Wages and salaries owing amounted to ₦4,880

- Provision for bad debts is to be reduced to ₦1,120.

You are required to prepare:

(a) Trading, Profit and Loss Account for the year ended 31st December, 2018

(b) Balance Sheet as at that date.

SOLUTION:

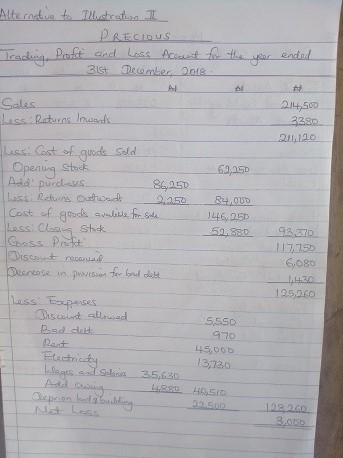

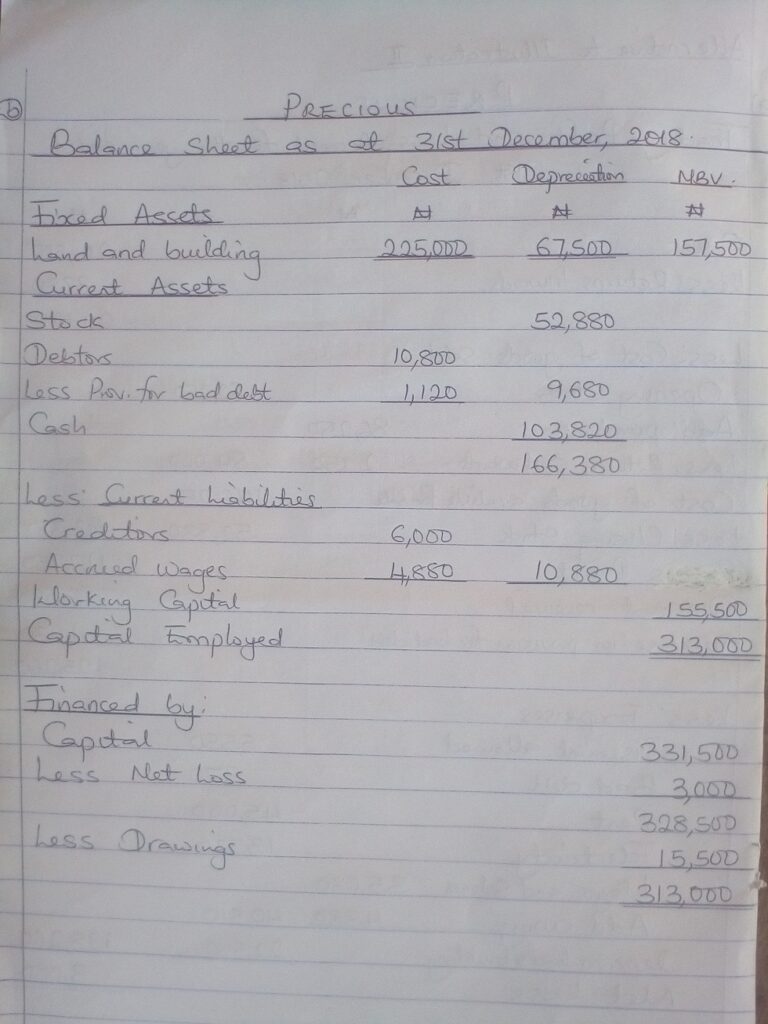

ALTERNATIVE SOLUTION TO ILLUSTRATION II

ASSIGNMENT

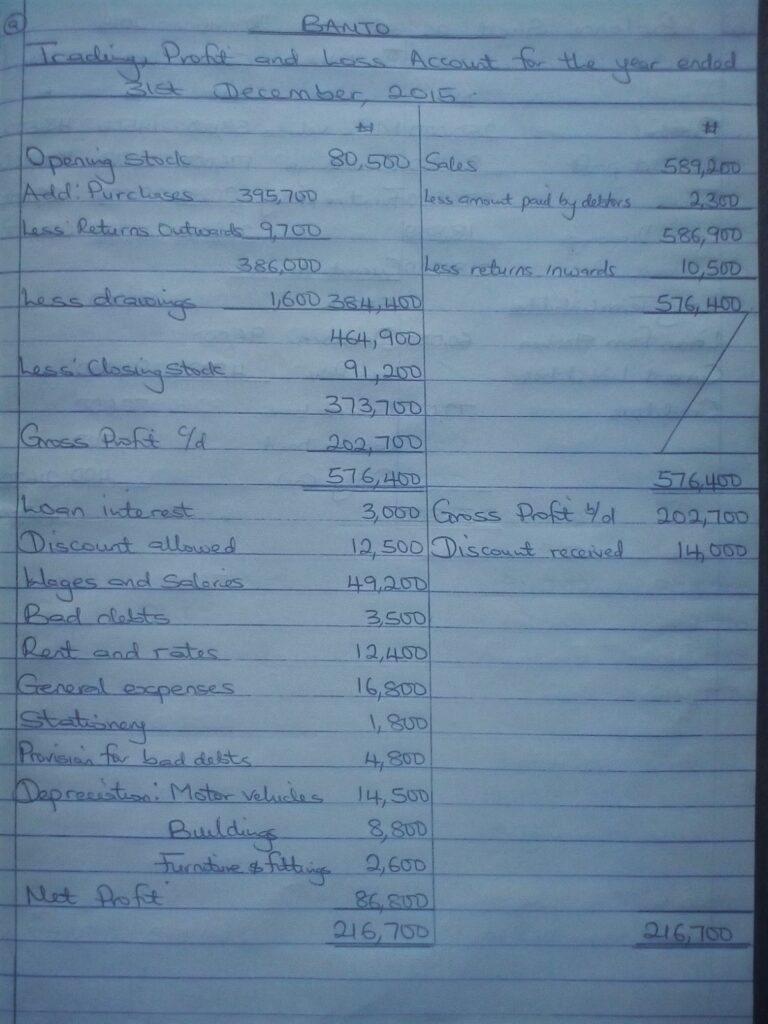

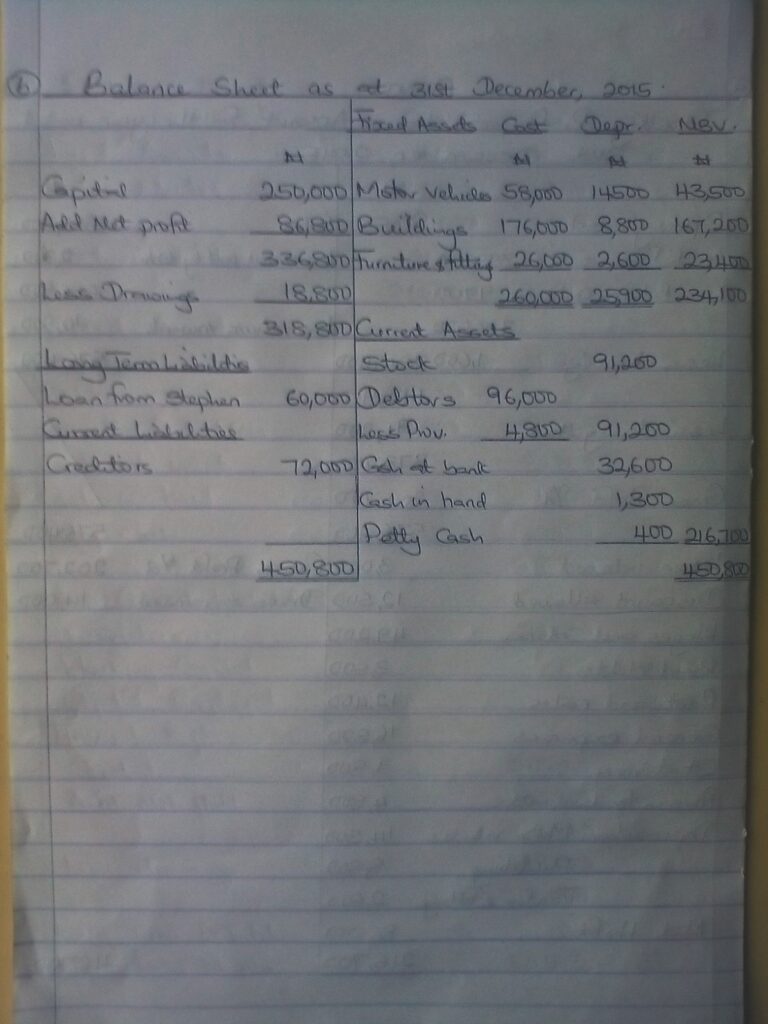

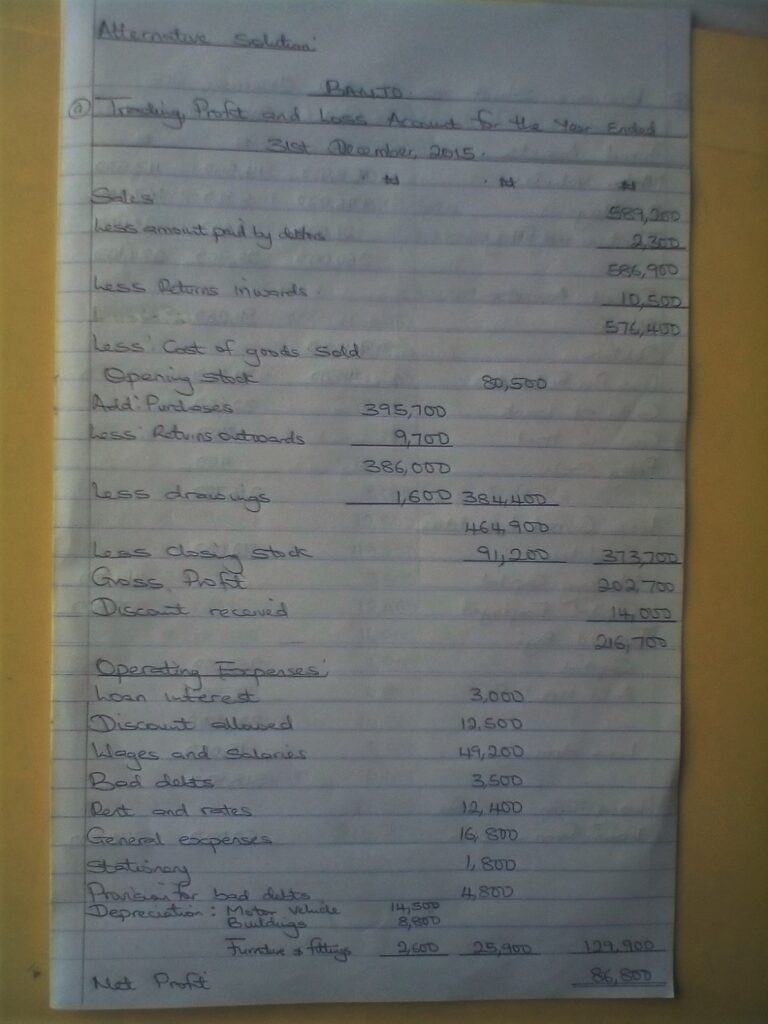

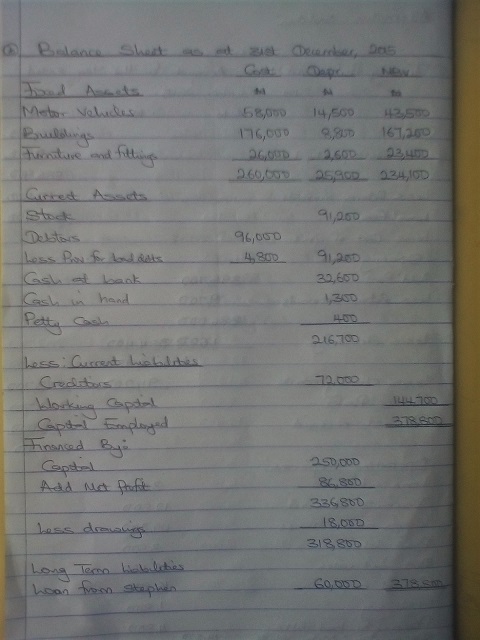

The following trial balance was extracted from the books of Banjo on 31st December, 2015

| ₦ | ₦ | |

| Stock – 1st January, 2015 | 80,500 | |

| Motor vehicles | 58,000 | |

| Buildings | 176,000 | |

| Furniture and fittings | 26,000 | |

| Debtors and Creditors | 98,300 | 72,000 |

| Purchases and Sales | 395,700 | 589,200 |

| Returns | 10,500 | 9,700 |

| Discounts | 12,500 | 14,000 |

| Wages and Salaries | 49,200 | |

| Drawings | 16,400 | |

| Loan from Stephen | 60,000 | |

| Bad debts | 3,500 | |

| Loan interest | 3,000 | |

| General expenses | 16,800 | |

| Stationery | 1,800 | |

| Rent and Rates | 12,400 | |

| Petty cash | 400 | |

| Cash in hand | 1,300 | |

| Cash at bank | 32,600 | |

| Capital | 250,000 | |

| 994,900 | 994,900 |

Additional Information:

- Stock – 31st December, 2015 was ₦91,500.

- Depreciation: Motor Vehicles 25%

Buildings 5%

Furniture and fittings 10%

- Make a 5% provision for doubtful debts

- ₦2,300 paid by a debtor during the year was mistakenly credited to sales account.

- Goods worth ₦1,600 withdrawn by Banjo was not accounted for.

You are required to prepare:

(a) Trading, Profit and Loss Account for the year ended 31st December, 2015

(b) Balance Sheet as at that date.

CORRECTION TO ASSIGNMENT GIVEN ON 25/6/2020

LESSON 2

REVISION ON REVALUATION ACCOUNT.

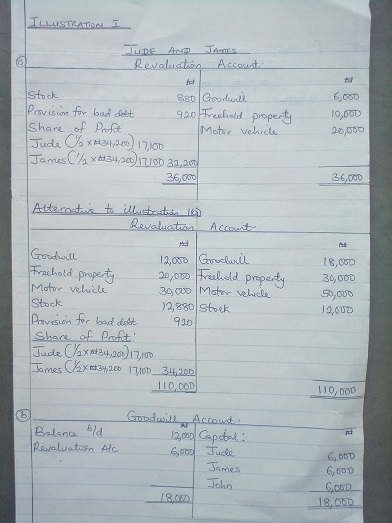

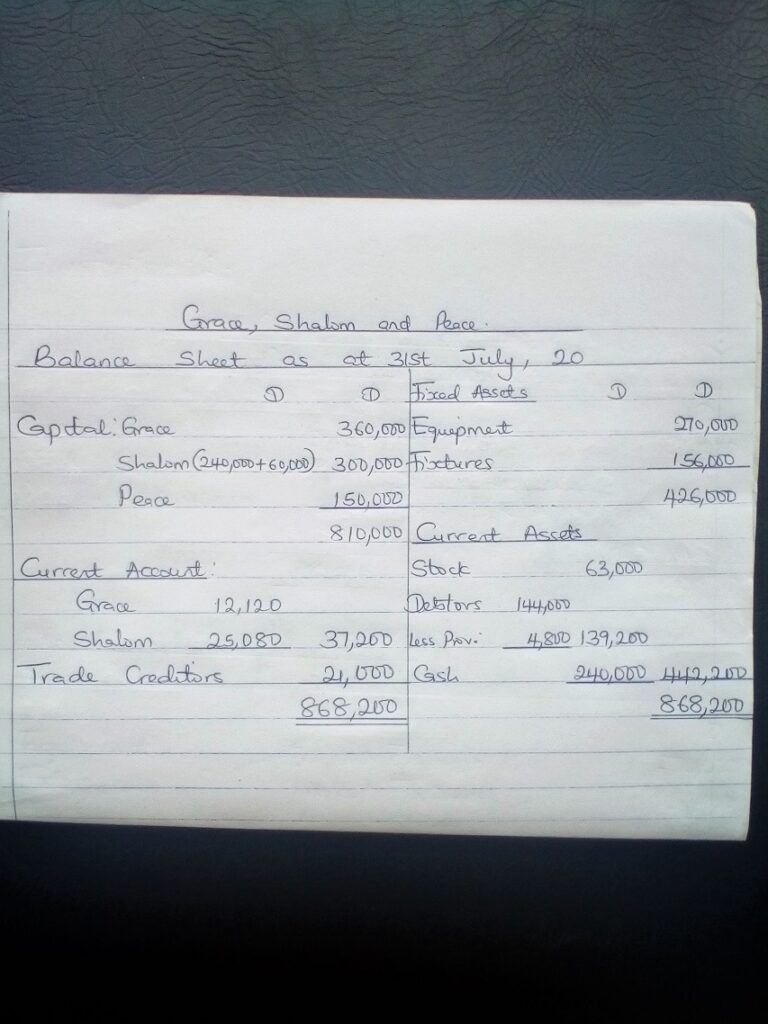

ILLUSTRATION 1

Jude and James are in partnership sharing profits and losses equally. Their balances as at 31st December, 2018 is as follows:

Jude and James

Balance sheet as at 31st December, 2018

| ₦ | ₦ | Fixed Assets | ₦ | ₦ | ||

| Capital: | Jude | 36,000 | Goodwill | 12,000 | ||

| James | 36,000 | 72,000 | Freehold property | 20,000 | ||

| Current Account: | Jude | 2,400 | Motor vehicle | 30,000 | ||

| James | 1,400 | 3,800 | Furniture and fittings | 6,000 | ||

| Current liabilities | 68,000 | |||||

| Creditors | 20,000 | Current Assets | ||||

| Bills payable | 7,000 | Stock | 12,880 | |||

| Accruals | 840 | 27,840 | Debtors | 18,400 | ||

| Bank | 3,360 | |||||

| Cash | 1,000 | 35,640 | ||||

| 103,640 | 103,640 | |||||

Additional Information:

i. On 31st December, 2018, John was admitted into the partnership.

ii. Profits and losses would still be shared equally

iii. John introduced capital of ₦36,000.

iv. The following assets were revalued:

₦

Goodwill 18,000

Freehold property 30,000

Motor vehicle 50,000

Stock 12,000

v. A provision of 5% is to be made on debtors

vi. Goodwill is no longer to be retained in the books.

You are required to prepare:

(a) Revaluation Account

(b) Goodwill Account

(c) Partners’ Capital Account

SOLUTION:

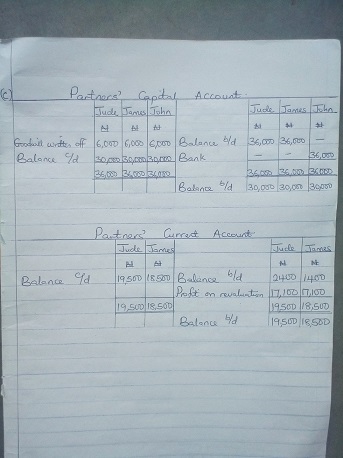

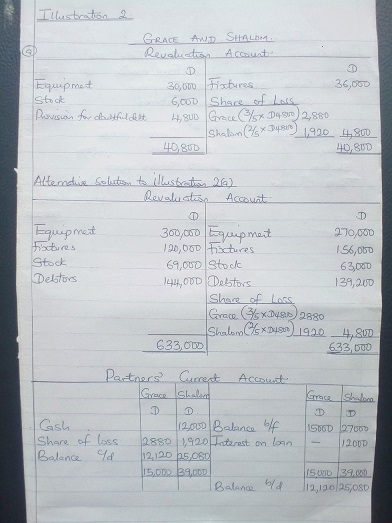

ILLUSTRATION 2

Grace and Shalom are in partnership, sharing profits and losses in the ratio 3:2 respectively. Their balance sheet as at 30th June, 2016 is as follows:

GRACE AND SHALOM

Balance Sheet as at 30th June, 2016

| Capital: | D | D | Fixed Assets | D | D |

| Grace | 360,000 | Equipment | 300,000 | ||

| Shalom | 240,000 | Fixture & fittings | 120,000 | ||

| 600,000 | 420,000 | ||||

| Current Account: | Current Assets | ||||

| Grace | 15,000 | Stock | 69,000 | ||

| Shalom | 27,000 | 42,000 | Debtors | 144,000 | |

| Loan: Shalom | 60,000 | Cash | 102,000 | 315,000 | |

| Interest accrued | 12,000 | 72,000 | |||

| Trade creditors | 21,000 | ||||

| 735,00 | 735,000 |

They decided to admit Peace into the partnership on the following terms:

- Peace shall contribute D150,000 as capital and be entitled to one-fifth of future profit

- Grace and Shalom shall share profits and losses equally.

- Shalom should have her loan converted to capital, but the accrued interest must be paid immediately.

- Assets are to be revalued as follows:

D

Equipment 270,000

Fixture and fittings 156,000

Stock 63,000

Debtors 139,200

You are required to prepare:

- Revaluation Account

- Partners’ Current Account

- Opening Balance Sheet for Grace, Shalom and Peace.

SOLUTION:

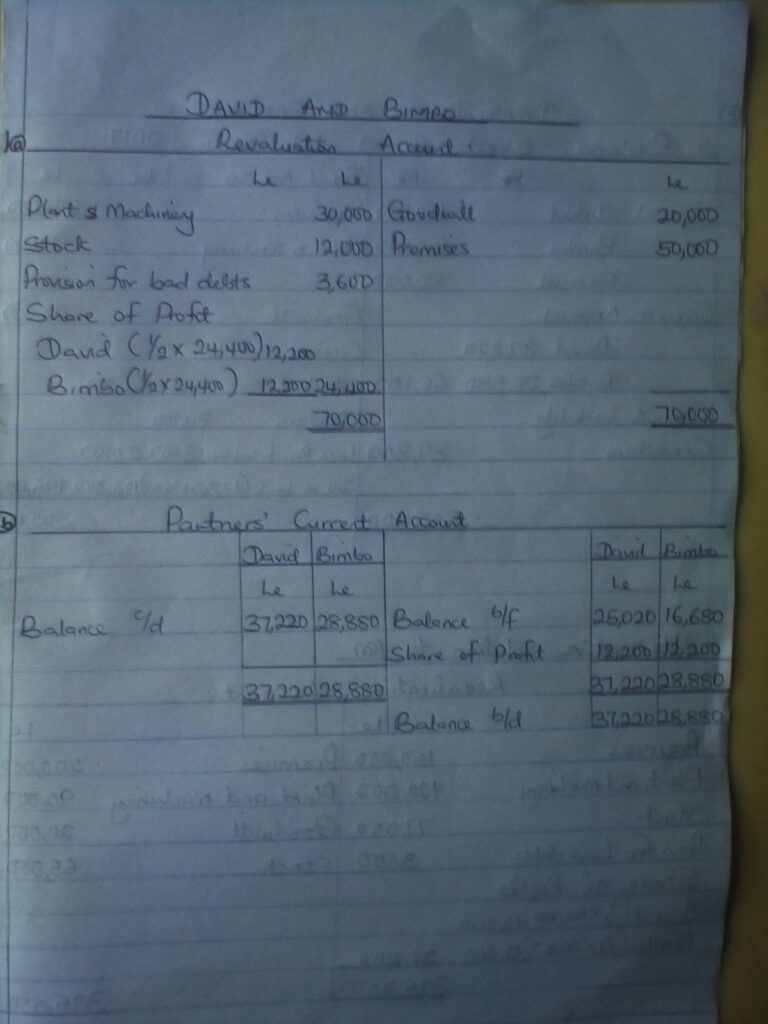

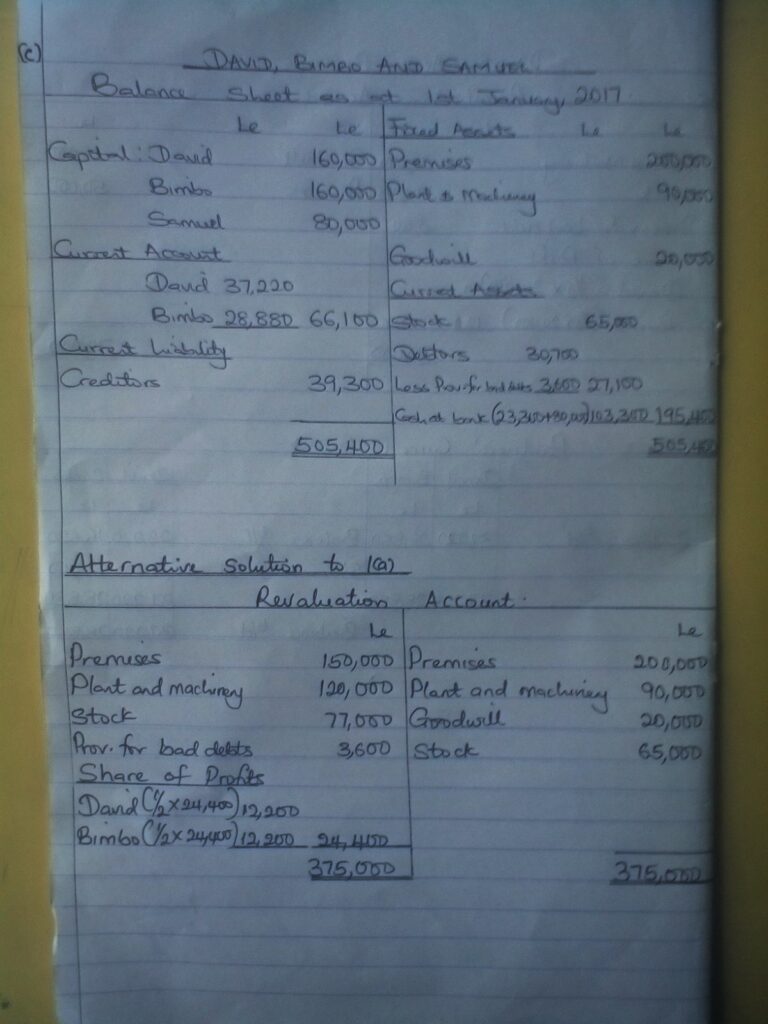

ASSIGNMENT

David and Bimbo are in partnership sharing profits and losses equally. On 1st January 2017, they decided to admit Samuel as a partner on which date their balance sheet was as follows:

| Le | Le | ||

| Capital account: | Fixed Assets | ||

| David | 160,000 | Premises | 150,000 |

| Bimbo | 160,000 | Plant & Machinery | 120,000 |

| Current account: | Current Assets | ||

| David | 25,020 | Stock | 77,000 |

| Bimbo | 16,680 | Debtors | 30,700 |

| Creditors | 39,300 | Cash at bank | 23,300 |

| 401,000 | 401,000 |

It was agreed as follows:

Samuel shall bring Le 80,000 as capital for one-fifth share of profit.

Goodwill shall be brought into the books at Le 20,000.

Assets are revalued at:

Le

Premises 200,000

Plant & Machinery 90,000

Stock 65,000

- A provision of Le 3,600 is to be made for bad debts

You are required to prepare:

(a) Revaluation account

(b) Partners’ current account

(c) Revised balance sheet as at 1st January, 2016.

CORRECTION TO ASSIGNMENT GIVEN ON 25/6/2020

FINANCIAL ACCOUNTING

LESSON 5

CLASS: SS 3 DATE: JUNE 18TH, 2020

You are welcome to this week on-line class. Are you are following the class?

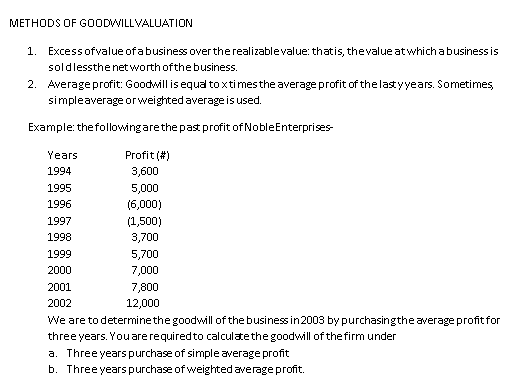

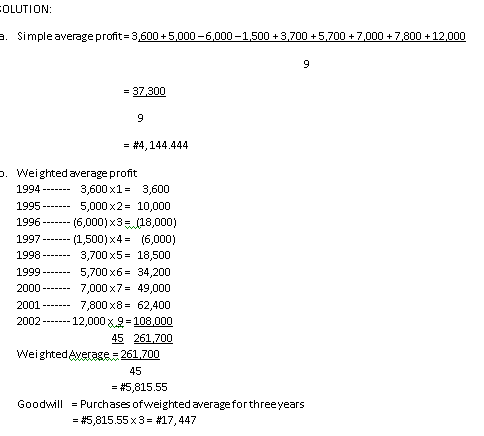

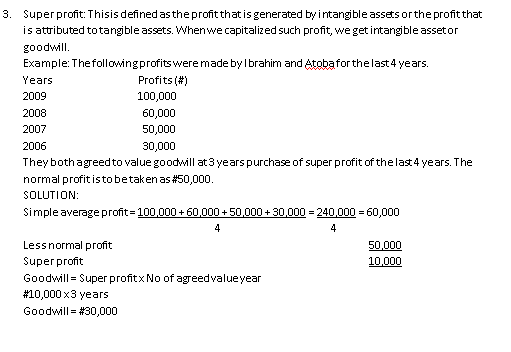

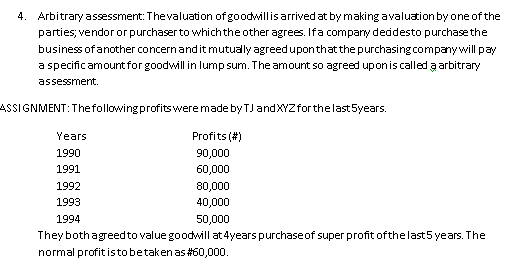

GOODWILL ACCOUNT

Goodwill is an asset, but it cannot be seen or touched, hence it is referred to as intangible asset. Goodwill can be defined as the excess of the purchases consideration over the total value of assets less liabilities. It can also be defined as the probability that the customers will continue to patronize old business even when there is change in ownership. It arises as a result of connection, reputation and efficiency of a business concern. It cannot be realized until the business is to be sold.

CHARACTERISTICS FOR GOODWILL

- It may fluctuate from day to day

- The value is subjective

- It cannot be sold separately apart from other assets of the business

TYPES OF GOODWILL

- Purchased goodwill: This is the goodwill that is bought as any other asset of the business is bought. We can only have this type of goodwill in a business in which the ownership has changed.

- Inherent goodwill: This is the goodwill that is made or earned because of the business itself (that is its good performance). This type of goodwill exists in business which has being existing without being purchased or merged with any other business.

REASONS FOR GOODWILL

Purchaser will be willing to pay for goodwill i.e. an amount over the realizable value of assets due to the following reason.

- The name, reputation and connection of the business.

- The quality and durability of the products of a company can bestow good name on it.

- Possession of partial monopoly due to less competition in the market.

- For patent and copy right protection

- Goodwill can also come into force when a purchaser feels that there may be high degree of growth rate in the future.

LESSON 5- CORRECTION

Good morning students, you are welcome to today’s online class. This morning, we shall be revising company’s account and bank reconciliation statement with adjusted cashbook.

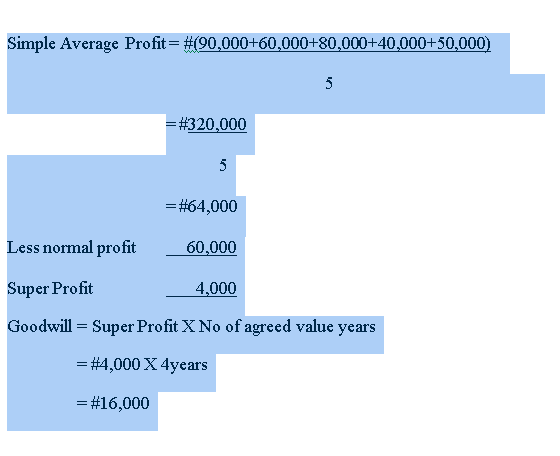

ILLUSTRATION ON COMPANY’S ACCOUNT

Collins Limited is a company with an authorized share capital of ₦800,000 made up of 600,000 ordinary shares of ₦1 each and 400,000 3% preference shares of ₦0.50 each. During the year ended 31st December, 2018, the following balances were extracted from the final records of the company.

| | |

| Issued and fully paid capital: | |

| Ordinary shares of | 500,000 |

| 200,000 preference shares capital of | 100,000 |

| General reserve | 30,000 |

| Goodwill | 20,000 |

| 5% Debenture | 20,000 |

| Stock | 25,000 |

| Net profit for the year | 80,000 |

| Land and building at cost | 517,500 |

| Fixture & fittings at cost | 25,000 |

| Motor vehicles at cost | 80,000 |

| Provision for depreciation: Fixture & fittings | 2,500 |

| Motor vehicle | 16,000 |

| Creditors | 10,000 |

| Debtors | 50,000 |

| Bank | 40,000 |

| Cash | 1,000 |

Additional information:

- Provision is to be made for the preference shares dividend. The directors recommended ordinary shares of dividend of 4%.

- Write off goodwill

₦5,000.

You are required to prepare:

- Appropriation account for the year ended 31st December, 2018.

(ii) Balance sheet as at that date.

SOLUTION:

WORKINGS

P reference shares dividend =3 /100 x 100,000

= ₦3,000

- Ordinary shares dividend = 4/100 x 500,000

= ₦20,000

ASSIGNMENT

NOTE: Please, make sure you submit your assignment on or before Tuesday 16th, 2020.

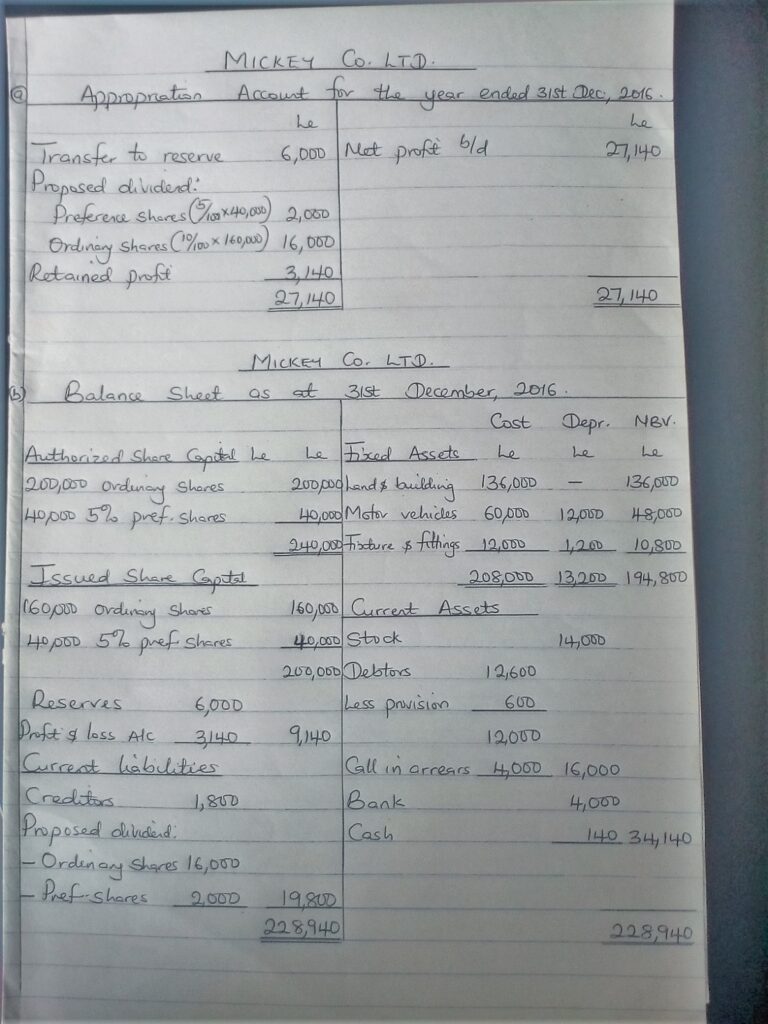

Mickey Co. Ltd has an authorized capital of Le240,000 divided into 200,000 ordinary share 40,000 5% preference shares.

| Issued and fully paid capital: | Le |

| Ordinary shares capital | 160,000 |

| 5% preference share capital | 40,000 |

| Land and building at cost | 136,000 |

| Motor vehicles at cost | 60,000 |

| Fixture and fittings | 12,000 |

| Stock | 14,000 |

| Debtors | 12,600 |

| Bank | 4,000 |

| Cash | 140 |

| Creditors | 1,800 |

| Call in arrears | 4,000 |

| Provision for doubtful debts | 600 |

| Profit for the year ended 31st December, 2016 | 27,140 |

Additional information:

- Provide for depreciation on motor vehicles at 20% and furniture & fittings at 10% per annum.

- The directors decided to:

- Transfer Le 6,000 to reserve

- Recommend a dividend of 10% on ordinary shares and pay preference shares dividend.

You are required to prepare:

- Appropriation Account for the year ended 31st December, 2016

- Balance sheet as at that date

SOLUTION TO JUNE 11, 2020 ASSIGNMENT

Illustration on Bank Reconciliation Statement

On 30th November, 2018, Adedeji’s cash book showed a debit balance of GHȼ 76,000. However, his bank statement showed an overdraft balance of GHȼ 18,800. On investigation, the following details were discovered:

- A standing order of GHȼ 1,600 had not been entered in the cash book

- Bank charges of GHȼ 400 did not appear in the cashbook;

- Cash paid into the bank for GHȼ 4,000 had been entered in the cashbook as GHȼ 3,600.

- A cheque of GHȼ 2,000 received from a customer was dishonoured;

- The bank received a credit transfer of GHȼ 4,000 from a customer;

- A cheque of GHȼ 13,600 paid to Dexteri Ltd had been entered in the cash book as GHȼ 17,200;

- A receipt of GHȼ 400 shown on the bank statement had not been entered in the cash book;

- A cheque drawn amounting to GHȼ 1,600 paid is still with the supplier;

- Receipt of GHȼ 36,000 paid into the bank on 30th November, 2018 did not appear on the bank statement until December 2018;

- A cheque of GHȼ 10,800 paid into the bank had been wrongly credited by bank as GHȼ6,000;

- A transfer of GHȼ 60,000 to the bank had not been recorded in the cash book.

You are required to prepare:

- Adjusted cashbook;

- Bank Reconciliation Statement as at 30th November, 2018.

SOLUTION

ADEDEJI

(a) Adjusted Cashbook

| 2018 | GHȼ | 2018 | GHȼ |

| 30th Nov. Balance b/d | 76,000 | 30th Nov. Standing order | 1,600 |

| Understated receipt | 400 | Bank charges | 400 |

| Credit transfer | 4,000 | Dishonoured cheque | 2,000 |

| Payment overstated | 3,600 | Amount transferred | 6,000 |

| Receipt omitted | 400 | Balance c/d | 20,400 |

| 84,400 | 84,400 | ||

| 1st Dec. Balance b/d | 20,400 |

(b) Bank Reconciliation Statement as at 30th November, 2018

| GHȼ | GHȼ | |

| Balance as per adjusted cashbook | 20,400 | |

| Add: Unpresented cheque | 1,600 | |

| 22,000 | ||

| Less: Uncredited cheque | 36,000 | |

| Bank error | 4,800 | 40,800 |

| Overdraft as per bank statement (30/11/2018) | 18,800 | |

Workings:

(iii) Understated receipt: GHȼ4,000 – GHȼ3,600

= GHȼ400

- Payment overstated: GHȼ17,200 – GHȼ13,600

= GHȼ3,600

- Receipt omitted: Debit GHȼ400

- Unpresented cheque: GHȼ1,600

- Uncredited cheque: GHȼ36,000

- Bank error: GHȼ10,800 – GHȼ6,000

= GHȼ4,800

- Amount transferred: GHȼ60,000

ASSIGNMENT

NOTE: Please, make sure you submit your assignment on or before Tuesday 16th, 2020.

On 31st December, 2017, the bank column of the cashbook of Durojaye Enterprise showed a debit balance of ₦ 48,500. However, the bank statement showed a credit balance of ₦ 54,900 as on the same date.

A detailed comparison of entries revealed the following:

- Customers’ cheques amounting to

₦8,450 had not been credited by the bank as at 31/12/2017. - Cheques amounting to

₦8,850 had not been presented for payment as at 31/12/2017. - Bank charges of

₦1,000 and interest on investment of₦2,500 collected by the bank appeared only in the bank statement. - On the 30/12/2017, there was a wrong credit of

₦3,500 in the bank statement. - Durojaye Enterprise, a customer, had paid into the bank directly a sum of

₦3,000 on 29th December, 2017. This had not been recorded in the cashbook. - A cheque for

₦2,000 received from Jessy Enterprise, a customer, which was deposited had been returned unpaid. This had not been entered in the cash book.

You are required to:

- Write up the adjusted cash book.

- Prepare a bank reconciliation statement as at 31st December,2017.

SOLUTIONS TO JUNE 11, 2020 ASSIGNMENT.

DUROJAYE ENTERPRISE

(a) Adjusted Cashbook

| | | ||

| Balance b/d | 48,500 | Bank charges | 1,000 |

| Interest received | 2,500 | Jessy Enterprise | 2,000 |

| Durojaye Enterprise | 3,000 | Balance c/d | 51,000 |

| 54,000 | 54,000 | ||

| Balance b/d | 51,000 |

(b) Bank Reconciliation Statement as at 31st December, 2017

| | | |

| Balance as per adjusted cash book | 51,000 | |

| Add: Unpresented cheques | 8,850 | |

| Wrong credit in the bank statement | 3,500 | 12,350 |

| 63,350 | ||

| Less: Uncredited cheques | 8,450 | |

| Balance as per bank statement | 54,900 |

Alternative to Q(b): Preparing Bank Reconciliation Statement beginning with Bank Statement balance.

(b) Bank Reconciliation Statement as at 31st December, 2017

| GHȼ | GHȼ | |

| Balance as per bank statement | 54,900 | |

| Add: Uncredited cheque | 8,450 | |

| 63,350 | ||

| Less: Unpresented cheque | 8,850 | |

| Wrong credit in the bank statement | 3,500 | 12,350 |

| Balance as per adjusted cashbook | 51,000 |

LESSON 3

FINANCIAL ACCOUNTING

CLASS: SS 3 DATE: JUNE 4TH, 2020

You are welcome back to class. I hope you are enjoying the stay at home. Please don’t eat more than expected. Have you been enjoying the class? You have not been attempting the assignment I gave. Why? Anyway, at the end of lesson 1, (beneath the form) the correction to the assignment is there.

CONTROL ACCOUNTS

Control account can be defined as memorandum account, the balance of which reflects the aggregate balances of many related subsidiary accounts which are part of the double entry system. it is the account to which is debited and credited the total amounts of all the transactions which have been debited and credited in details to individual debtors and creditors ledgers.

Advantages of Control account

- It helps in locating errors.

- It can provide a check on the accuracy of balances of the ledgers.

- Fraud will become difficult

- They can be used to detect missing figures.

- They save time.

- They allow homogenous accounts to be grouped together.

- The balances of the total debtors and creditors can be easily calculated.

Divisions of Control account

- Total Debtors Control account or Sales Ledger Control Account

- Total Creditors Control Account or Purchases Ledger Control Account

Contral Entries

Contral entries occur when a supplier is also a customer. The firm can sell on credit to a customer and but on credit from the same person. The inter-indebtedness will be set-off against each other. At the end of the month, the smaller of the two balances will be set-off against the larger balance.

Dr Total Debtors Control Account Cr

| # | # | ||

| Balance b/f | x | Cash from customers | x |

| Credit sales | x | Cheque from customers | x |

| Debit note issued | x | Returns inwards | x |

| Interest charged on overdued account | x | Bad debts | x |

| Dishonoured cheque | x | Discounts allowed | x |

| Discount disallowed | x | Credit notes issued | x |

| Carriage outward | x | Bills receivable | x |

| Contra entry/Set-off | x | ||

| Balanced c/d | x | ||

| x | x | ||

| Balance b/d | x |

Dr Total Creditors Control Account Cr

| # | # | ||

| Cash to suppliers | x | Balance b/f | x |

| Cheque to suppliers | x | Credit purchases | X |

| Returns outwards | x | Debit note received | X |

| Discounts received | x | Discounts received withdrawn | X |

| Credit notes received | x | Cash refunds | X |

| Bills payable | x | ||

| Contra entry/Set-off | x | ||

| Balanced c/d | x | ||

| x | x |

Assignment

Essential Financial Accounting, Exercise 17.1

No Fields Found.CORRECTION TO LESSON 3 ASSIGNMENT

ADE AND SEGUN ENTERPRISES

Sales Ledger Control Account

| # | # |

| Balance b/f 23,230 | Sales returns 1,955 |

| Sales 93,290 | Discount allowed 547 |

| Dishonoured cheque 350 | Credit notes issued 345 |

| Bad debts 183 | |

| Cheque from cust. 85,700 | |

| Balance c/d 28,140 | |

| 116,870 | 116,870 |

Purchases Ledger Control Account

| # | # |

| Discount received 735 | Balance b/f 18,180 |

| Cash paid to suppliers 83,000 | Purchases 78,470 |

| Balance c/d 13,199 | Debit notes received 284 |

| 96,934 | 96,934 |

28/05/2020

Good morning students. I hope you are staying safe.

CLASS EXERCISE

Precious Limited operates an imprest with N90,000 paid out of bank. The following expenses were settled out of petty cash during the month of June, 2016.

| June | | |

| 1 | Wages | 6,000 |

| 2 | Rates | 4,500 |

| 3 | Postage stamps | 600 |

| 4 | Transport expenses | 15,600 |

| 5 | Postage stamps | 750 |

| 8 | Wages | 1,500 |

| 10 | Segun (creditor) | 6,000 |

| 13 | Wages | 4,500 |

| 18 | Gbenga (creditor) | 4,500 |

| 22 | Rates | 6,000 |

| 23 | Wages | 4,200 |

| 24 | Rates | 2,400 |

| 26 | Registered letters | 3,000 |

| 28 | Rates | 2,700 |

| 29 | Wages | 3,600 |

| 30 | Wages | 4,800 |

| 30 | Float restored | ? |

You are required to write up the petty cash book for the month of June, 2016 having analysis columns for Rates, Postage, Transport, Wages and Ledger.

SOLUTION:

ASSIGNMENT

1 (a) Explain the following terms:

(i) petty cash book

(ii) contra entries

(iii) imprest system

(b) State three advantages of keeping petty cash book using imprest system.

(c) State four source documents that are used to make entries in the petty cash book

No Fields Found.CORRECTION TO ASSIGNMENT GIVEN ON 28/5/2020

1(a)

- Petty cash float: It is the maximum amount a petty cashier is allowed to hold at any point in time for the payment of minor expenses.

- Contra entries: These are entries which are recorded on the opposite sides of an earlier entry to reverse or offset their effects on their account balances. OR They are entries made for transactions whose debits and credits are in the same book.

- Imprest system: This is a system wherebya fixed amount of money is given to a petty cashier for the payment of minor expenses and he is reimbursed with the amount disbursed over a period of time.

1 (b) Advantages of keeping petty cash book using imprest system.

- It saves the main cashier’s time so as to concentrate on larger disbursements.

- It provides a training opportunity for young and inexperienced cashiers that enables them to take up higher cash responsibilities.

- It provides support for internal checks or detection of errors.

- It minimizes delays in cash disbursements.

- It reduces the burden on the main cashier.

- It enables the petty cashier to analyse expenditure as they occur.

- It decongests the main cashbook.

- It helps to classify petty expenses for easy identification.

1 (c) Source documents that are used to make entries in the petty cash book.

- Receipts

- Petty cash vouchers

- Certificate of honour

- Invoices

- Bills

LESSON TWO

CLASS EXERCISE

Adeola and Seyi started a partnership business on 1st January, 2016.

They contributed D600,000 and D500,000 respectively as capital. Their partnership deed stated that:

(i) Interest of 8% should be paid on capital per annum;

(ii) Seyi would be paid D20,000 monthly as salary;

(iii) Interest on drawings – 5%

(iv) The profits are to be shared in the ratio 3:2 respectively.

At the end of the year, the profit made was D600,000.

During the period, Adeola and Seyi made drawings of D40,000 and D30,000 respectively.

You are required to prepare:

( a) Profit and Loss Appropriation Account for the year ended 31st December, 2016;

(b) Partners’ Current Account.

SOLUTION:

ASSIGNMENT

Favour and Mercy are partners, sharing profits and losses in the ratio 2:1.

The following balances were extracted from the books of the firm for the year ended 31st December, 2019

| Dr | Cr | |

| Capital Account: Favour | 125,000 | |

| Mercy | 100,000 | |

| Drawings: Favour | 10,000 | |

| Mercy | 7,500 | |

| Purchases and Sales | 1,000,000 | 1,250,000 |

| Salaries | 125,000 | |

| General expenses | 50,000 | |

| Discounts | 12,500 | 10,000 |

| Rates | 2,500 | |

| Freehold property at cost | 125,000 | |

| Bank balance | 25,000 | |

| Debtors and Creditors | 75,000 | |

| Furniture & Equipment at cost (75,000) | 60,000 | |

| Stock 1st January | 57,500 | |

| 1,550,000 | 1,550,000 |

Additional Information:

- Stock at 31st December, 2019 was

N62,000 - Rates paid in advance at 31st December, 2018 was

N500 - Bad debt to be written off –

N1,500 - Depreciation of furniture and equipment is to be provided at the rate of 5% per annum on cost.

- Interest on capital -10% per annum.

- Interest on drawings: Favour –

N500

Mercy – N750

You are required to prepare:

- Trading, Profit and Loss Account for the year ended 31st December, 2019

- Appropriation Account

- Partners’ Current Account

- Balance Sheet as at that date.

CORRECTION TO ASSIGNMENT GIVEN ON 28/05/2020

Hello students, i hope you have not been getting too bored with this stay at home and you are staying safe.

You welcome to financial accounting class. I want us to go through revision of the topics we did during the 1st and 2nd term.

DEPRECIATION OF FIXED ASSETS

Depreciation is the gradual reduction in the value of a fixed asset. It can also be defined as the permanent and continuous decrease in the quality, quantity and value of an asset.

REASONS FOR CHARGING DEPRECIATION

- To avoid overstating the profit for a given financial period.

- It follows the matching concept, that is, the cost of asset is spread over its useful life.

- The amount charged as depreciation can be used for the replacement of the asset at the end of the useful life.

CAUSES OF DEPRECIATION

- Time factor

- Physical deterioration

- Obsolescence

- Depletion

- Inadequacy

ELEMENTS OF DEPRECIATION

- Original cost

- Estimated residual value

- Estimated useful life

- Replacement cost

DEPRECIATION METHODS

- Straight line method

- Diminishing or Reducing balance method

- Revaluation method

- Sum of the year digit method

Straight Line Method

This method is otherwise called fixed installment method. With this method, equal or same amount is charged as depreciation for each year of useful life of an asset.

Formula: (Cost – Residual or scrap value) / Years of useful life

Illustration: If a machine costing #1,000 is estimated to last for five years, what is the depreciation rate to be written off for each year?

Solution: cost = #1,000; Scrap value = nil; Years of useful life = 5

#1,000 / 5 = #200

Depreciation Schedule

| YEARS | COST OF ASSET # | DEPRECIATION AMOUNT # | ACCUMULATED DEPRECIATION # | NET BOOK VALUE # |

| 1 | 1,000 | 200 | 200 | 800 |

| 2 | 1,000 | 200 | 400 | 600 |

| 3 | 1,000 | 200 | 600 | 400 |

| 4 | 1,000 | 200 | 800 | 200 |

| 5 | 1,000 | 200 | 1,000 | 0 |

ASSIGNMENT

- Briefly explain how the following can cause depreciation: time factor, physical deterioration and inadequacy

- What do the following mean in depreciation of fixed assets: replacement cost, residual value, original cost

- The cost of an asset is #600,000. The residual value is #50,000. It is expected to last for 5 years. Use the straight line method to calculate the depreciation amount and prepare the depreciation schedule.

IF YOU WANT TO UPLOAD YOUR ANSWER, USE THE BELOW FORM

CORRECTION FOR LESSON 1 ASSIGNMENT

- Briefly explain how the following can cause depreciation: time factor, physical deterioration and inadequacy.

Solution:

i. Time factor: Depreciation occurs in some assets with the effusion of time, i.e. passage of time e.g. Leaseholds, patents and copyright.

ii. Physical deterioration: This is caused by wear and tear. An asset may depreciate as a result of constant usage. Physical factors such as erosion, dampness, rust and decay resulting from being exposed to wing, rain, sun, etc can cause as asset to reduce in value.

iii. Inadequacy: As a result of expansion in the productive capacity of a company, an asset may become too small or inadequate and thus required replacement of bigger asset.

2. What do the following mean in depreciation of fixed assets: replacement cost, residual value, original cost.

Solution:

i. Replacement cost: This is the amount at which a new asset is acquired to replace the old asset.

ii. Residual value: This is the scrap value or the estimated residual value. This is the amount which can be recovered when the asset is sold at the end of the useful life.

iii. Original cost: This is the cost incurred in purchasing, installation and cost of carriage of an asset.

3. The cost of an asset is #600,000. The residual value is #50,000. It is expected to last for 5 years. Use the straight line method to calculate the depreciation amount and prepare the depreciation schedule.

Solution:

Format: (Original cost – scrap value) /Est. useful life

=(#600,000 – #50,000)/5yrs = #110,000

| YRS | COST OF ASSET | DEP. AMOUNT | ACC. DEP. | NBV |

| # | # | # | # | |

| 1 | 600,000 | 110,000 | 110,000 | 490,000 |

| 2 | 600,000 | 110,000 | 220,000 | 380,000 |

| 3 | 600,000 | 110,000 | 330,000 | 270,000 |

| 4 | 600,000 | 110,000 | 440,000 | 160,000 |

| 5 | 600,000 | 110,000 | 550,000 | 50,000 |